With Jay Powell and the Fed having opted to officially kick the interest rate can down the road to the next FOMC meeting, it is time to look at liquidity trends and see where things stand.

Are the dominoes still lined up to fall? Or is there some hope disaster might be avoided?

Surprisingly, things are somewhat better than they were. At the very least, a liquidity crisis is not just over the horizon (yet).

Readers may recall that at the beginning of May, I pondered the possibility of a looming liquidity crisis.

The longer the deposit outflows continue, the greater the likelihood there will be more banks caught up in bank run and liquidity squeeze. The longer the deposit outflows continue, the greater the certainty that more than one bank will need to be closed and bailed out through the remainder of this year.

More banking dominoes will fall. We do not yet know for certain which banks those dominoes will be.

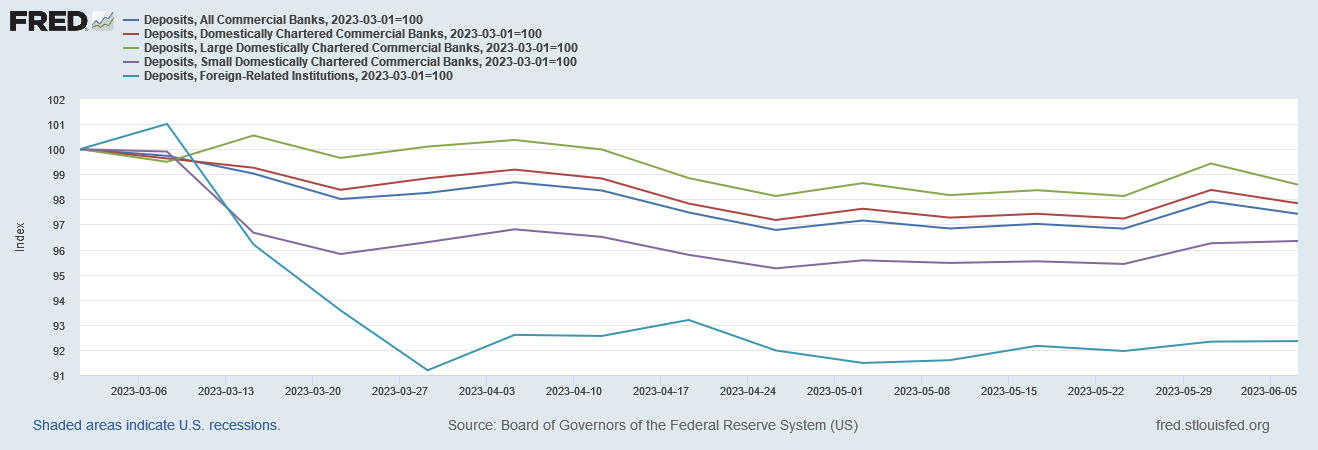

While I see no reason to change my assessment of the underlying dynamics, we must acknowledge one important reality: Deposits have largely stabilized, and may even be increasing again. This is immediately apparent if we index deposits to January 1 of this year.

It is also worth noting that deposits at small banks have increased for the past two weeks, which we can see clearly if we index deposits to March 1.

Thus while it is still true that if there is a continued drain on deposits out of the banking system, there will inevitably be a liquidity crisis and at least one bank will falter as a consequence, for now, that drain has largely stopped.

