It will take more than Shakespeare’s pen to turn Great Britain’s coming winter of economic discontent into a glorious summer.

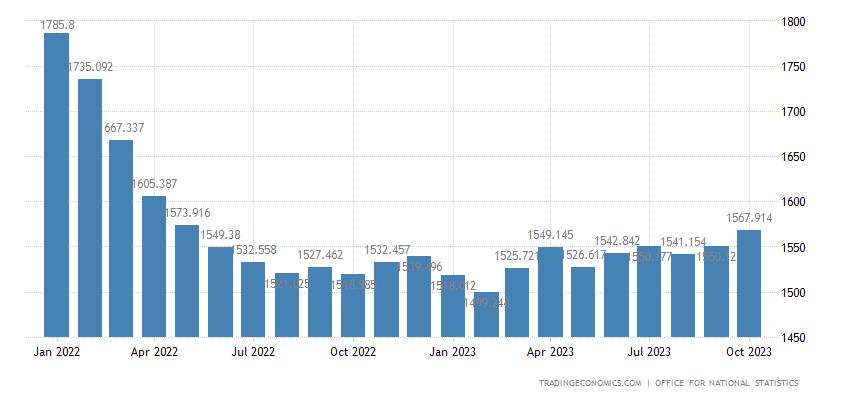

Instead of posting the looked-for growth, UK retailers posted declining sales across the board.

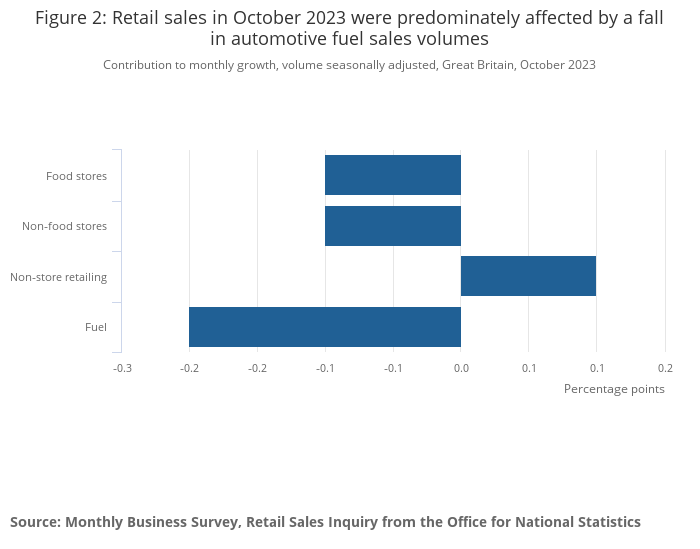

Shoppers bought less fuel and food in October as they were hit by rising living costs and poor weather, according to official figures.

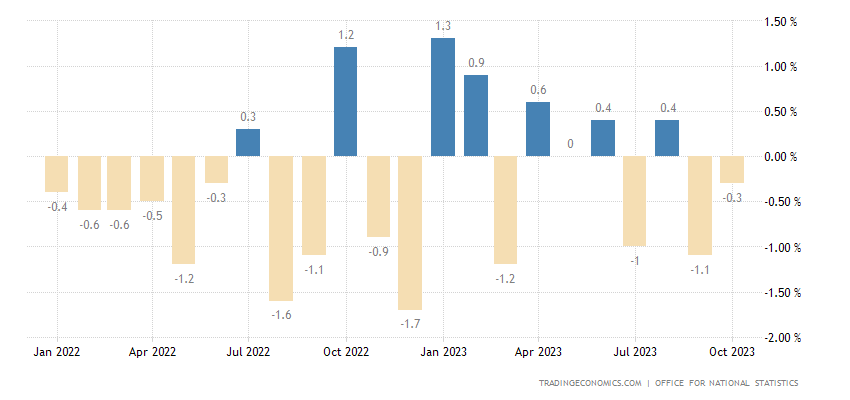

The volume of products sold last month fell by 0.3% to the lowest level since February 2021 when large parts of the UK were in Covid lockdowns.

Retail sales had widely been forecast to grow in October.

We know the US economy is in bad shape.

We know China is in even worse shape.

The UK is merely the latest sign of recession going global.

Great Britain’s numbers are not at all encouraging.

