I will give Federal Reserve Chairman Jerome Powell this much credit: the man never misses an opportunity to miss an opportunity.

Yesterday, he also demonstrated yet again his singular talent for tanking markets just by opening his mouth, in his regular post-FOMC press briefing where he attempted to explain the Fed’s economically illiterate decision to, as expected, punt on lowering the federal funds rate.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

The Fed’s announcement ahead of Powell’s presser was very nearly Shakespearean in quality. While it lacked much sound or fury, the announcement was demonstrably a tale told by an idiot and signified nothing.

As I argued yesterday in advance of the FOMC decision, if the Fed wanted to support maximum employment it would have trimmed the federal funds rate.

A 50bps rate cut at this juncture would be more of a catching up than anything else.

However, Powell was not satisfied with merely punting on the federal funds rate. During his press briefing he persuaded the Dow to drop and Treasury yields to rise.

Ah, if only he would use his powers for good!

Instead, he offered up a mix of tortured logic and blatant misreading of the data, as we can see when we unpack just a few of his remarks.

Contents

A Word About The Economy

Before we unpack Chairman Powell’s ramblings, we do need to touch upon the other economic news item from yesterday, which was the Bureau of Economic Analysis’ Advance Estimate for 2Q 2025 Gross Domestic Product.

Real gross domestic product (GDP) increased at an annual rate of 3.0 percent in the second quarter of 2025 (April, May, and June), according to the advance estimate released by the U.S. Bureau of Economic Analysis. In the first quarter, real GDP decreased 0.5 percent.

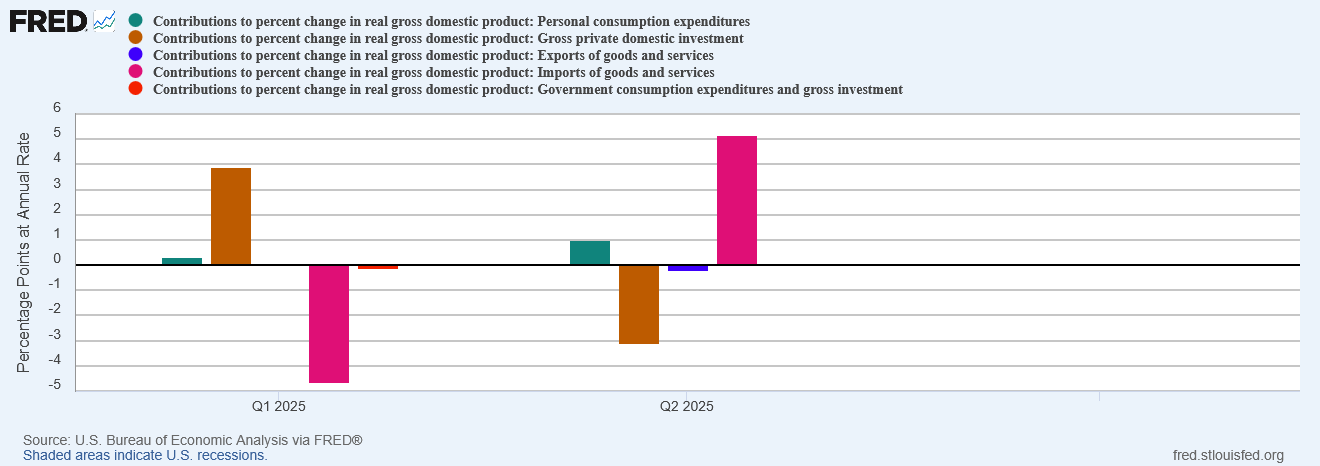

The increase in real GDP in the second quarter primarily reflected a decrease in imports, which are a subtraction in the calculation of GDP, and an increase in consumer spending. These movements were partly offset by decreases in investment and exports. For more information, refer to the "Technical Notes" below.

President Trump, true to form, lost no time in taking a victory lap on Truth Social while reiterating a call for Powell to lower interest rates.

Perhaps also true to form, Trump made the right call—Powell needs to lower interest rates—but for exactly the wrong reason. Powell does need to lower interest rates, but because the economy is not performing at all well. The real economy is doing nowhere nearly as well as the top-level GDP numbers suggest.

