While the New Year is typically a time for new resolutions, new changes, and a generally optimistic looking forward into the future, we must not lose sight of the reality that the future is always built upon whatever exists in the past.

Where we are is invariably the product of where we have been.

Similarly, where the US economy is today is the product of where the US economy has been.

Unfortunately for American manufacturing, in 2024 where the US manufacturing economy has been is nowhere good.

For all of the hype and hooplah from the (Biden-)Harris Administration about jobs creation and a “Manufacturing Boom”, American manufacturing did not prosper in 2024.

If prevailing trends in capacity utilization and employment are not reversed quickly, 2025 will similarly not be a kind year for American manufacturing.

With Donald Trump about to take office for a second time, and about to set about implementing his Agenda 47, we should look critically at what the current data tells us about the state of the US manufacturing sector, and what challenges will lie ahead for President Trump as he takes office on January 20.

Let us see what the numbers have to tell us!

ISM Purchasing Manager’s Index Has Printed Contraction All Year

The catalyst for this exploration has been the publication of the Institute for Supply Management’s (ISM) Purchasing Manager’s Index (PMI) for Manufacturing for December, 2024.

While the ISM Manufacturing PMI rose by 0.9 points in December, it still remained well below the 50-point threshold that is the transition between expansion and contraction.

US Manufacturing enjoyed only one month where the PMI showed expansion at all in 2024, way back in March. Every other month has shown US manufacturing to be contracting, based on the ISM PMI survey data.

Just to keep everything clear, my notion of a “manufacturing boom” does not entail the manufacturing sector contracting. Expansion is the preferred level of the Purchasing Manager’s Index, and that manufacturing did not get in 2024.

The ISM Manufacturing Production PMI shows production in this country languishing in particular during the latter half of 2024.

While the first part of the year almost showed some promise, after the same good March month as the overall sector PMI, Production waned, with the Production PMI printing contraction from June onward.

The ISM Manufacturing Inventories PMI did not fare any better. If anything, it fared worse.

The manufacturing sector has not been caching inventories ahead of any anticipated uptick in demand.

The ISM PMI data has shown contraction across the manufacturing sector quite literally all year long, and there is very little to indicate any organic reversal of that trend any time soon.

Can President Trump Reverse This?

This is setting quite a challenge for President Trump as he takes office. One of his signature pledges within his Agenda 47 is to turn the US into a manufacturing superpower.

While I absolutely applaud this goal and hope very much that the US can revitalize the manufacturing side of the economy, it’s important to recognize that such transformations do not merely just happen.

Much of the heavy lifting that has to happen in reality lies outside the President’s purview. To revitalize manufacturing companies will need to actually expand manufacturing output, increase manufacturing employment, and increase overall plant capacity utilization.

The government can incentivize these activities, but it will remain for private enterprise to actually do them.

To be sure, Donald Trump and his proxies have spoken at some length about the incentives that could be brought to bear on the issue.

The cornerstone of Trump’s manufacturing plan includes significant tax breaks for companies that establish or expand production facilities within the U.S. In a move aimed at reducing outsourcing, the administration is also proposing increased tariffs on imported goods, particularly from countries like China and Mexico.

According to White House officials, these measures are designed to encourage companies to shift operations back to American soil, boosting local employment. The administration is also exploring government contracts that prioritize businesses with U.S.-based supply chains.

Donald Trump’s stance on tariffs has, as readers are aware, roiled global geopolitics, as countries including Mexico, Canada, and China are having to grapple with what to do if Trump should make good on his tariff threats.

Critics argue that these policies will not help, but will actually weaken the overall US economy by driving inflation.

However, while that is a risk, consumer goods prices—and import goods in particular—have been broadly declining in 2024, thereby creating a potential window of opportunity for Donald Trump to make good on the tariff threat without triggering significant consumer price inflation.

Will his policy proposals work? For that answer we will have to wait for 2025 to unfold itself.

Ask me again next year!

Not All Manufacturing Data Is Grim

We should note, however, that not all of the Manufacturing PMI data presents a problem. Some of it may even present a bit of promise.

The for the most part, the ISM Manufacturing Prices PMI expanded in 2024.

While rising prices and inflation is problematic for any economy, if manufactured goods can command higher prices that itself will be an incentive for manufacturing enterprises to expand their footprint in this country, irrespective of tariffs and tax breaks.

The rise in prices paid has certainly not dissuaded new orders from being placed.