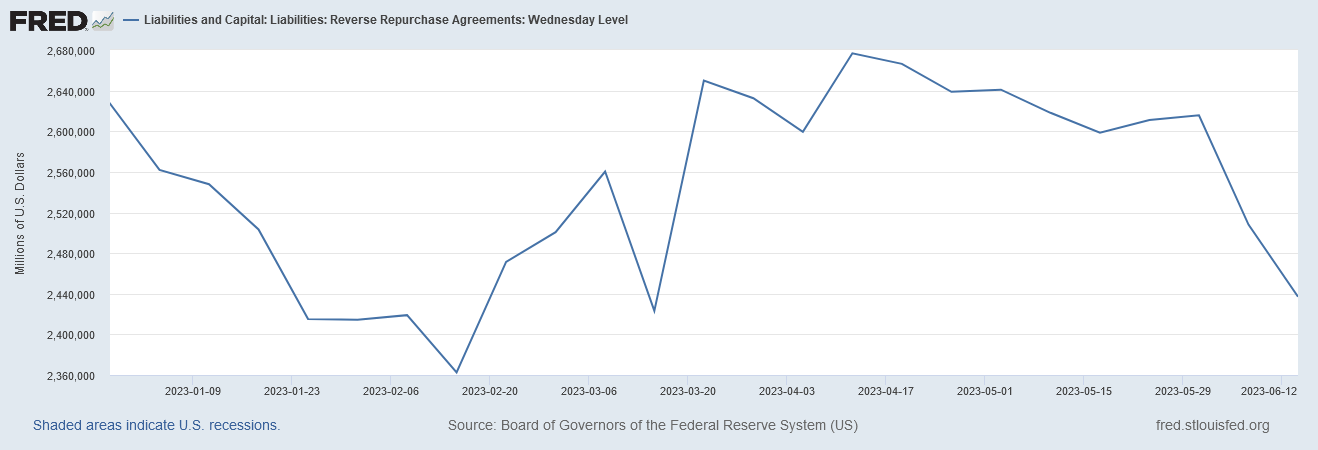

Moreover, while it is too soon to call the increase in deposits a trend, there is a definite decrease in funds placed in the reverse repurchase market with the Fed.

If we focus on weekly levels in the reverse repo market for 2023, we immediately see that there was a surge in repo activity that began around the time Silicon Valley Bank ran into rough waters, and which culminated in mid-April, roughly two weeks prior to First Republic’s takeover by JPMorgan.

Before and after that, reverse repo activity has been very much on the decline.

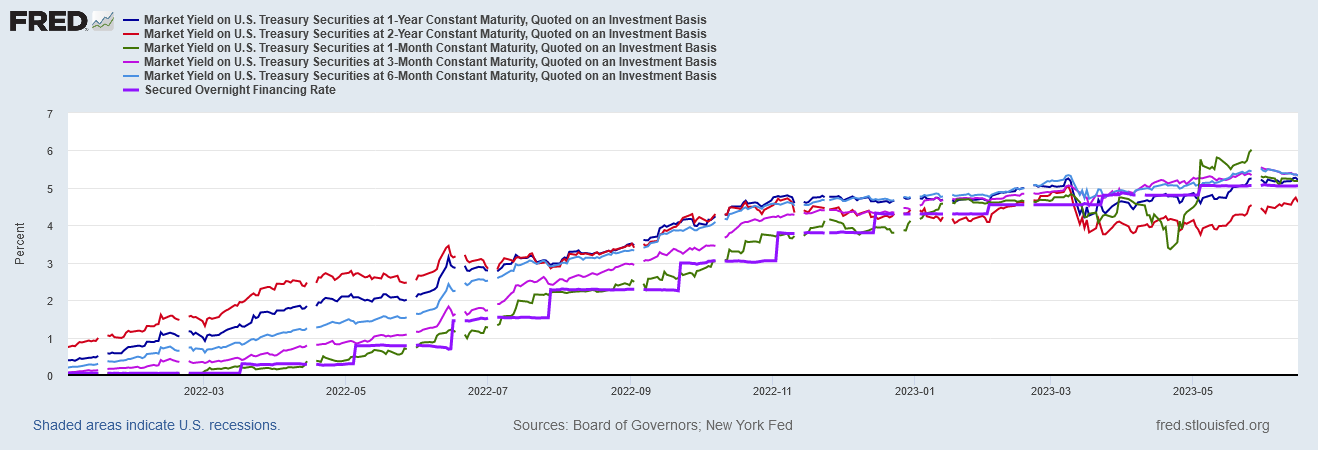

This has happened even as short-term treasury yields have slowly moved upward, and are higher now than they were just before they reversed at the beginning of March around the time that SVB collapsed.

The yields on 1-Month Treasuries are anomalous because of that Kabuki Congressional cock-up over the debt ceiling. Washington did its periodic yanking of Wall Street’s chain before doing exactly what they’ve always done before—raise the ceiling and raise spending to match.

