What Changed In April's Inflation Report? Not A Damn Thing

Jay Powell Still Hasn't Figured Out You Can't Push A String

The build up in the corporate media for April’s Consumer Price Index Summary Report, released yesterday, bordered on the absurd.

A high-stakes inflation report due Wednesday is expected to show that price pressures within the economy remained strong last month despite an aggressive interest rate hike campaign by the Federal Reserve.

High stakes? Is Phil Hellmuth1 running the Federal Reserve or the Bureau of Labor Statistics now? The Bureau of Labor Statistics data releases are just that—data. These should be as undramatic and boring a set of news releases as you can imagine.

They aren’t, of course, for one simple reason: the Federal Reserve’s interest rate hike campaign has been an abysmal failure and people are starting to notice.

The dramatic prelude in the corporate media made the actual inflation metrics for April almost anti-climactic, since the data was almost unchanged since March.

The all items index increased 4.9 percent for the 12 months ending April; this was the smallest 12-month increase since the period ending April 2021. The all items less food and energy index rose 5.5 percent over the last 12 months. The energy index decreased 5.1 percent for the 12 months ending April, and the food index increased 7.7 percent over the last year.

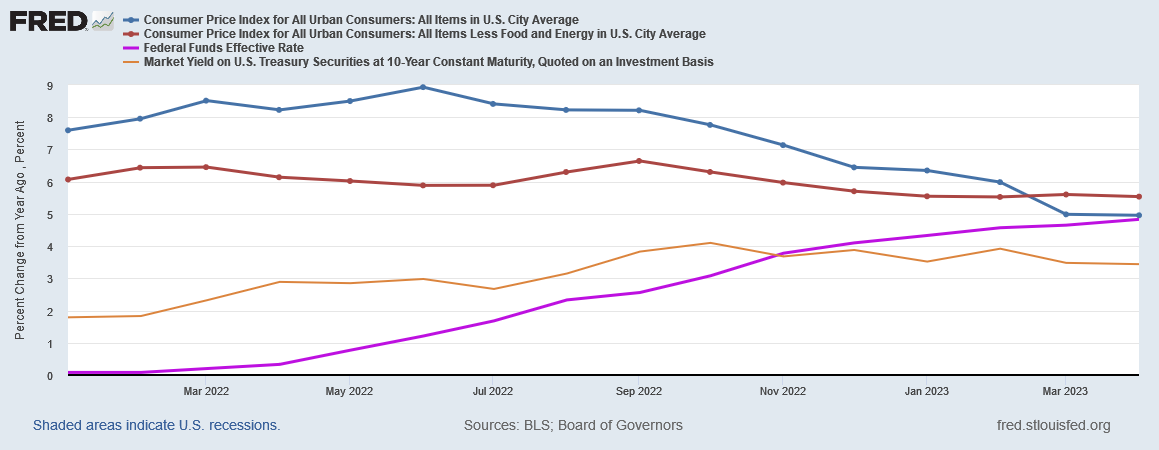

Headline inflation at 4.9% and core inflation of 5.5%, compared to March inflation numbers of 5% and 5.6%, respectively. As the chart shows, these are plainly massive changes month on month (warning: don’t slip on the dripping sarcasm).

Quite simply, nothing much really changed between March and April as far as the top inflation numbers were concerned. The Federal Reserve hiked the federal funds rate at the beginning of February and at the end of March and the end result was….nothing.

We are now into the second year of the Fed’s interest rate hike efforts and what does Jay Powell have to show for it? Not a damn thing.

Nor is this an exaggeration. Core consumer price inflation—the consumer price index with the influences of the typically volatile food and energy prices removed—has stayed in the same 5.5%-6.5% range since December of 2021.

Powell’s year of hiking the federal funds rate has altered core inflation by not very much, if at all. The impact on core inflation of two successive federal funds rate hikes in February and March has been almost exactly nil.

Consumer price inflation is choosing to ignore the Federal Reserve.

