Another Step Backwards: PCE Report Shows Rising Inflation

The Fed's Strategy Is A Failure

Another month, another month’s inflation report, another reminder that the Fed’s “strategy” for fighting inflation has failed miserably.

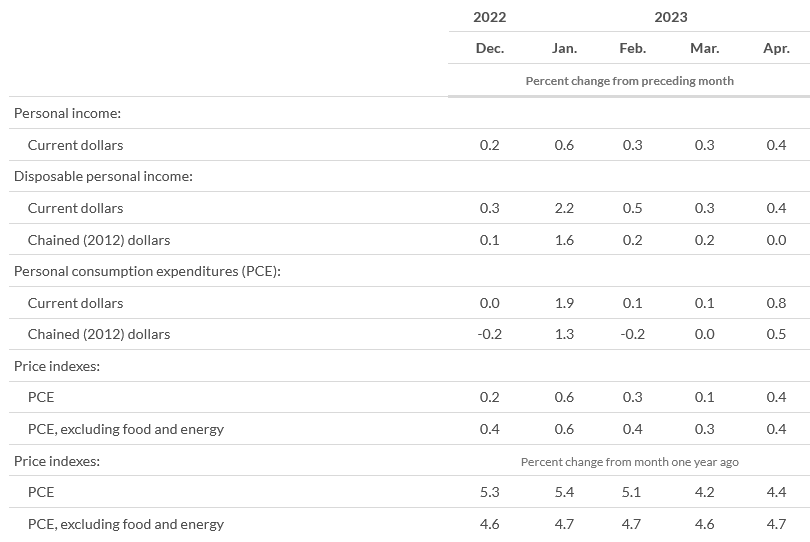

The Bureau of Economic Analysis released April’s Personal Income and Outlays Report showing that not only has inflation not gone down, it’s actually gone up.

From the same month one year ago, the PCE price index for April increased 4.4 percent (table 11). Prices for goods increased 2.1 percent and prices for services increased 5.5 percent. Food prices increased 6.9 percent and energy prices decreased 6.3 percent. Excluding food and energy, the PCE price index increased 4.7 percent from one year ago.

In March the year on year increase in the PCE Price Index was 4.6%.

This is what failed monetary policy looks like.

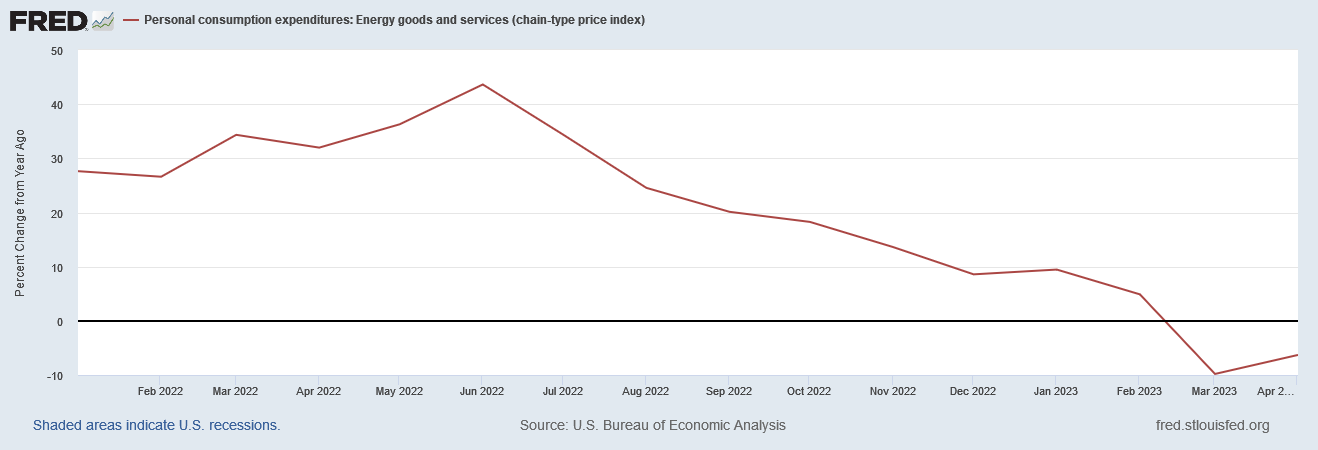

With the exception of the problematic “good news” about the decline in energy prices (deflation carries its own set of risks), there is absolutely no good news in the April PCE report.