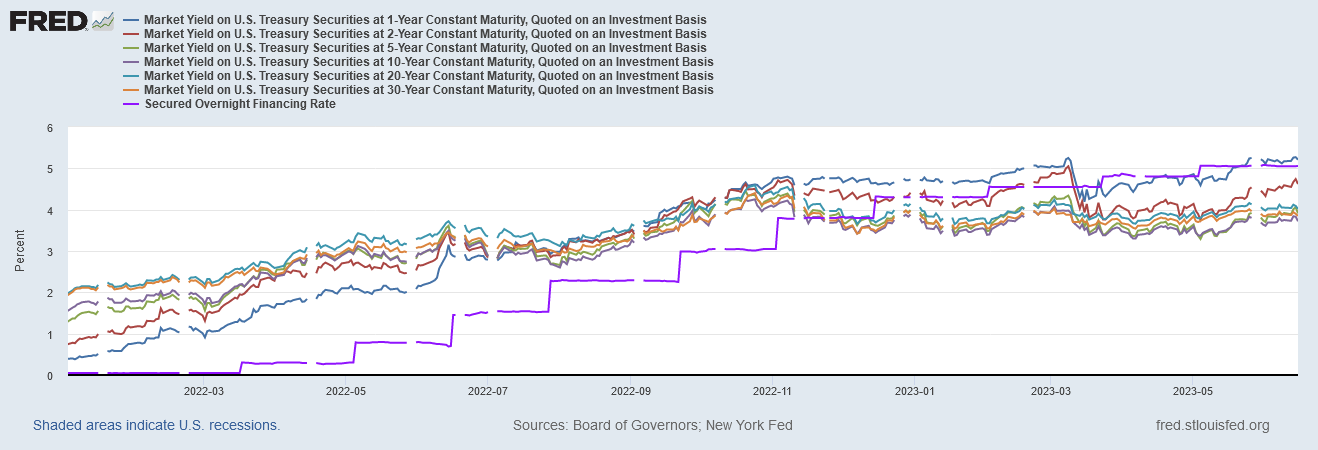

Intriguingly, while short term yields are moving higher, longer term yields have largely plateaued.

The 2-year yield is increasingly below the 1-year yield, and the longer term maturities are increasingly below the 2-year yield. Given that this is still the mother of all inversions—the typical and expected behavior for interest rates and bond yields is that longer maturities have higher yields and shorter maturities have lower yields, which is the polar opposite of what we’ve had on Treasuries for roughly a year now—the ramifications of this divergence can only be described as “not good.”

Wall Street seems also to be breathing a bit easier on banking prospects. In the wake of SVB and First Republic, it was almost a foregone conclusion that banks such as PacWest and Western Alliance were queued up to fall with one foot already in their corporate graves.

Recently, however, PacWest’s stock has stabilized and for a time was even rising again.

Western Alliance has held up even better and recovered more of its pre-crisis market value.

Overall the banking sector has managed to hold its own since the serial crises earlier in the year.

Has the banking sector in fact turned the corner and is moving away from impending crisis? Certainly for the near term that appears to be the case.

Still, we should not be to quick to pronounce the banks hale and healthy.