New order growth is, of course, essential to expanding production in any endeavor. A steady flow of new order business increases the likelihood that there will be manufacturing growth in the future. While new orders staggered a bit during the fall, they have managed to rebound back into expansion territory for December.

For Donald Trump to achieve his policy objective, there will need to be a lot of new manufacturing orders placed.

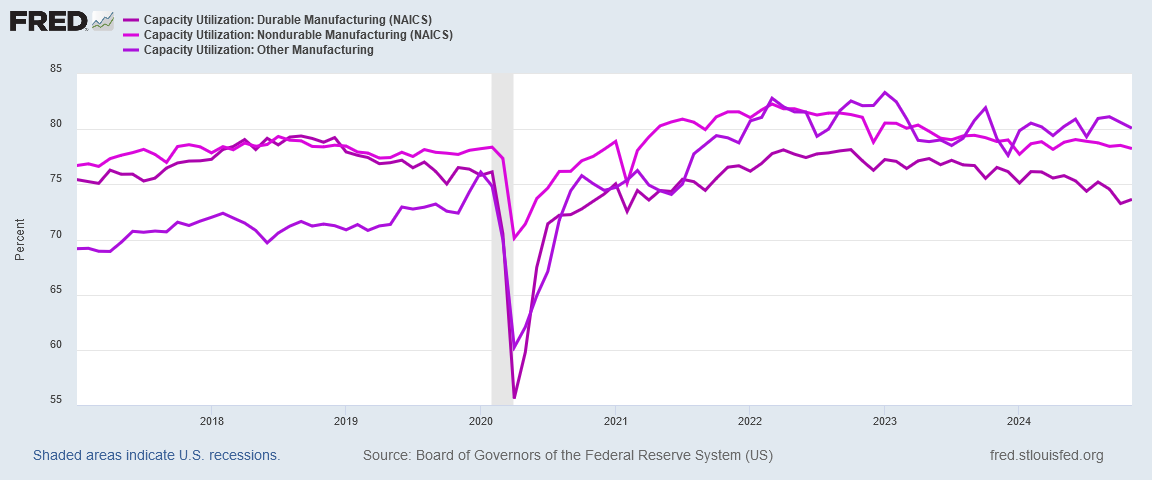

Capacity Utilization In Multi-Year Decline

What makes the challenge before Donald Trump particularly imposing, however, is the reality that 2024, while a bad year, really has not been an unusual year. Sobering metrics like the steady decline in capacity utilization are a multi-year phenomenon.

It is worth noting, however, that capacity utilization did show some growth during Donald Trump’s first term.

That improvement continued for a time during the (Biden-)Harris Administration, but by the end of 2022, capacity utilization began moving down across the board.

Again, this is one of the basic metrics that needs to reverse if the United States is to become a “manufacturing superpower”, and at present there are no larger organic trends to suggest that this trend will be reversing on its own. We have to bear in mind that the expansion in the ISM Manufacturing New Orders PMI and in the ISM Manufacturing Prices Paid PMI occurred even as the capacity utilization has been trending down.

Continued growth in new orders may help arrest the decline in capacity utilization, but it has already been shown to be insufficient at current levels to arrest that decline.

Problems Extend Back Into Trump’s First Term

The blunt economic truth is that manufacturing in the United States has not been doing well for quite some time, with many of the symptoms extending back into Donald Trump’s first term of office pre-COVID.

Overall, Industrial Production in this country, after rising during the first part of Donald Trump’s previous term of office, began to decline in late 2018.

During the Pandemic Panic, Industrial Production of course dropped off a cliff. It rebounded somewhat during the first year of the (Biden-)Harris Administration, but by the end of 2022, the production index had reverse and was trending down again.

When we zoom in on the (Biden-)Harris years, we can see that there was a definite inflection in September and October of 2022.

When the current regime speaks of a manufacturing “boom”, understand that they are either lying or that they simply do not know how to read the existing data, because after October, 2022, the trend in the Industrial Production indices were clearly down. A “manufacturing boom” of any kind is simply not compatible with this data.

Yet the problems with manufacturing itself within the Industrial Production indices predate the (Biden-)Harris Administration.

The late 2018 decline in Industrial Production was felt particularly in the “Other Manufacturing” sector, having already been in decline since early in the Trump Administration. While “Other Manufacturing” plunged and rebounded during the COVID Pandemic Panic, the Durable and Nondurable Goods sectors managed to stabilize for a time post-COVID, although the recent trend has been once again downward.

