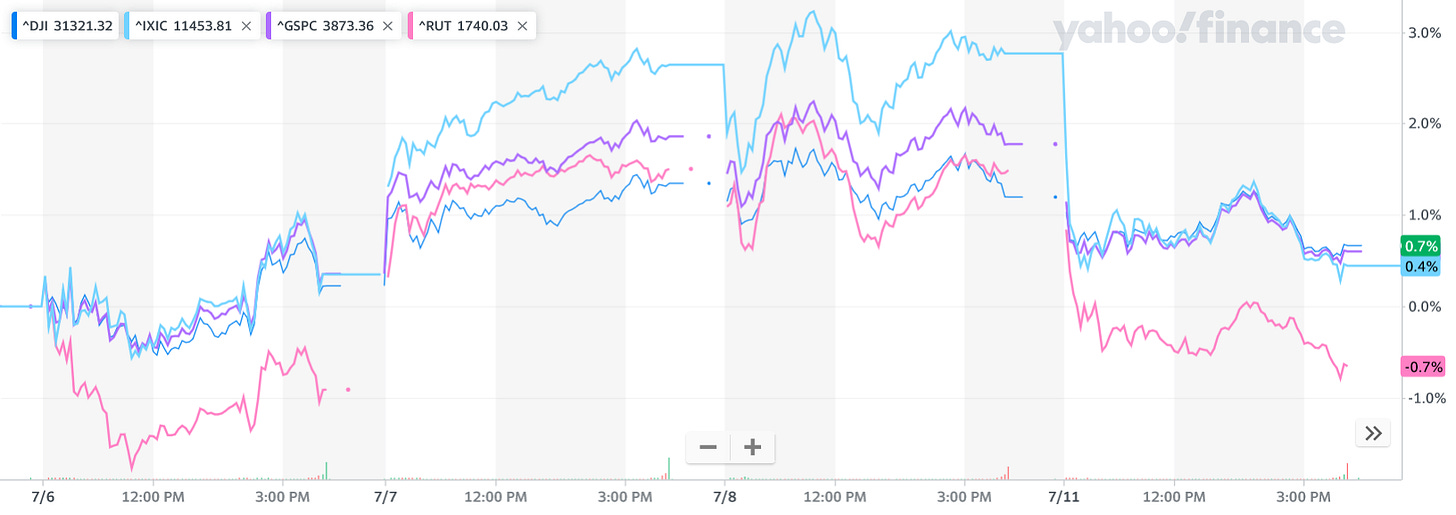

Despite the June Employment Situation Report using Lou Costello Labor Math to paper over a steep decline in the total numbers of people employed in order to tout the “creation” of some 372,000 jobs, Wall Street took the weekend to reflect on the implausibility of that report and apparently is coming to realize the Federal Reserve is making decisions based on faulty and/or inaccurate data. The result was a nose-dive at the opening bell across the board, with all major indices closing down for the day.

Inflation appears to be on everyone’s mind today.

"It’s a nervous market," said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management in Seattle. "It’s all about the kick-off to earnings season and what inflation (data) tells us tomorrow."

"We know inflation is being driven by supply constraints, and China is an important factor," Haworth added. "And (the Macao shutdown) threw a cold blanket on the market this morning."

Bond Yields Tell Of A Deteriorating Economy

Bond yields on the day leave no room for doubt: both the US and the global economy is weak and getting weaker. The short end of the yield curve continued rising, as it has done even before last week’s jobs report, with the 1-Year Treasury yield at 2.983% coming close to inverting with the 10-Year Treasury yield at 2.987% (as a general rule, the shorter term maturities on Treasury bonds have lower yields than the longer term, and the inversion of this relationship is generally seen as an indicator that recession is happening or is about to happen)

1-Year Treasury:

10-Year Treasury:

Paradoxically, the 5-Year and 10-Year Treasury yields actually declined on the day, in an apparent “flight to safety” reaction to deteriorating economic conditions in Europe. However, the continued inversion of 2-Year and 5-Year yields with the 10-Year yields highlights the reality that bond investors view the short term economic outlook negatively.

Everyone Is Expecting More Inflation

Despite the hopium being floated in the corporate media that moderating commodity prices are an indicator of “peak” consumer price inflation (a canard I explain to my paying readers is at distinct odds with reality), both Wall Street and Main Street are expecting more inflation in the future.

In an interview with Fox News on Sunday, market economist Edward Yardeni predicted Wednesday’s June CPI report will show inflation having increased from May.

Yardeni said Sunday that he believes the "headline inflation rating," which includes food and energy, will "be up something like 1.1%."

Financial data site Trading Economics is forecasting a rise in consumer price inflation from 8.6% to 8.8% year-on-year in the June CPI report.

Meanwhile, the Center For MicroEconomic Data at the New York Federal Reserve, in its latest survey of consumer expectations, reported that even consumers are predicting a continued rise in inflation for the short term.

The median one-year-ahead inflation expectation increased to 6.8 percent in June, up from 6.6 percent in May, a new series high

Keep in mind that Wall Street and Federal Reserve “experts” view such consumer expectations as a problem because it will incentivize workers to seek higher wages, which the Fed hopes to curtail with its policy of demand destruction through interest rate hikes.

When households expect prices to keep rising at rapid rates, economists fear they will ask for increasingly higher wages to cover the costs and add further fuel to inflation. That dynamic, called a wage-price spiral, led the U.S. to an inflation crisis in the late 1970s.

Moreover, while inflation is anticipated to be bad here in the US, Europe is grappling with an even worse economic outlook.

Euro zone finance ministers said on Monday the fight against inflation was the current priority despite dwindling growth in the bloc, as they were informed of a deteriorating economic outlook by the European Commission.