For the most part, the markets are also choosing to ignore the Federal Reserve. The Dow Jones index gave up around 0.1% on the day, while S&P 500, NASDAQ and Russell 2000 indices eked out marginal gains.

Even Treasury yields didn’t have much to say about the inflation data, as the 3-Month, 2-Year, and 10-Year yields all trended down on the day.

Even the forex markets yawned, with the US dollar gaining slightly against the yuan.

Wall Street had the closest thing to a non-reaction to the inflation data as it could achieve.

Corporate media tried to put lipstick on the pig by crowing about headline consumer price inflation coming in just below 5% for the first time in two years.

Inflation, the pace at which prices rise, was 4.9% in the 12 months to April, official figures show.

That was down from 5% in March, and marks the tenth month in a row that price rises have slowed.

However, when core inflation is running hotter than headline inflation, headline inflation doesn’t matter much—consumers are still paying more for most things.

This, of course, has been the entire problem—consumers are paying much more than they were two years ago, thanks entirely to inflation.

Energy costs in particular are way up—more than 50% since the 2020 recession—even with the recent declines in energy prices (energy price deflation).

Even corporate media has had to concede that extended elevated consumer price inflation—and all nonzero consumer price inflation rates—is by definition a reduction in the average worker’s purchasing power.

Put it all together, and incomes have risen about 3 percentage points less than inflation during the last two years. That’s de facto evidence that Americans, on average, are falling behind. And it’s happening in ways that are visible and painful to ordinary people: Rent, groceries, transportation and utility bills are taking a bigger bite out of the typical paycheck.

That bigger bite out of the typical paycheck is all that Jay Powell has to show for his interest rate hike campaign. Even interest rates are reluctant to move higher in response to Powell’s pushes on the federal funds rate.

The 3-Month Treasury yield began to plateau in October of last year, and while it remains the most responsive part of the yield curve to increases in the federal funds rate, the 3-Month yield is nevertheless converging with the federal funds rate.

For its part, the 2-Year Treasury yield has already converged with the federal funds rate and has actually declined despite Powell’s increases.

The 10-Year yield peaked lower and sooner, and has also declined since.

Not only is the federal funds rate having little to no impact on other interest rates, but it is failing to get interest rates above the rate of inflation.

Even corporate debt yields are proving uncooperative. While high-yield (junk) bonds have trended up above even headline inflation, they also have plateaued and, like their government security cousins, have proven most non-responsive to hikes of the federal funds rate.

The ability of the Federal Reserve to influence interest rates has been shrinking steadily since last fall and has, in most regards, fallen to near zero. Wall Street is ignoring the signal from the federal funds rate and decidedly not pushing any other interest rate any higher.

Inflation’s lack of substantive change in April is the latest example of a lesson I have pointed out repeatedly and which Jay Powell refuses to learn: You cannot push a string. Unfortunately for Jay Powell, relying on interest rate manipulations to corral consumer price inflation is exactly that—the (largely futile) pushing of an interest rate string hoping to force inflation down.

Relying on the Federal Funds rate to regulate treasury yields and, by extension, market interest rates broadly, has all the efficacy and smoothness of trying to push a string from one end and expecting it to stay straight. Eventually, enough string bunches up to where you can move it, but relative to the energy needed to move the string pushing it is extremely wasteful.

What was true last fall is still true today. Using the federal funds rate to manipulate market interest rates more broadly in the hope of bringing down consumer price inflation is exactly that wasteful and counterproductive pushing of an interest rate string.

Jay Powell has been pushing the federal funds string for over a year, and has failed to push core consumer price inflation out of the 5.5%-6.5% range established in December of 2021. The results of that wasted effort are all too apparent: core consumer price inflation continues to remain within that range and continues to shrink people’s paychecks by so doing.

Jay Powell would be well advised to stop pushing that string. Alas, Jay Powell refuses to be well advised on anything.

Phil Hellmuth is a champion poker player who has won the World Series Of Poker a record 16 times.

Would you say that we have definitely entered an era of stagflation now? And what - given the set of circumstances we have today - would it take to tip us into deflation?