Decline Causing Manufacturing Job Loss

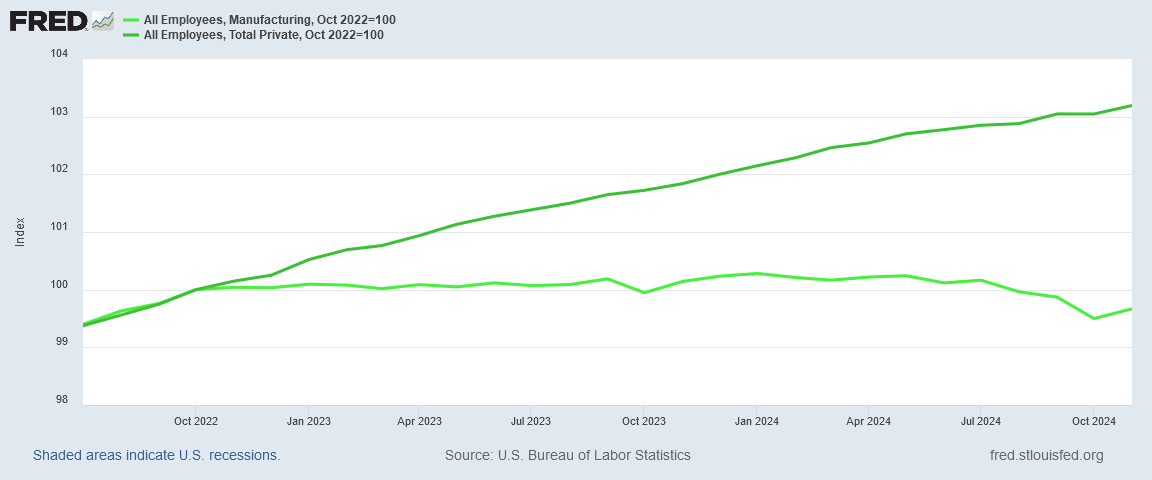

Where the decline in manufacturing really shows up, however, is in terms of manufacturing employment. Particularly in the past couple of years, manufacturing job growth has been either suffering or negative—absolute proof that Bidenomics has not been working, and certainly not for manufacturing workers.

Significantly, at the same time Industrial production began trending down—October 2022—is also when manufacturing employment growth essentially stopped in this country.

If we index manufacturing payroll employment and total payroll employment to October 2022, we can see that there is indeed a change in the overall trend.

This stagnation of manufacturing employment extends from October 2022 throughout the remainder of the (Biden-)Harris Administration, proving conclusively that the current regime’s economic policies have not produced good results for manufacturing employment.

For manufacturing, Bidenomics has not been working at all.

Manufacturing Wages Are Suffering

As might be expected from stagnant jobs growth in manufacturing, manufacturing wages in this country have also not done well. As has been true in most wage categories, manufacturing wages have not at all kept pace with consumer price inflation in this country.

While 2024 did apparently bring some slight improvement in the disparity between inflation’s rise and the rise in manufacturing wages, it has not been enough, and the pay gap that emerged in 2022 has not been closed here at the transition from 2024 to 2025.

Compounding the problem is that manufacturing hours have also been in long-term decline.

Pre-COVID manufacturing workers were working nearly an average of 41 hours per week. Now they are lucky to be working 40 hours per week.

Given that many manufacturing jobs are hourly, if people are working fewer hours they are earning less money. As with any job, people need to not merely be technically employed, they need to be working a solid work schedule as well in order to have an income that allows for even a small amount of wealth creation.

Declining hours per week in manufacturing is not how workers get to a point where they can enjoy even a small amount of wealth creation.

A Jobs Recession, And Elon Isn’t Helping

I will take the opportunity to beat the jobs recession dead horse one more time—because what this data is showing is that US Manufacturing is absolutely experiencing a “jobs recession”.

When it comes to manufacturing, we can even pinpoint the likely start of this jobs recession: October 2022.

That was when the employment growth stopped.

That was when industrial production began to trend down again.

That was when a large portion of America’s capacity utilization began to decline.

These are the trends that we must see reversed if the US is to become a manufacturing superpower.

We need to see employment growth resume in manufacturing.

We need to see industrial production trend up again.

We need to see America use more of its industrial capacity.

All of this is, of course, part and parcel of what Donald Trump has pledged with Agenda 47. Policy points such as this was a major reason why I supported Donald Trump during the election and why I am supporting Donald Trump now.

Yet we need to also be mindful of the sobering reality that not all of Trump’s “supporters” are all that supportive. When it comes to turning the US into a manufacturing superpower, Elon’s track record with the execrable H1-B visa program is not one that gives one confidence he grasps that vision.