At a regular monthly meeting of the so-called Eurogroup, the EU executive gave an update of its economic forecasts, showing slower growth and higher inflation, the commission's vice-president Valdis Dombrovskis said on the sidelines of the meeting.

Even with the US economy itself in a deteriorating position, Europe’s decline is stark enough to further push the euro towards parity with the US dollar, a trend which has been ongoing throughout the year.

Europe’s economic outlook in particular has been complicated by indications of further dislocations emanating from China, which itself is reporting higher than expected inflation on top of renewed COVID-19 pandemic concerns with the appearance of BA.5 Omicron sub-variant.

China spooked speculative interest as the June Consumer Price Index in the country rose by more than anticipated, hitting 2.5%. Furthermore, Shanghai officials reported the first case of the coronavirus Omicron sub-variant BA-5, spurring concerns of a new lockdown in the region just a few weeks after the end of a month-long isolation mandate. The previous restrictions in the Chinese region exacerbated supply-chain issues, weighing on economic progress and boosting inflationary pressures.

Europe, China, Wall Street, Main Street….pretty much everywhere the economic prognosis is grim and getting grimmer.

The Fed’s Fate Is Fixed—It Has No Choice But To Raise Rates

As I alluded to in discussing last week’s Employee Situation Report, barring a surprise of greatly diminished inflation, the Fed’s interest rate path is set in stone—it will raise interest rates again at the end of this month, probably by a relatively large amount of 75-100bps (0.75-1.00%). Despite the numerous indicators of a weak economy that will only deteriorate with increased interest rates, the Fed at this point has no real choice in the matter.

Regardless of the very obvious defects in Friday’s jobs report, its top-level number portrays an economic situation where jobs are growing rather than shrinking (even though the internals clearly show a shrinking workforce, which makes the top-level number an absurdity). Additionally, the earlier Job Openings and Labor Turnover Summary (JOLTS) report showed more job openings than unemployed people in the workforce to fill them. Taken together, these metrics, even if inaccurate, feed economists’ concerns of a looming “wage-price” spiral, where the pressures of consumer price inflation lead to greater wage demands by workers, driving up the cost of labor and thus feeding into even more consumer price inflation—a positive feedback loop scenario last seen during the stagflation of the 1970s.

The solution, in the eyes of “experts”, is to stop inflation and thus block the concurrent wage growth. Which is why the Fed’s interest rate manipulations are of concern to everyone, not just Wall Street speculators—to target inflation the Fed also has to explicitly and deliberately target paychecks as well.

Nor is the Fed alone in this thinking. As highlighted above, Europe (and thus the European Central Bank) is painted into the same inflationary corner, and even China is struggling with a weakening economy amid rising inflation. As I have argued previously for paying subscribers, this is why the Fed must continue with its interest rate hikes—to defend the dollar amidst the central bank manipulations of other central banks regarding the other leading fiat currencies in the world.

The Federal Reserve’s credibility as a central bank is tied to the relative credibility of the dollar within the chaotic confusion of the world’s fiat currencies. For the Fed, the absolute worst case scenario is a collapse in dollar legitimacy, in large part because a stable currency—the foundation of a stable price regime, generally—is an explicit legal obligation of the Fed ever since the Full Employment and Balanced Growth Act of 1978. The Fed can, for policy reasons, choose to ignore or overlook a weakening economy, but it cannot, because of its mandate, ignore a weakening currency.

Which means that the Fed will continue to stomp out inflation by choking off jobs growth and demand for labor, hoping to produce a wider demand destruction which will in turn ease inflation despite the ongoing supply side pressures of diminishing availability of goods due to pandemic-related lockdowns as well as the Russo-Ukrainian War. I remind my readers that the Richmond Fed President Tom Barkin has already stated this publicly (emphasis mine).

Barring an unanticipated event, I see rising rates stabilizing any drift in inflation expectations and in so doing, increasing real interest rates and quieting demand. Companies will slow down their hiring. Revenge spending will settle. Savings will be held a little tighter. At the same time, supply chains will ease; you have to believe chips will get back into cars at some point. That means inflation should come down over time — but it will take time.

This was Volcker’s prescription for curbing inflation in the 1980s, and the Fed has committed itself to repeating the Volcker playbook as best it can—raise interest rates, crash the economy (while pretending to avoid exactly that), thereby squelching consumer demand for goods and worker demand for wage increases. Inflation will be cured at the expense of consumers and workers, just as before.

About the only saving grace in the Fed’s campaign to crush consumer demand and worker wages is that it is almost sure to trigger asset price deflation as well—meaning Wall Street will feel some of Main Street’s pain in the process.

"I feel your pain" should be "I caused your pain."

I remember the Carter Administration vividly.

For me, it was an era of amazing productivity, by necessity.

I was working 25 hours a week at the university library (interlibrary loans-lending), around 55-70 hours a week at one or more night clubs, all while going to pharmacy school full time (my dime)!

Eventually I came down with a massive case of mono, me!

I never got sick, just broken from motorcycle accidents.

The doc sat me down to have a discussion about "burning the candle at both ends" and I said "Doc, don't give me that crap."

He said "I'm not, it is just that you are using a f-cking flame thrower!"

"The Fed ... cannot ... ignore a weakening currency."

Uhm... Over the past ~50 years, the dollar has weakened by a factor of roughly 10.

If you're old enough to remember 1972, think back what stuff cost then. A house. A car. A gallon of gas. A loaf of bread. A gallon of milk. An ounce of silver or gold, or a pound of copper.

The Fed is responsible for this incessant decline in the value of the currency. They just don't want it to happen too quickly.