November JOLTS: "Little Changed" Means "Still Getting Worse"

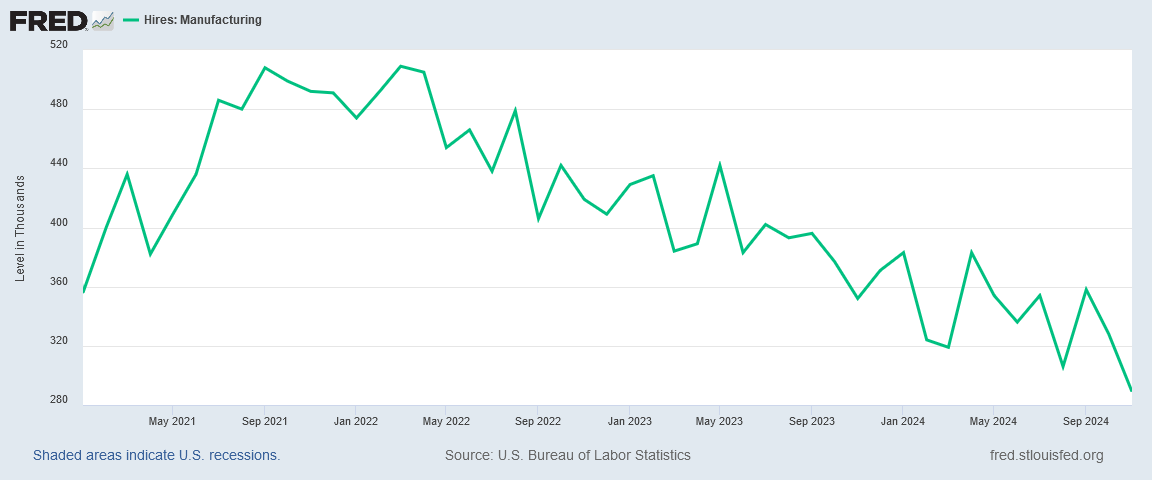

No Holiday Cheer For Manufacturing

If we take the opening paragraph of the Bureau of Labor Statistics November Job Opening and Labor Turnover Summary report at face value, the month was more or less a news nothingburger. Job openings were “little changed”. Hires were “little changed. Separations were “little changed.”

Oh, layoffs and discharges “changed little”.

Alas for the American worker, what “little changed” really means is that the job outlook in this country is continuing to deteriorate.

In manufacturing especially, November was not a month that contained much in the way of employment holiday cheer, as the bad news from October only got worse.

But…Fake Job Openings Were Up!

If one follows the usual corporate media propaganda regarding the job openings report, the report showed continued strength in the US economy, as November was a month of increased job openings.

Job openings are good right? They are a sign the economy is doing well, aren’t they?

No, they are not. Not when they are accompanied by a decline in hiring, which they were.

Job openings are of no use to anyone, and certainly of no value to the economy, when they are not translated into actual job placements—that is to say, when they are turned into actual hiring.

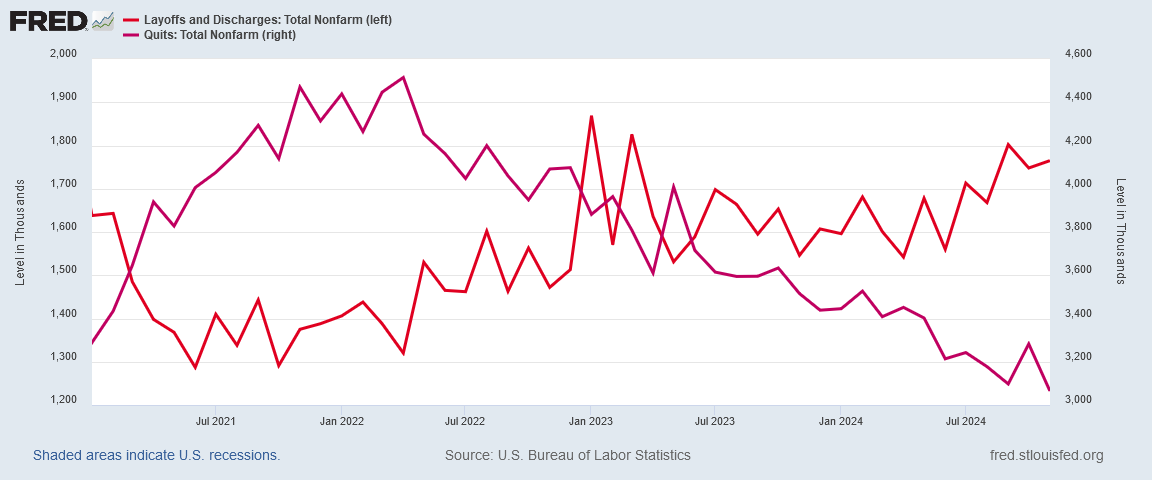

Further making a mockery of the increased job openings is the reality that, just as was the case in October, even though Quits continued to trend down, Layoffs continued to trend up.