New data, compiled by the National Foundation for American Policy (NFAP), shows that Musk has a vast financial interest in keeping the H-1B visa program up and running as Tesla grows its foreign workforce in the United States.

The NFAP report states:

Tesla, led by Elon Musk, showed a significant increase in H-1B approved petitions, rising to 16th on the list of most approved H-1B petitions for initial employment in FY 2024 after not appearing in the top 25 among employers in previous years. Tesla had 742 approved H1B petitions for initial employment in FY 2024, more than double its total of 328 in FY 2023 and 337 in FY 2022. Tesla also had 1,025 H-1B petitions for continuing employment (primarily extensions for existing employees) approved in FY 2024. [Emphasis added]

Moreover, the paper trail within the H1-B visa program shows that Elon has not been at all shy about laying off American workers and using the H1-B program to import their replacements from abroad. As I noted last week, Elon clearly has a dog in the H1-B visa hunt.

However, it is important to note that Elon’s actions vis-a-vis the H1-B visa program have occurred at the same time that manufacturing employment is stagnating in this country, at the same time that manufacturing work hours are declining in this country, and at the same time that industrial production is either stagnating or declining outright.

While it would be extreme to blame Elon for all of the economic weakness within the manufacturing portions of the US economy, it still may be fairly said that he has not helped the US economy add manufacturing jobs

It may still be fairly said that Elon Musk has not helped increase industrial production in this country—and it is beyond any and all contestation that the H1-B visa program of which Elon is so enamored is hurtful and harmful towards workers.

Of course, Elon Musk is not the President-Elect, and will not be inaugurated as President on the 20th. That honor is reserved for Donald Trump, and Agenda 47 is Donald Trump’s platform, not Elon Musk’s.

But Elon Musk has managed to insinuate himself into Trump’s inner circle. For better or worse, Elon is at the moment one of Trump’s principal advisors.

With American manufacturing in a parlous state, and having been in a parlous state for years, Trump’s pledge to restore and revitalize US manufacturing is unequivocally the right policy for the right time. It is what this country needs, and badly.

In order for Donald Trump to deliver on that pledge, he needs sound advice and solid counsel from those around him, and at present that includes Elon Musk.

Will Elon Musk give prudent counsel to President Trump on how to grow the manufacturing side of the US economy? One certainly hopes he will, but there is, obviously, no way to know for certain.

Will Donald Trump’s other advisors, including his cabinet officers, advise him poorly or well on the economy? One certainly hopes they will, but there is, obviously, no way to know for certain.

What is certain is that US manufacturing has had a very rough year—one of decline, and one of contraction. What is also certain US manufacturing has had a year of declining hours worked and shrinking real wages.

What is certain is that, when it comes to transforming the US into a “manufacturing superpower”, Donald Trump has his work cut out for him!

Peter yes these facts definitely matter and honestly, the government doesn't know how to calculate numbers- look at what they say the inflation rate is what a joke!

There are a lot of factors Trump can make a lot of promises just like the rest of them do but what can actually be done and there's factors like you stated outside of what he can control. Of course, he can make deals and make it better for companies to want to manufacture here cut their taxes and then the thing with the tariffs and all of that let's just see what happens.

I hope for the best because people are really suffering. I talk to people every day and they can't afford a lot of things they could before and they're having to decide on which bill to pay this month....they weren't that way four years prior

now am I saying it was all Trump? absolutely not, but things were better.

Really appreciate your articles. I actually pass them on to people to read so they can become more educated on what's really going on because most people have no clue 🤔

You always have the real scoop, in reliable data that does not lie, along with your smart analysis. Thank you, Peter.

One of the foul things that politicians do is to kick bad consequences of their policies down the road so that the next administration has to take the blame. Amazingly, too few voters see through this tactic, and will fall into the trap of blaming the wrong people. I fear that this is what is going to happen to Trump regarding manufacturing. This is why I was asking you last week about turnaround times for improving manufacturing - the faster Trump can improve manufacturing metrics, the less political damage to his MAGA strategy.

One thing that is probably impossible to predict is the effect on our manufacturing from Europe’s economic troubles, and China’s, and all of the trouble spots on the globe. Will their troubles make it easier for companies to decide to reestablish manufacturing in America? Or will their troubles, on balance, lead to such lower global demand for goods that manufacturing doesn’t grow anywhere? I hope you will fill us in on the trends as data emerges. Thanks in advance, Peter!