Trump’s Tariffs Didn’t Spike Prices—Here’s What Did

Tariffs Aren't Tanking the Economy (Yet)

I am a committed libertarian, and for that reason I do not like tariffs. I do not like taxes, I do not like tariffs, I do not like government edicts of any kind.

Do I like President Trump’s “Liberation Day” tariffs, and all the tariffs he’s announced since? No. I do not.

That being said, I am also firmly committed to considering all the facts of any situation, not just ones that further a narrative I find personally appealing. While I dislike President Trump’s tariffs, I dislike the fake news and propaganda being spread about them even more.

Opposition to tariffs is a policy dispute; opposition to propaganda is a stand on principle.

June was a bad month for consumer price inflation, with prices rising in a month when wages did not.

We should not be surprised that corporate media rushed to blame the inflation on President Trump’s tariffs.

We should also not be surprised that corporate media was not merely wrong, but provably wrong.

Contents

Corporate Media’s Knee-Jerk Journalism

When the June Consumer Price Index Summary was released last week, corporate media lost no time in pronouncing President Trump’s tariffs as the primary culprit, almost gleefully prognosticating a summer of worsening inflation as Trump’s tariffs tank the economy.

The New York Times blamed all of the inflation on President Trump’s tariff and trade policies.

Inflation accelerated in June as President Trump’s tariffs started to leave a bigger imprint on the economy, keeping the Federal Reserve on track to hold interest rates steady when policymakers next meet this month.

More significantly, the Gray Lady projected that June was just the beginning of an inflationary cycle driven by tariffs, and that the rest of the summer would likely be worse.

The June data still reflects only the initial impact of Mr. Trump’s global trade war. Economists expect price pressures to intensify over the coming months, especially if new tariffs the president has threatened against the European Union and a host of other countries in recent days are imposed on Aug. 1 as planned.

Nor was the New York Times alone in projecting inflation doom and gloom.

Reuters similarly forecast that tariff-driven inflation was just beginning.

Nonetheless, economists generally expect the tariff-induced rise in inflation to become more evident in the July and August CPI reports, arguing that businesses were still selling merchandise accumulated before President Donald Trump announced sweeping import duties in April. They also noted that when Trump slapped tariffs on washing machines in 2018, it took several months for the duties to show up in the inflation data.

Reuters takes some liberties with surrounding the tariffs President Trump imposed in 2018, suggesting that they drove price inflation, when the data clearly shows that they did no such thing.

NPR, America’s answer to Soviet-style state-run media, took the simplistic approach that inflation was up because Trump.

Even The Hill joined in the Trump dogpile over inflation. President Trump’s tariffs just had to be the reason prices were up.

Inflation rose by 2.7 percent in June following warnings from economists that the cost of President Trump’s tariffs would make it through value chains and start to show up in consumer prices over the summer.

If one took corporate media seriously, one would easily conclude that President Trump’s tariffs were the worst thing for the US economy since Smoot-Hawley.

As readers are aware, however, I do not take corporate media seriously. They have lied too much about too much for that ever to be a wise idea. I do not know if they are lying about the impact of President Trump’s tariffs or are just economically illiterate. I do know they are wrong.

Input Prices Have Been Rising

While June was a bad month for consumer prices, the reality is that the prices of economic inputs has been rising for some time.

After an initial plunge on the heels of “Liberation Day” back in April, commodity prices have been rising across the board.