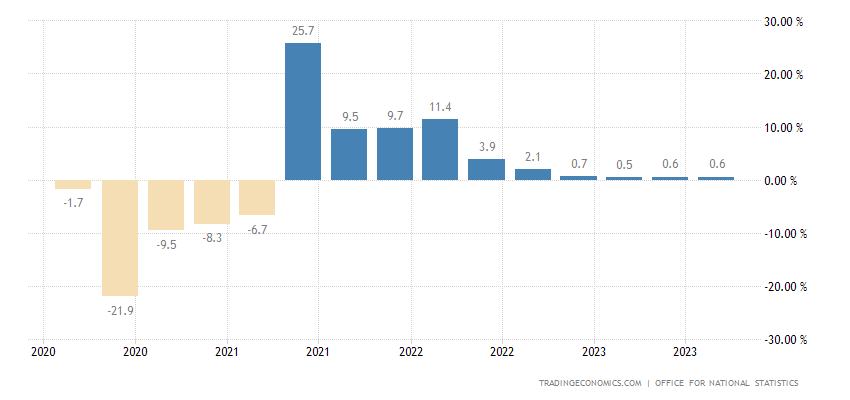

Retail sales dropped month on month by 0.3% in October, and that was an improvement over September, when they dropped by 1.1%.

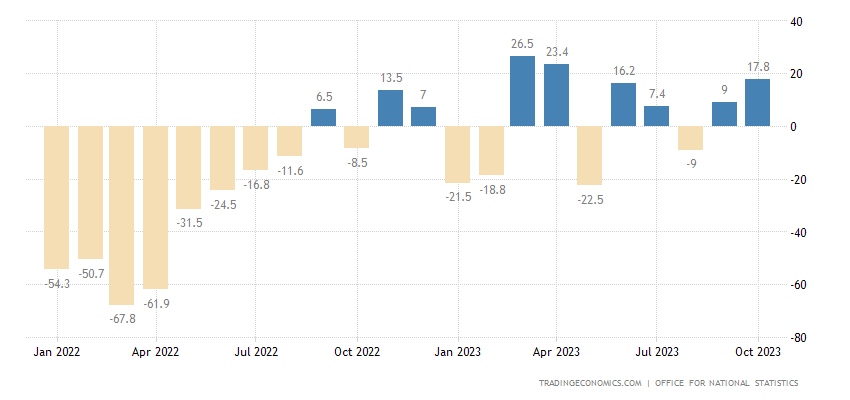

Year on year is even worse, as retail sales have been in decline since April of 2022.

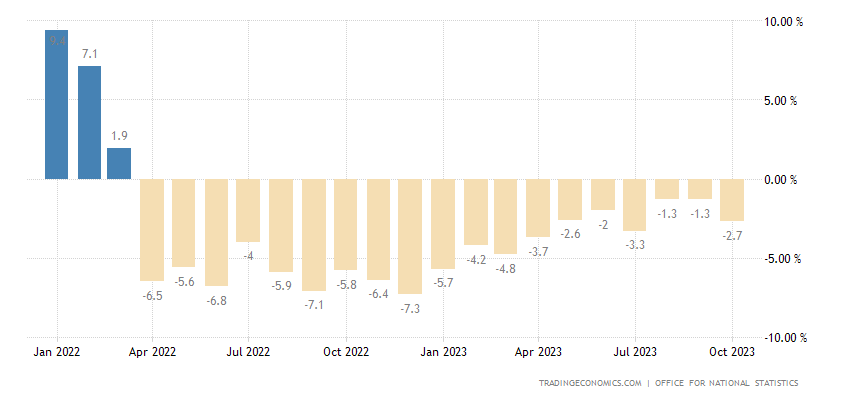

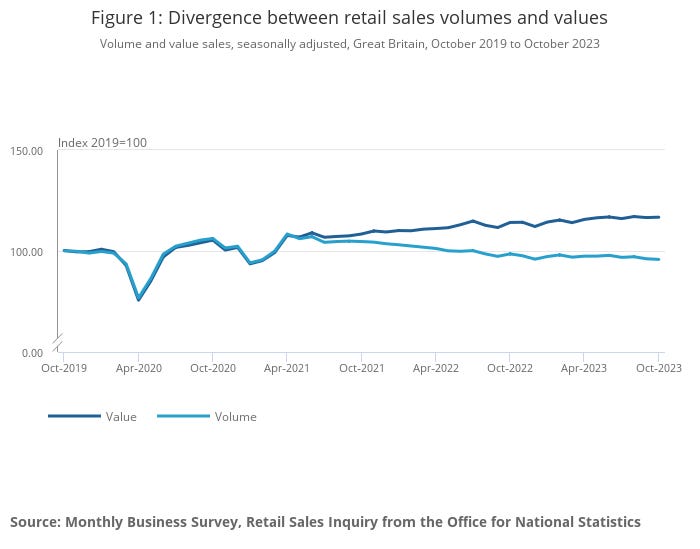

Yet it is not merely that retail sales have been declining since last year. Sales volumes have been declining steadily since 2021.

The declines are across the board, with only “non store” retailing posting any gains.