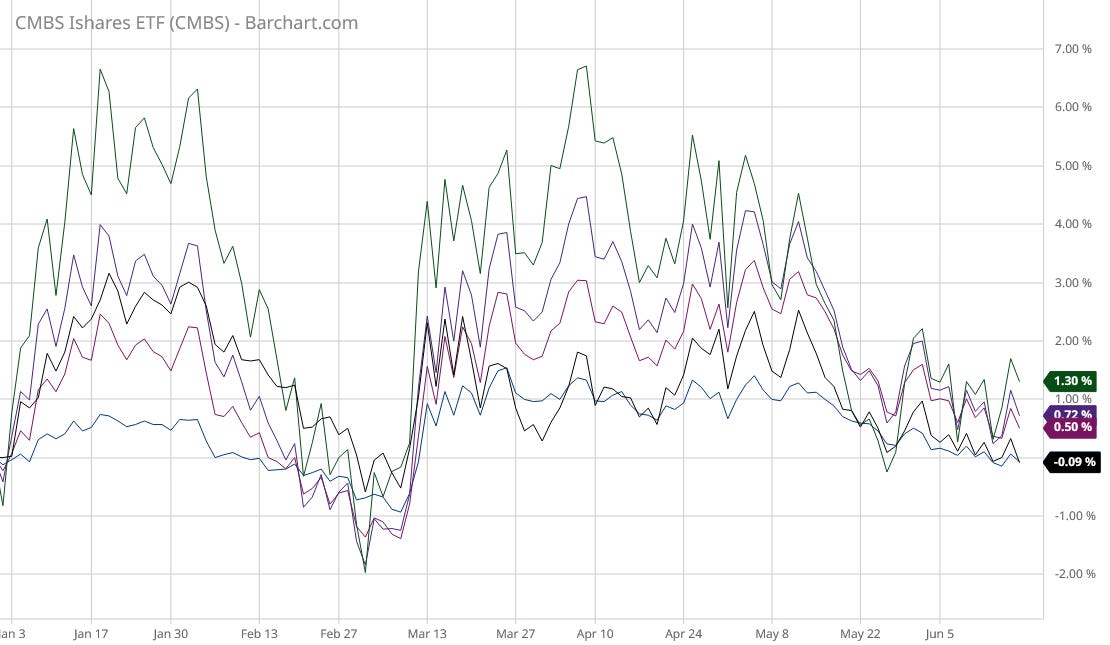

Fixed income exchange traded funds, such as the CMBS ETF for corporate mortgage backed securities, have been steadily losing value since April.

Powell’s comments after the FOMC meeting thus far have not inspired market confidence in the future value of fixed income securities—and that means there is still a big glaring weakness on bank balance sheets that could blossom into a crisis should deposit outflows resume.

That Jay Powell is just inept enough to misread the data yet again and draw all the wrong conclusions about the state of the economy has been a recurring theme in his FOMC pressers. He was befuddled this last time and he was clueless in May.

With the Fed still committed to at least 50bps more worth of federal funds rate hikes, Powell is still at risk of triggering a liquidity crisis and then a banking crisis—so long as the Fed keeps hiking the federal funds rate it continues to inch that much closer to causing a sharp and painful money shortage.

If bank deposit inflows continue, then there is at least a chance that a fresh banking crisis can be averted. If banks are adding deposits they are not under pressure to divest their underwater securities portfolios. If funds continue to flow from the reverse repo market back into bank deposits, banks have a chance to sit on their securities portfolios until maturity, and thus can avoid taking big losses on the sale of those securities.

As we have already seen, however, this outcome is almost entirely in the Fed’s hands. If Powell pushes to hard on the federal funds rate, deposit outflows will resume and reverse repo activity will rise again. Deposit outflows, if sustained, will provoke first a liquidity crisis and then a banking crisis. With the bank failures that have happened this year we have already seen how that sequence of events plays out—not well.

Powell made a sound choice (finally!) by hitting pause on interest rate hikes. Now let’s see if he can continue to make sound choices. The health of the banking sector hinges on the choices he will be making throughout the rest of this year and into 2024.

It’s always so impressive how you can see all of this and explain it so well, Mr. Kust!

Some questions:

This ‘mother of all inversions’ - do you know if that has happened before, and if so, how did it play out?

Also, Siicon Valley Bank tanked in part because they had gone deep into a ‘woke’ culture and away from sound banking fundamentals (as I remember, their risk-analysis officer was a young, woke lesbian who apparently got her job primarily because of these attributes). In your always-amazingly uncovering of banking info, have you seen any discussion within the industry regarding the need to dump the creeping wokeness and return to solid banking practices? Any evidence that it is happening? Hard to quantify, I know, but maybe you’re seeing something reading between the lines...

Good analysis as usual. Peter. I think this will just be temporary as I don't think Powell and the Fed really know what direction to go in. The pause was I think just a way to regroup and to see what happens because, to be honest, I really don't think they really know! what will happen!! Linking as usual @https://nothingnewunderthesun2016.com/