People are less willing to leave their jobs now than in months past. Companies are compensating for this by firing them and pushing them out the door anyway.

Neither trend speaks of a confident and robust jobs market where jobs are plentiful.

Less hiring, less quits, more layoffs…three trends which call “BS” on the increase in job openings. As has been the case so often since COVID, the job openings data is almost surely fake. The reported job openings might as well not exist.

Everything Was Worse For Manufacturing

The November JOLTS report had absolutely no love for manufacturing—even the job openings data showed a drop.

Hires, of course, dropped again as well.

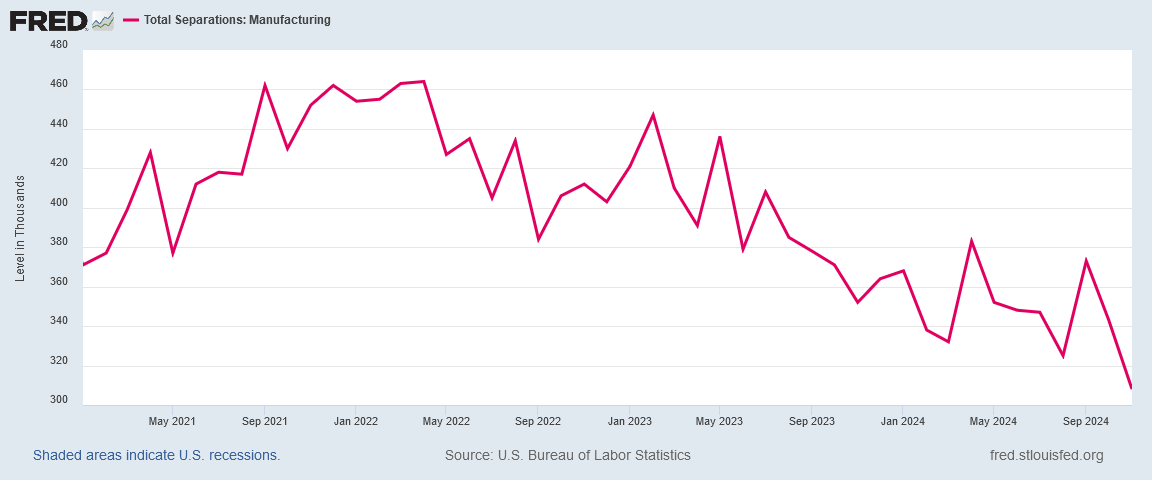

The decline in hires made it a cold comfort that total separations in manufacturing were down as well.

While the Layoffs and Quits figures for manufacturing both notched declines for the month, overall the trends were moving in the same direction as the total layoffs and total quits numbers: up for layoffs and down for quits.

Job Openings were down. Hires were down. Layoffs were up.