As even the BEA conceded, the major shift in GDP came from a drop in imports during the second quarter.

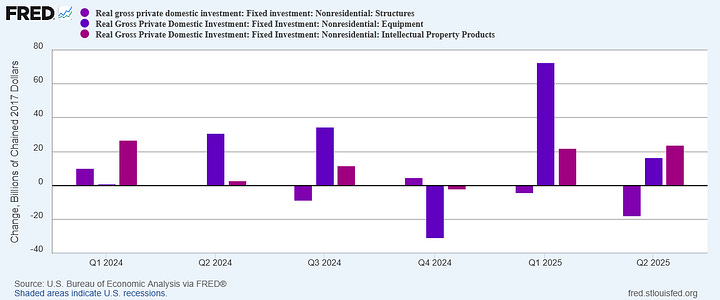

Imports are a reduction in GDP, so the drop in imports produced a surge in GDP. However, imports are the only sector which is contrarian like that. For private domestic investment, a drop in investment means a drop in GDP, and private investment plunged in the second quarter in addition to the plunge in imports.

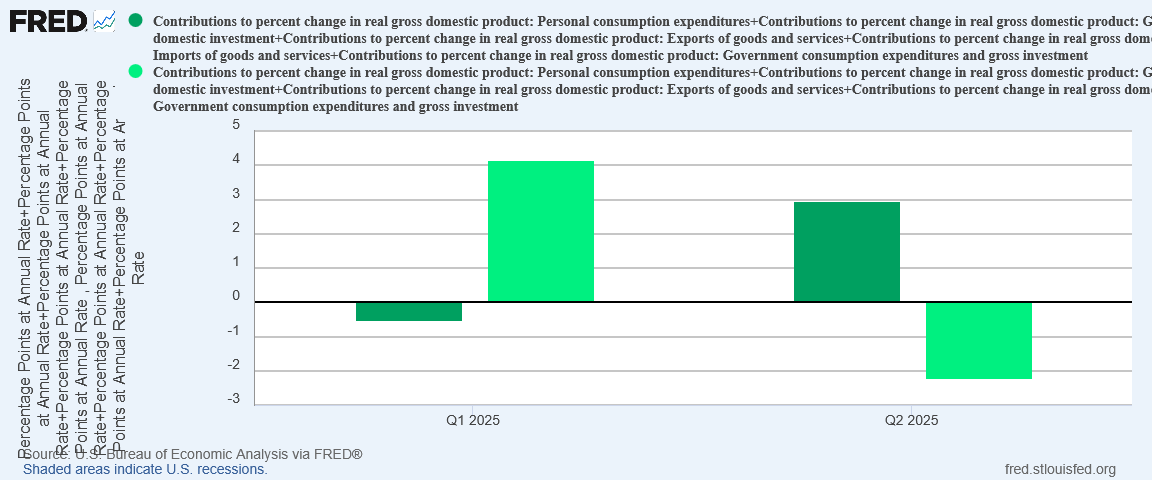

That drop in investment is significant, because without imports in the mix, that shift in investment means overall GDP actually declined.

If we exclude imports, GDP grew by more than 4% in the first quarter, and declined by more than 2% in the second quarter. With imports, GDP declined by 0.5% in the first quarter and rose by 3% in the second quarter.

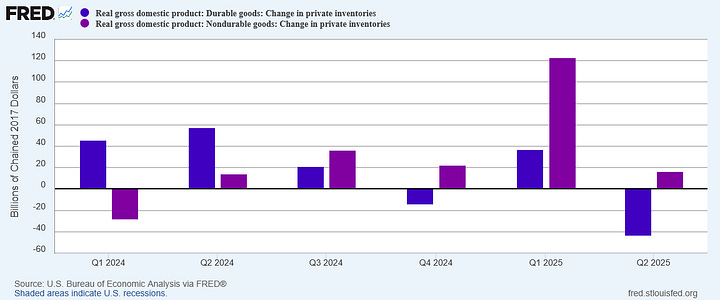

Moreover, the drop in imports was bound to happen. Remember, the first quarter surge in imports was almost entirely a case of front-loading demand as businesses tried to get ahead of anticipated tariffs and trade wars. Where investment and private inventories did increase in the first quarter, a second-quarter drop-off was always sure to follow, and it did.