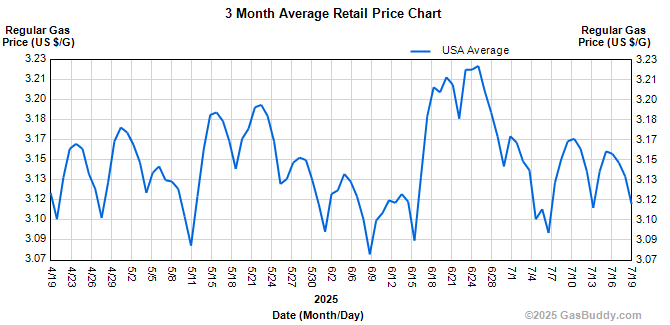

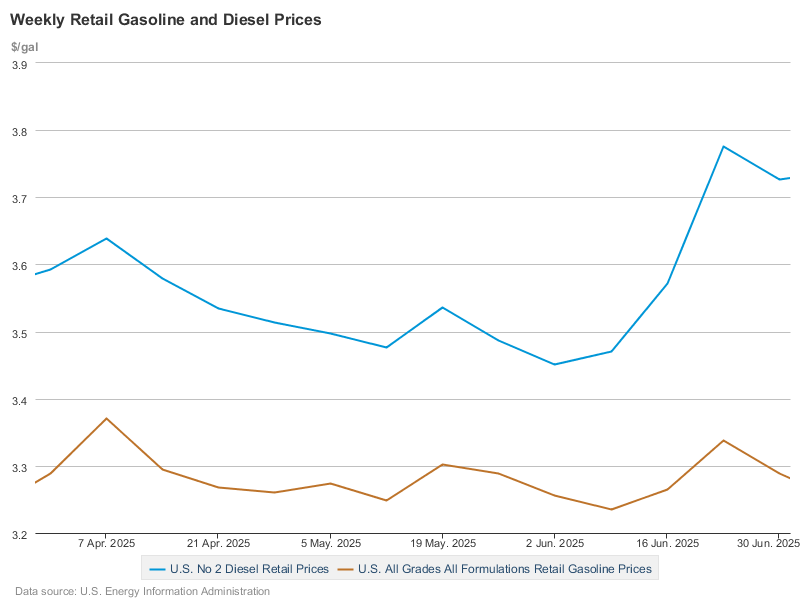

Oil prices largely followed the same pattern.

While retail gas prices have not been following any clear trend up, neither have they been following any clear trend down.

Even the Energy Information Administration’s weekly fuel price data has not shown any price deflation at the pump since April.

As I noted back in May, these energy price trends would likely result in higher prices over time, an important cautionary note in a month when the inflation data was otherwise quite positive.

Corporate media’s knee-jerk insistence that June’s price rises are all about President Trump’s tariffs ignores these other very real pricing pressures in the economy. While a tariff itself by definition represents an inflationary price pressure, it is but one of several such pressures both inflationary and deflationary, and whether prices rise or fall hinges on how all of them are expressed over time.

Input prices have been rising for some time. We should not be surprised that those pressures finally emerged in June’s inflation data.