By every significant measure, the Fed is losing the battle with consumer price inflation.

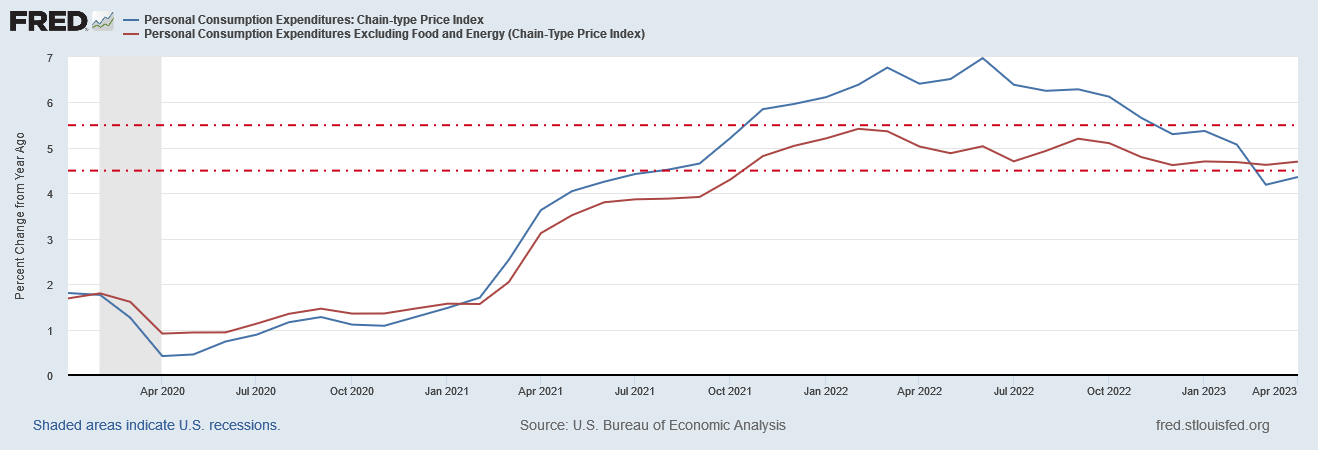

Moreover, we can see this directly just by examining the year on year “core” consumer price inflation rates per the PCE.

While the headline PCE Price Index value has risen and fallen—and is now rising again—the core metric has remained in the same range around 5% ±0.5% since November of 2021. Since a full five months before the Federal Reserve began pushing the federal funds rate up, core consumer price inflation has not appreciably changed.

We see the same pattern in core consumer price inflation per the CPI metric as well. Core inflation per the CPI has remained at 6%±0.5% since well before the Federal Reserve began hiking the federal funds rate.

In order for the Federal Reserve to claim it has had any effect on consumer price inflation, there has to be…well…some demonstrable effect to be claimed. There is none.