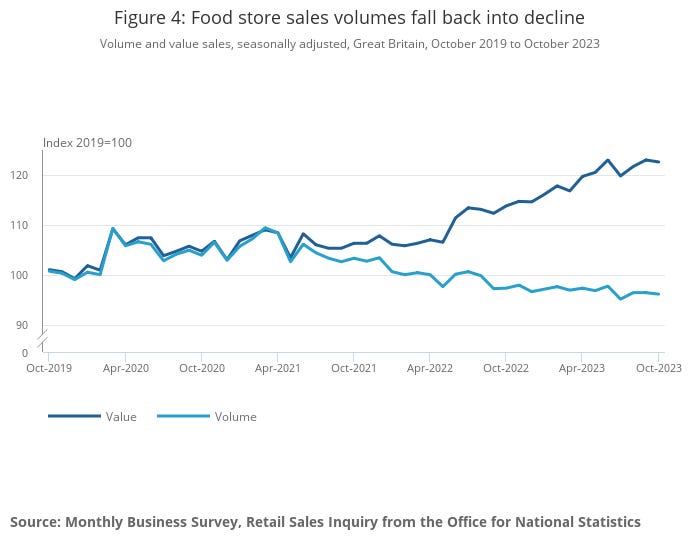

Even more worrisome is the fact that food purchase volumes have been declining steadily since mid-2021.

Food sales value (i.e., what people are paying) is going up while food sales volume (i.e., what people are buying) is going down. This is why food inflation today means food insecurity tomorrow, and hunger the day after.

For any reader looking for the definition of a “retail recession”, Great Britain is officially that definition.

Yet it is not merely British retail that is sliding into a winter of economic discontent. The British economy as a whole was largely stagnant during the third quarter.

The UK economy failed to grow between July and September, figures show, after a succession of interest rate rises.

The chancellor said higher rates were hitting growth, but added that the economy had performed better than expected this year.

Forecasters suggest the economy is set to be stagnant for several months yet.

Last week, the Bank of England said the UK was likely to see zero growth until 2025, although it is expected to avoid a recession.

By “stagnant”, we mean “no growth”. At all.

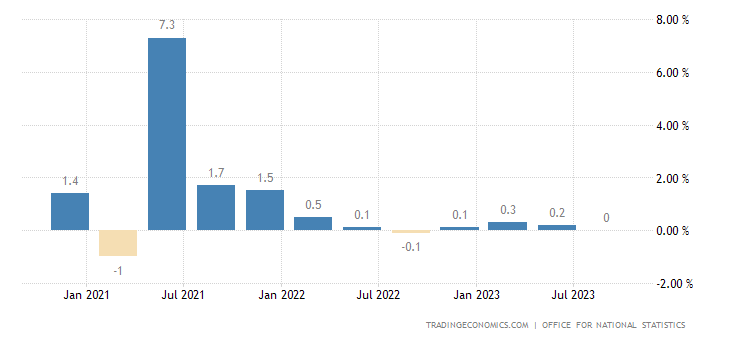

The UK’s annual economic growth rate is only slightly better, hovering just above comatose at 0.6%.

Thanks to inflation, that means the UK’s GDP in Constant Price (i.e., “real GDP”) actually declined.

There is more than a little irony in British economic analysts saying a recession is “likely”. The data is saying the recession is already here—as it is in so many parts of the world.

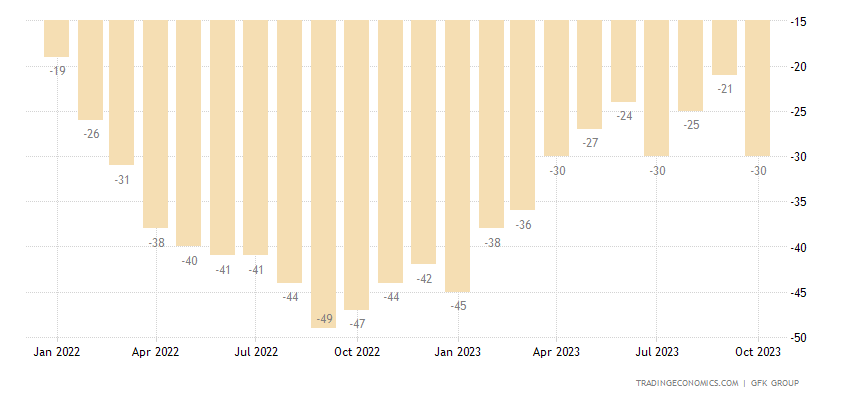

The British people already know their situation is not good. Consumer confidence has been negative since at least the start of 2022.

That’s a long time even for the historically stoic Brits.