Producer And Import Prices Tell Different Story

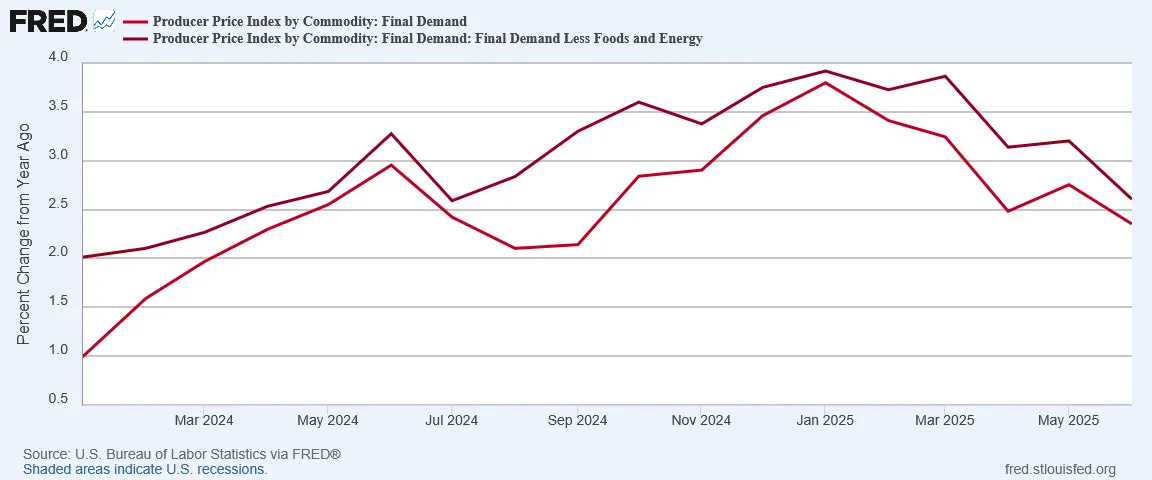

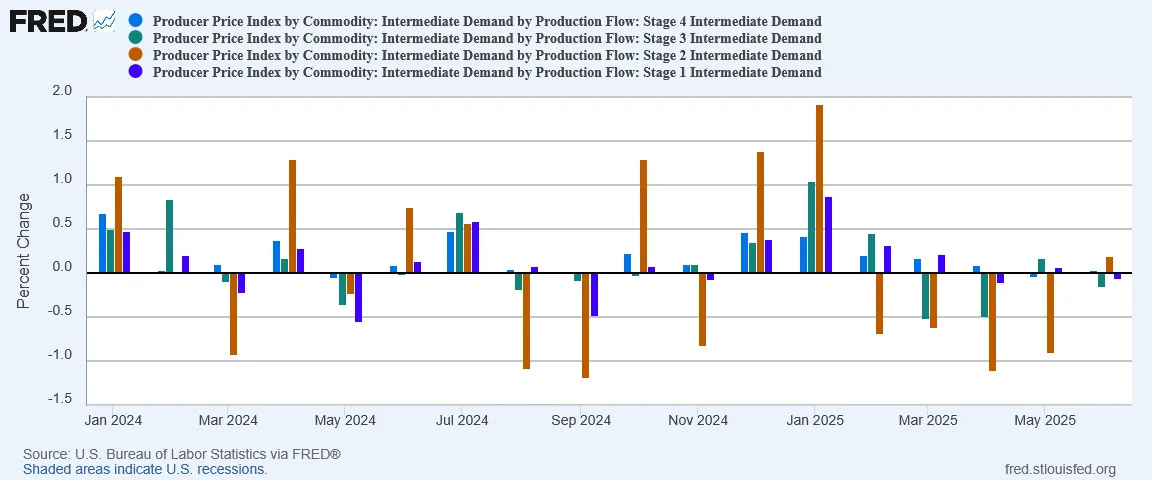

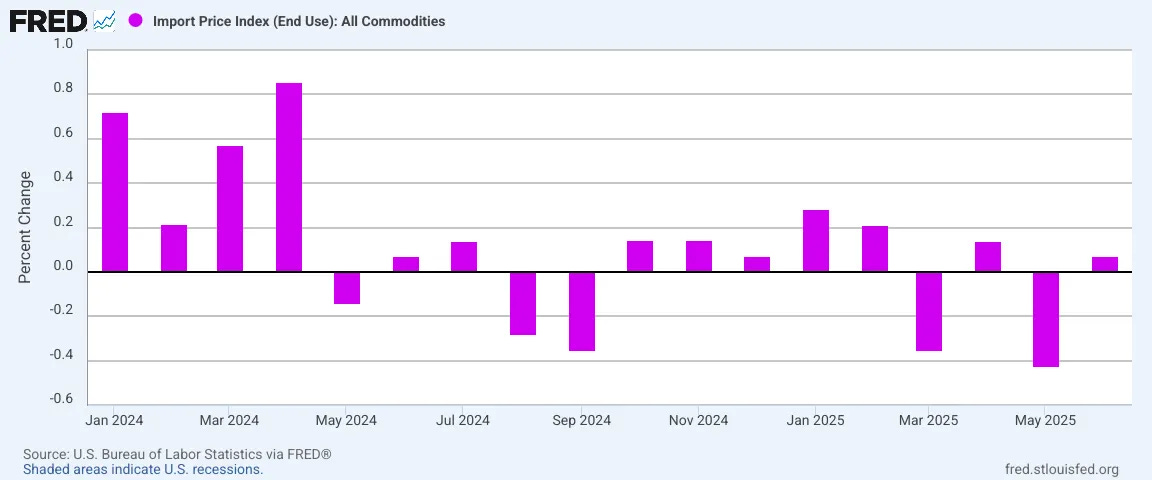

The tariff theory of inflation for June takes a direct hit when we look at the Producer Price Index and Import Price Index data. The take away from those data sets is simple: don’t panic.

The PPI gave some very good news for June with a continued disinflationary trend year on year.

This has significance for July and August consumer price inflation data, as the PPI generally serves as a leading indicator for the CPI. Inflation that shows up in the PPI is likely to appear in the CPI within a month or two.

However, with much of the Intermediate Demand data showing deflation month on month for June, the PPI is not projecting any inflation being transmitted into July or August.

When the PPI is not projecting any inflation, predicting tariffs will be causing inflation immediately becomes a more fantastic and improbable claim. When the prognosis is that there will be only weak inflationary pressures coming from producer prices throughout the remainder of the summer, there are just no inflationary forces available to be blamed on tariffs.

That import prices rose only very slightly (0.07%) in June directly contradicts the tariff thesis.

With input prices having been applying inflationary pressure on consumer prices for the past couple of months, with producer prices showing no inflationary pressure being transmitted into July or August, and with import prices barely increasing in June, corporate media’s insistence that the inflation is all due to tariffs quickly becomes not only suspect but highly discredited.

Even with just this much data we can see that corporate media is not correct about President Trump’s tariffs and inflation.