Far from a robust economy in the second quarter, we actually have an economy that’s woozy and a little hung over.

Contrary to President Trump’s Truth Social post, that lack of private investment growth in the GDP data—and the contraction in GDP sans import data—are the argument for Powell lowering interest rates. If the economy really had grown at 3%, Trump would be wrong-footed in his evangelism for lower interest rates. The economy really contracted, however, so Trump’s call for lower interest rates is, ironically, the right call.

Understanding the parlous actual state of the US economy is necessary to properly apprehend Chairman Powell’s economic misinformation from his press briefing.

Powell’s Remarks

For reference, Powell’s press conference is here in full.

Powell lost no time before spouting pure nonsense about the supposed “health” of US labor markets.

In the labor market, conditions have remained solid. Payroll job gains averaged 150,000 per month over the past three months. The unemployment rate at 4.1 percent remains low and has stayed in a narrow range over the past year. Wage growth has continued to moderate while still outpacing inflation.

Overall, a wide set of indicators suggests that conditions in the labor market are broadly in balance and consistent with maximum employment.

As I’ve discussed in previous articles, in the May Employment Situation Summary overall joblessness was still increasing.

On the May JOLTS report, net hiring fell even though fake job openings rose.

On the June Employment Situation Summary, while the top-level data looked good, thanks to the BLS’ usual application of Lou Costello Labor Math, the sector-level numbers were a disappointment across the board.

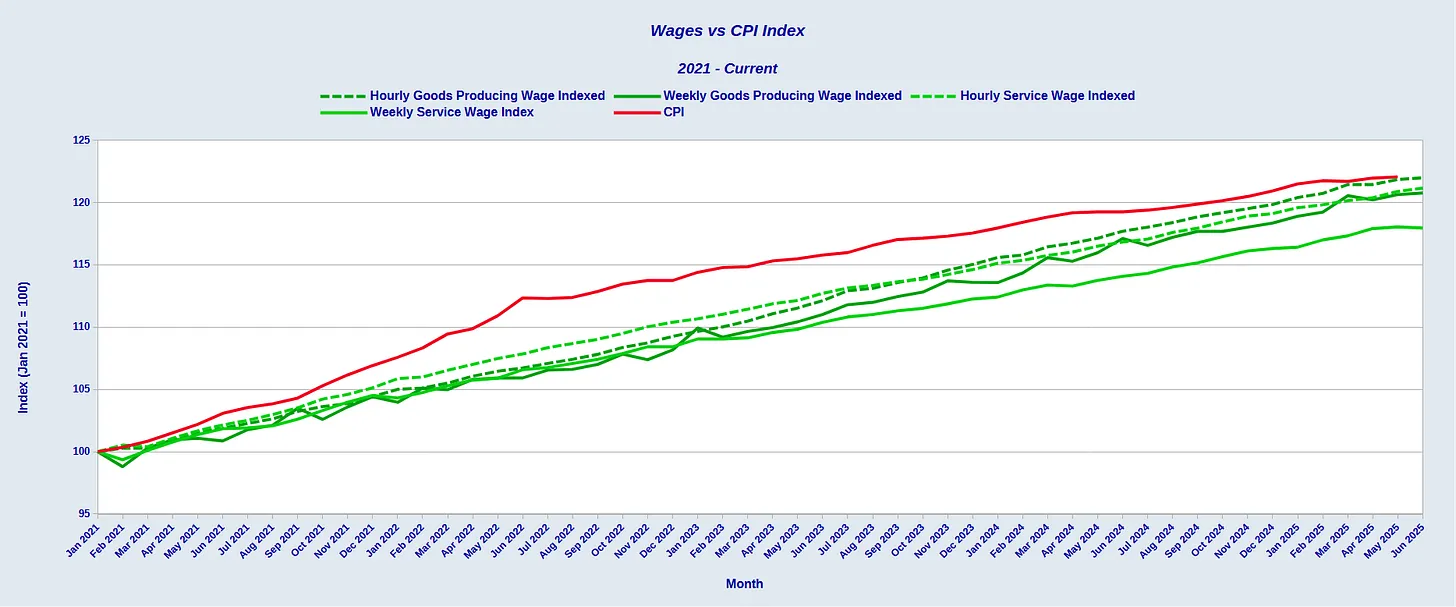

Additionally, June showed that wages still have not caught up with inflation.