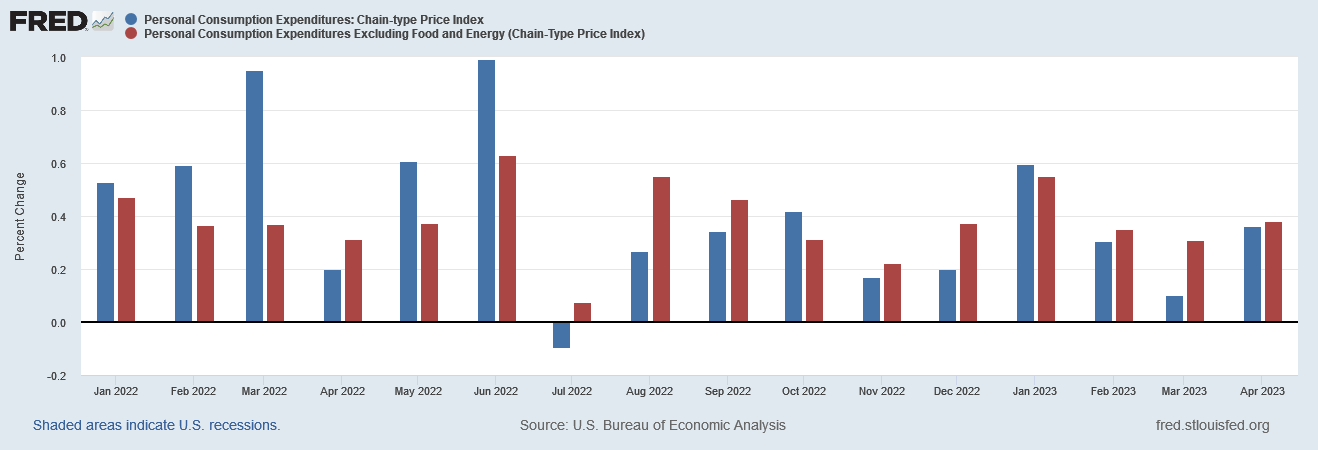

Moreover, while the month on month headline inflation rate per the PCE Price Index shows the same sharp drop last June as has been observed in for the CPI metric, once again that drop did not percolate through to the core inflation rate.

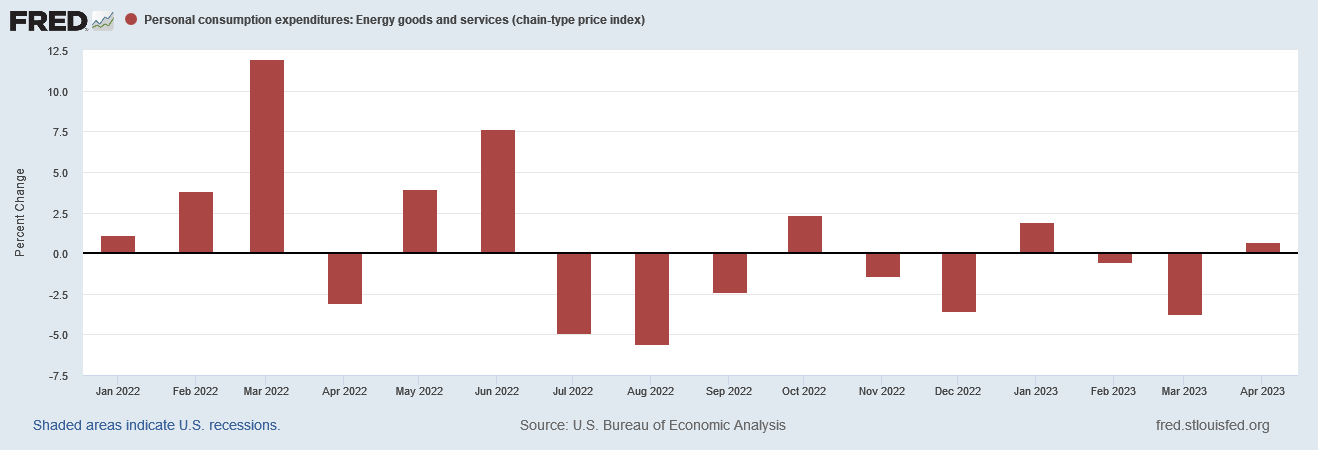

Nor is there any great mystery as to why this is: energy prices peaked in June of last year, and so did energy price inflation.

The reason the headline inflation rate is below the core inflation rate is due entirely to the fact that we’ve had energy price deflation for months now.

Food price inflation, however, is still considerably higher year on year than either the headline rate or the core rate.

Only in the past few months—since January of this year—has the month on month rate for food price inflation been below either the headline or the core rate.

Whether food prices remain on this disinflationary trend remains to be seen. The outright deflation we are seeing in energy prices could be a harbinger of deflation throughout the economy, which would bring on its own problems and challenges.