The Real Reason For June’s Inflation: Consumption

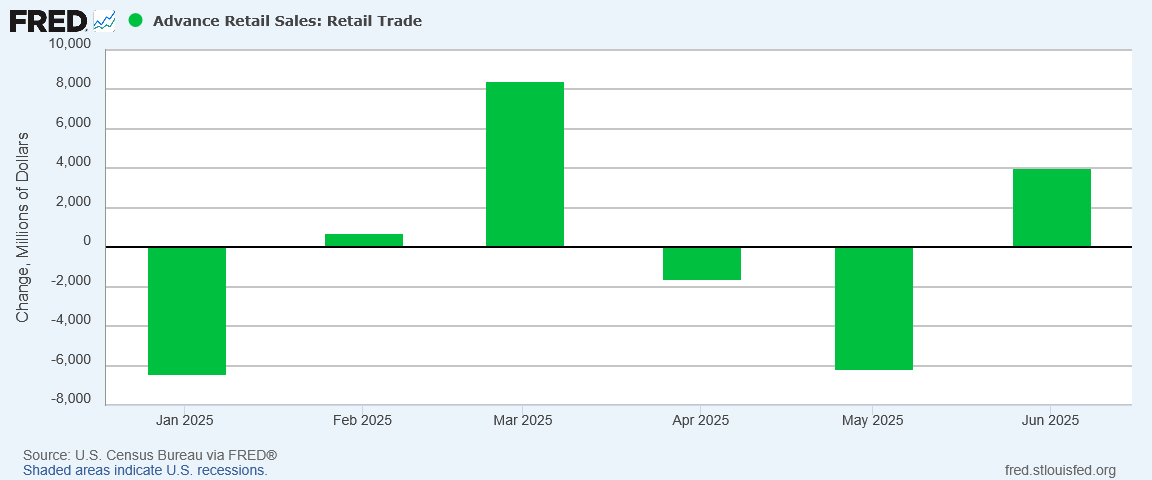

The most likely reason prices rose in June is fundamentally simple: people consumed more.

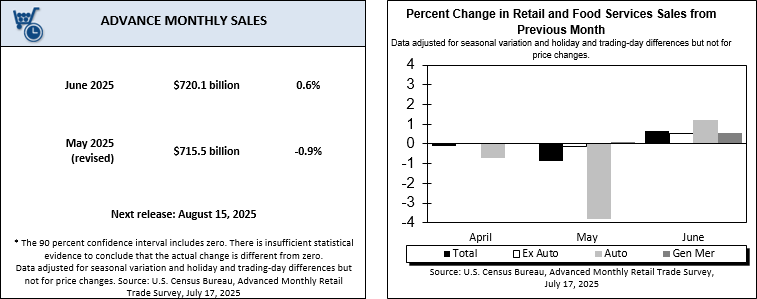

According to the US Census’ Advanced Monthly Sales data, retail sales rose some 0.6% in June.

Advance estimates of U.S. retail and food services sales for June 2025, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $720.1 billion, up 0.6 percent (±0.5 percent) from the previous month, and up 3.9 percent (±0.5 percent) from June 2024. Total sales for the April 2025 through June 2025 period were up 4.1 percent (±0.4 percent) from the same period a year ago. The April 2025 to May 2025 percent change was unrevised from down 0.9 percent (±0.2 percent).

In terms of retail trade sales, June saw a $4Billion rise.

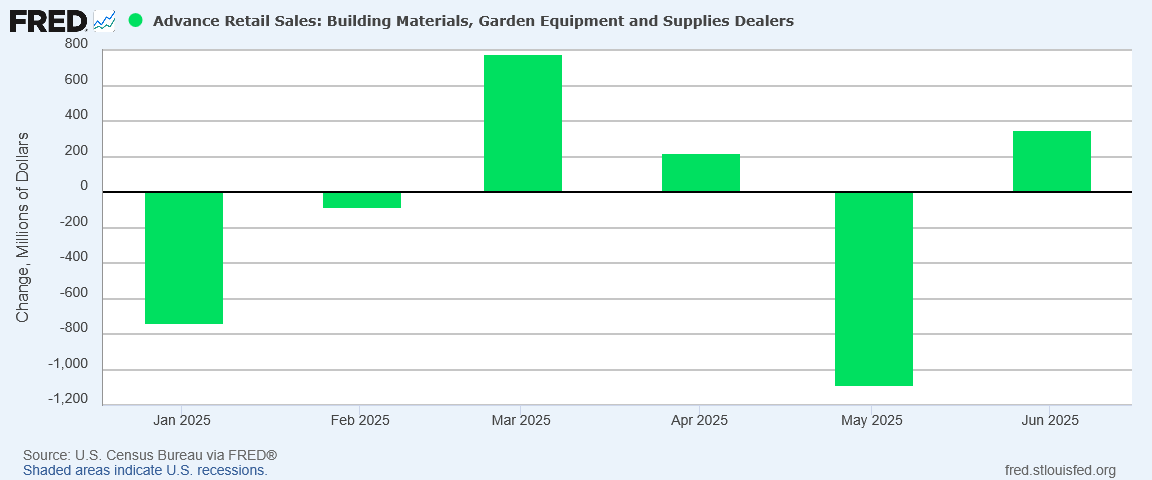

Even more encouraging was the increase in sales of building materials by some $348Million.