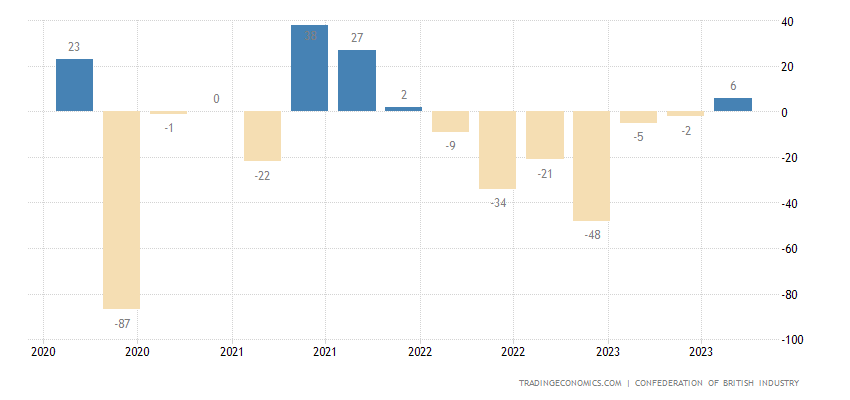

Business confidence is scarecely any better.

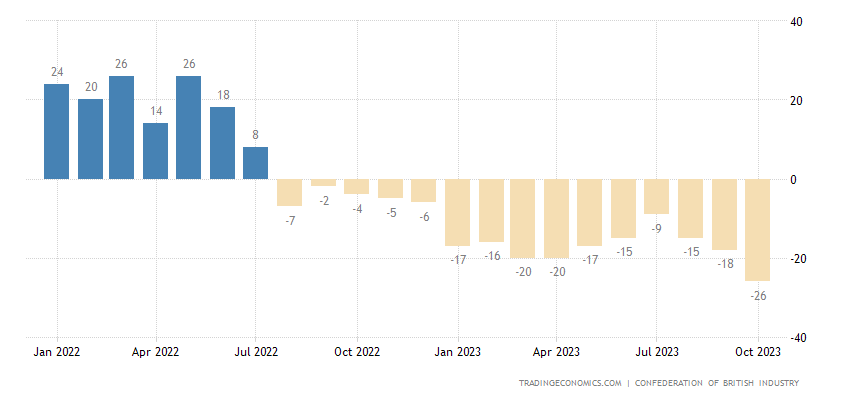

Both businesses and consumers have reason not to feel much confidence in the economy. When industrial orders have been shrinking since July of 2022, that by itself means the economy is in trouble.

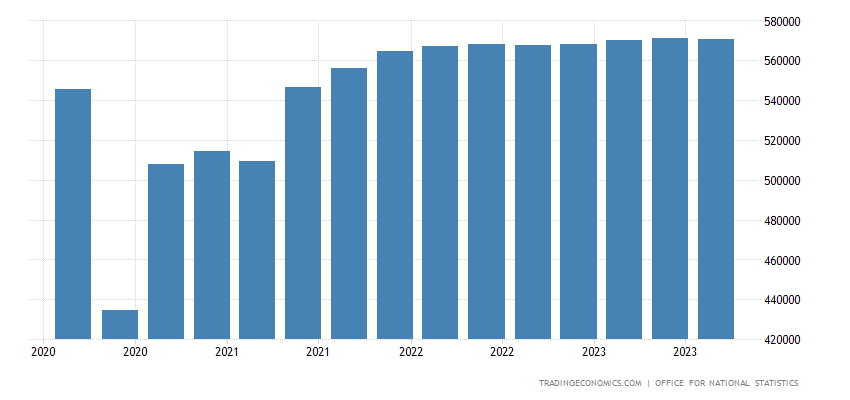

Add to that a rising unemployment figure since the start of 2023.

Unemployment claims surged in October, meaning the bad situation has taken a significant turn for the worse.

Perhaps what tells the tale on the moribund state of the British economy is that these numbers are only scratching the surface of the bad UK economic data.

For space considerations I haven’t discussed their inflation numbers, or their rising core consumer prices, or how core inflation is running hotter than headline inflation just like in the US.

I have not mentioned how their food price inflation is still in double digits.

I have not mentioned their producer price numbers, which are sending largely the same deflationary signals as in the US.

Britain is caught in a worsening recession, a recession that by the data is worse than what we are seeing here in the United States.

With China sliding further into deflation, and with the US economy also getting bogged down by declining demand across entire economic sectors, Britain’s economic woes, which are sure to worsen throughout the remainder of this year at least, are but the latest sign that the global economy as a whole is bogging down in recession.

The world’s economies are in a race to the bottom, and it is by no means clear what “winning” that race looks like.