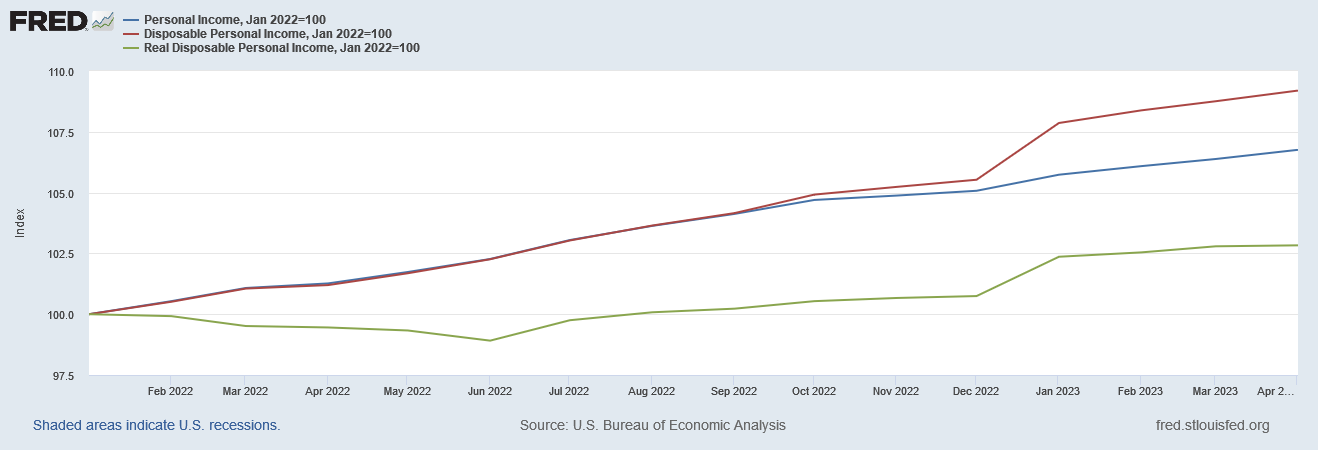

While consumer price inflation is rising, real wages, alas, are not.

While incomes have rising in nominal terms, the PCE data shows real disposable income to have been largely flat since January of 2022.

Throughout all of 2022, real disposable income increased by less than 1%. After jumping 1.% between December, 2022 and Janaury, 2023, real disposable income again largely plateaued.

Since January of 2021, real disposable income has actually fallen 9%, while consumer prices have risen between 12.7% (PCE metric) and15.3% (CPI metric).

Just so there’s no confusion, a healthy economic situation would have these graphs reversed, with real income rising and consumer prices falling.

To appreciate just how completely asinine the Fed’s insistence on pursuing rate hikes is at this juncture, we do well to recall that inflation is an outgrowth of overall money supply, but not money supply growth.

This is the relationship between money supply and prices Friedman asserts is controlling. The supply of money in an economy defines the price level in that economy.

However, this is not the relationship Jay Powell and the economists at the Federal Reserve infer. Rather, their monetary policies presume a relationship between money supply growth and inflation, which is not the case and which Friedman does not assert to be the case. Indeed, owing to the concurrent influence of money velocity, it is not possible to establish a clear correlation between money supply growth and inflation. Velocity becomes a confounding factor that invariably disrupts all such calculations.

If we accept Friedman’s thesis that inflation is everywhere a monetary phenomenon, we are immediately confronted with the impossibility of the Fed’s inflation strategy ever working. Hiking inflation rates was always the wrong strategy (and it was wrong during the Volcker Recessions of the early 1980s as well).

In this regard, the April PCE report is merely a replay of the March report, and proves once again that inflation is still more stubborn than Jay Powell.

Far from working, the Fed’s rate hikes have simply made matters worse. Thanks to the Fed’s inflation strategy, the United States is spiraling down with the rest of the world economy into a deeper and more prolonged period of stagflation.

When incomes are down and prices are up, the policy has failed.

Incomes are down and prices are up, and so the Federal Reserve’s monetary policy has failed.

As the Fed has been unable to succeed at monetary policy, it would be best if it stopped futzing with monetary policy. We are living the proof that bad policy is worse than no policy.

What's next, first time debt ceiling default, they have already extended it 5 days due to incompetence?