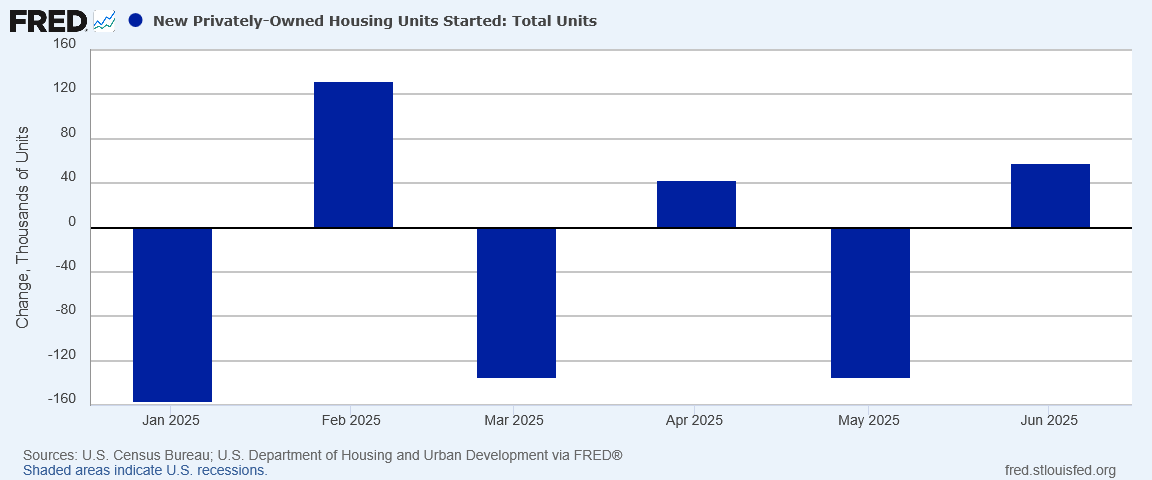

This coupled with the rise in June Housing Starts by 58,000 suggests that new home construction may be starting to pick up.

An increase in home construction would not only augur well for housing prices, but an increase in construction means an increase in construction-related jobs and upward pressure on construction-related wages.

Why did prices rise in June? Price rose because people were spending money. When more people buy more things—when demand rises—prices tend to rise. That is Economics 101.

Will inflation continue to rise in July and August? Possibly. If retail sales continue to increase prices will very likely increase somewhat as the inevitable consequence.

Yet if people are spending money and that is what is driving prices up, the inflationary consequence is inherently self-limiting. Rising prices become a disincentive to spending, leading consumer to forego or postpone purchases, thereby ending the consumption increase which catalyzes the price increase.

Moreover, if people are spending money and that is what is driving prices up, the consumption side of the economy is expanding. Whatever other ills might remain in the economy, increases in consumption are an economic positive, even when they result in higher inflation.

For June, the PPI does not indicate there are significant inflationary pressures being brought forward from supply and distribution chains.

Energy and commodity prices have been moving largely horizontally since the end of the Twelve Day War, fluctuating up and down across a band of trading prices.

The inflationary pressures which helped drive June’s inflation metrics up have not yet shown up in July. They may not show up in August.

Aside from consumption, there are not major predictors of inflation on the horizon.

To be sure, if consumption falls in July while consumer prices rise significantly, under those circumstances tariffs would be the most likely culprit. Tariffs are undeniably an inflationary price pressure that, all else being equal, will always push prices higher. They may yet have inflationary impact—they may have significant inflationary impact—and we should not be unmindful of this.

Yet all else is never equal, and consumer consumption is one variable we should not overlook when debating the possible underlying causes of any rise in consumer prices. If anything, when there is a rise in consumption we should ascribe to it first any increase in consumer price inflation. Any increase in demand is going to have the most direct impact on consumer prices, bar none. So long as consumption is on the rise, there is little logic in blaming inflation increases on tariffs.

Prices rose in June, and that is not good news. Yet prices rose because consumption rose, because economic activity rose, and that is always good news.

Corporate media does not want to report that because Trump.

You can’t hate corporate media enough.

Tariffs are not an inflationary phenomenon. Money creation is.