To Jay Powell, this level of labor dysfunction is what constitutes “broadly in balance.”

Powell also could not resist spouting more of the TDS-inflected rhetoric about tariffs causing inflation (emphasis mine).

Estimates based on the Consumer Price Index and other data indicate that total PCE prices rose 2.5 percent over the 12 months ending in June, and that, excluding the volatile food and energy categories, core PCE prices rose 2.7 percent.

These readings are little changed from the beginning of the year, although the underlying composition of price changes has shifted. Services inflation has continued to ease, while increased tariffs are pushing up prices in some categories of goods.

While tariffs are always going to be an inflationary price pressure with the potential to push prices higher, Trump’s Liberation Day tariffs have yet to actually result in higher prices, a point I have discussed at some length.

Powell was simply spouting nonsense, and it should be dismissed as nonsense.

Nor did Powell satisfy himself with being wrong here and there on the data. He went all in and was wrong about the economy as a whole, and how it is performing with interest rates at their current levels.

[Reporter] Thanks, Chair Powell. There's a lot of lean in the markets, not to mention out of the administration for a rate cut now in September. Is that expectation unrealistic at this point?

[Chair Powell] So, as you know, today we decided to leave our policy rate where it's been, which where I would characterize as modestly restrictive. Inflation is running a bit above 2 percent, as I mentioned, even excluding tariff effects. The labor market's solid, historically low unemployment. Financial conditions are accommodative, and the economy is not performing as though restrictive policy were holding it back inappropriately.

As I highlighted above, private investment fell during the 2nd Quarter. Factor out import offsets and the US economy shrank during the 2nd Quarter. Yet Powell thinks the US economy is not feeling constrained by Powell’s interest rate policies.

On what planet does Jay Powell spend most of his time?

Wall Street Panicked

As markets have done so often when Jay Powell speaks, they reversed almost as soon as the Powell press briefing began.

The Dow was actually having an almost okay day—right up until Jay Powell held his press briefing—says all anyone needs to know about what the markets thought of Jay Powell and his remarks about full employment.

The yield on the 10-Year Treasury note rose as well.

Yields moved sharply higher when the GDP estimate came out, and then jumped again as Powell began misinforming the media at his press briefing.

One does not need to be an investment guru to see that Wall Street listened to Powell babble about the economy and have something of a “Whiskey Tango Foxtrot” moment.

Wall Street did not believe him, and folks on Main Street should not believe Jay Powell either. It does not matter whether Powell is lying or just putting basic economic illiteracy on display. Call it either malice or stupidity, the endpoint of the analysis is the same: Jerome Powell was shoveling out pure horse hockey at the press briefing, and the FOMC’s decision to punt on the federal funds rate was a bad decision.

Investment is weak in the US economy. Job creation is not anywhere near where it needs to be for the economy to be approaching full employment. Wage growth has not overcome the effects of the 2022 hyperinflation.

The data tells us this. People’s real-world experiences tell us this. Yet Powell denies this to everyone’s face.

Jerome Powell had the perfect opportunity to do something that would actually fulfill the Fed’s full-employment mission. Instead of making use of that opportunity, he missed it completely.

That has been Powell’s trademark throughout his tenure as Federal Reserve Chairman. He has never missed an opportunity to miss an opportunity.

Another witty and insightful analysis, Peter. You are the best!

I have really wondered how out of touch with reality Powell is.

My high school French teacher taught us that when Marie Antoinette said, “Let them eat cake” she was not being callous or flippant. Marie was actually so ignorant of how peasants lived that it never occurred to her that peasants wouldn’t have both bread and cake in their houses. If they were out of bread why don’t they just eat some of their cake?

That seems to be Powell’s mentality. Everything’s fine in America - why don’t people just eat the current interest rates?

When Trump publicly shamed Powell on the building of the Fed’s marble-bathroomed palace, I thought Trump was building to a tactic, a trick up his sleeve to pressure Powell to lower rates. Was Powell too clueless to sense the pressure? Is he even out of touch with that? Hmmm.

Why is Trump allowing him to stay?