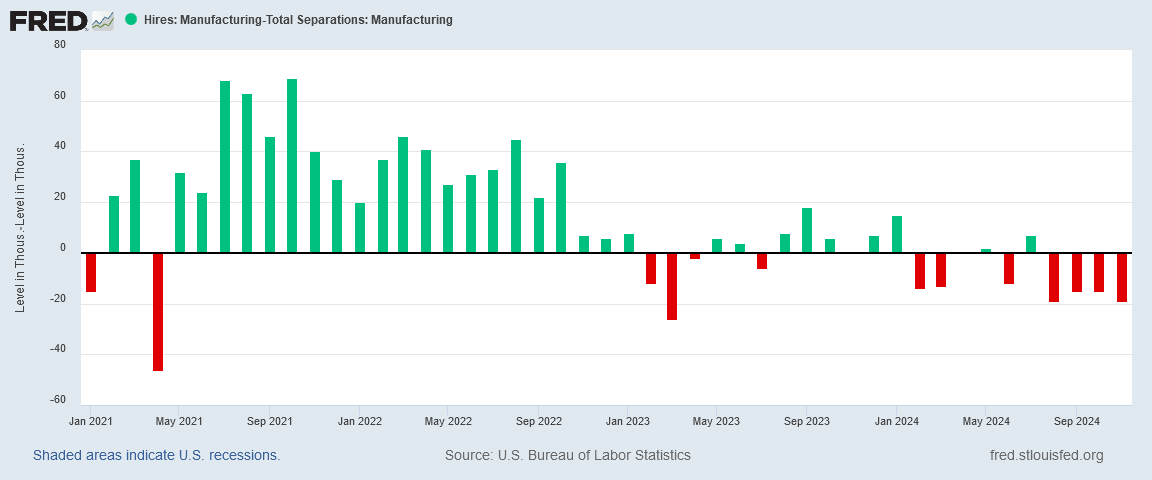

With trends like these, it comes as no surprise that net hiring for manufacturing was once again in the negative. As readers may recall from last month, net hiring for manufacturing has softened greatly since 2022.

If we zoom in on 2024, we can see that net hiring for manufacturing has been negative almost all year.

All of which only serves to further confirm my thesis from the other day, that 2024 has been a year of decline for US manufacturing.

The more data we gather, it seems, the more manufacturing declines. This is not a good thing.

No Good Hiring News Anywhere

A decline in manufacturing is never a good thing, but there would be some tempering of the bad news with some good if there were at least some positive trends in hiring in other sectors. There are not. There is no good hiring news anywhere.

While Private Education and Health Services had been trending up earlier in the (Biden-)Harris Administration, for 2024 the hiring trend has been down, and that trend was continued in November.

Construction has also soured in 2024.

Trade, Transportation, and Utilities, has been getting worse since early 2022.

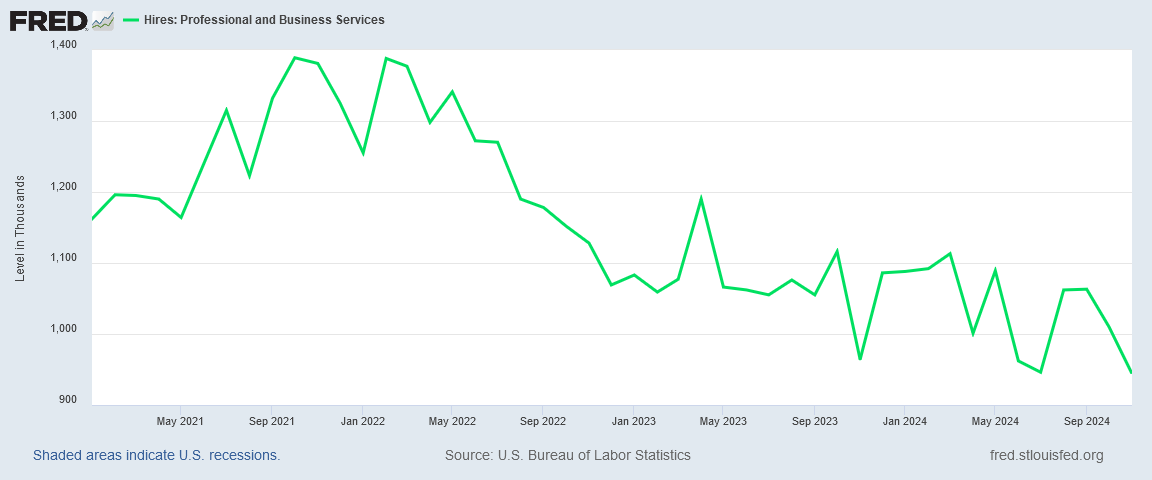

Even the Professional Services categories have not fared well.

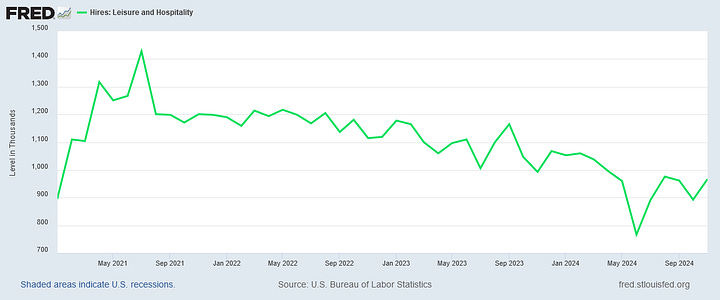

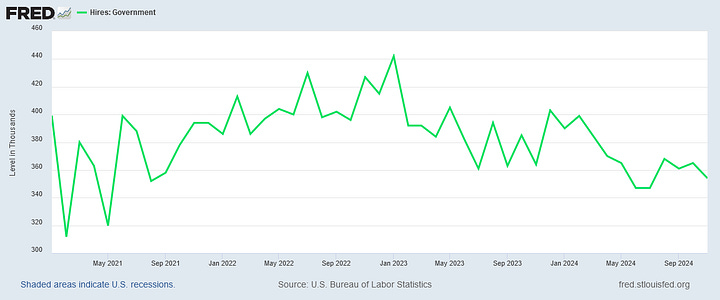

Leisure and Government have also been trending down throughout 2024.

When all major employment sectors are showing declining hiring trends, what else can we call that but a jobs recession? As readers are well aware, that is what I have been calling it for quite some time.

Still Getting Worse

Corporate media and the “experts” prefer to focus on the overall job openings numbers, and gloss over the rest of the data in the JOLTS report. As is by now quite apparent, I reject that view.

I look at how many people were actually hired in the month, per the report. I look at how many people were actually let go in the month, per the report. I look at how many people actually quit vs how many people were actually let go in the month.

Job openings are little more than an unfulfilled promise. A job opening is a declaration by an employer that it might hire somebody at some point. However, an opening by definition means the employer has not actually hired somebody, and there is no certain commitment that the employer will hire somebody.

When we look at the overall hiring and separation trends, it is apparent that employers are not hiring, no matter how many job openings they report.

Nor can we overlook the confirmed reality that employers have incentive to “game” the numbers by padding their job openings stats. A presumed inability to staff sufficiently, which a high number of job openings might indicate, is the needed rationale for employers to exploit the much-abused H1-B visa program to import lower-wage workers from abroad.

As readers may recall, that such visa programs are little more than systemic wage theft is all too easily proven by the available data.

In any economy, expansion should mean more jobs, more employment, and rising wages. Without increased employment and increased earnings, there can be no expansion of the middle class and therefore no expansion of overall consumption.

Without increased employment and increased earnings, long-term economic growth simply will not happen.

The November JOLTS report does not show employment to be increasing. Rather, the report shows that employment has been steadily decreasing. The report shows that layoffs are rising even as quits are falling—a plausible interpretation for this is that enough people are getting fired to make everyone else more reluctant to risk a job switch.

What makes the November JOLTS report particularly damning is the reality that these declines have been printing pretty much throughout 2024, and even before 2024. The decline we see in the November report is the decline we saw in the October report, and the decline we have seen in earlier reports.

The BLS says the November JOLTS report is “little changed.” The BLS said the same thing about the October report as well. Unfortunately, that’s been the problem—a continuation of the same downward trends month on month.

The BLS is in love with the phrase “little changed.” They would be more accurate had they said “still getting worse.”

We all know how this is going to play out: “it’s Trump’s fault!” About twenty days after Trump’s inauguration, the MSM will start screaming that job hiring is down, layoffs are up (especially because of DOGE), and the economy is crashing, and it’s all Trump’s fault! Few people will think it through enough to see that of COURSE this downturn started under Biden. But those of us who read the hard data and sound analysis in All Facts Matter know better. Thanks, Peter!

Just for fun, Peter, maybe you could keep track of the number of days it takes after Jan 20 before the MSM starts blaming this on Trump. We could even place bets - I’ll bet a $5 ko-fi tip that you see the first media blaming on Feb 6. If I’m wrong, I pay you. Anyone else care to place a bet on a date?

Oh, if I’m right? Peter, you may kiss my hand.

I would rather receive🦉 a 'bad' truth 😒 than a good "lie". I guess I had never heard of ⚡🇺🇲✍🏼 JOLTS. 🤷🏻 These are pretty brutal numbers amigo. All Facts Matter and the MSM 📻📺📰 ain't nevah gon git it.... Hopefully the new administration will be a more positive influence on the private sector's view of risk taking and expansion. Sleepy Joe 🦤 and Kamal💃🏽 generated a hunker-down vibe in ♠️ SPADES!

So, let's MAGA! 🌐💪🏼 (A=A) 🗽🦅📜🔔✔️