Rising Prices, Falling Paychecks: June Was Not A Good Month

Is Stagflation On The Horizon?

The June Personal Income and Outlays Report from the Bureau of Economic Analysis confirms at least this much: consumer price inflation is rising in the US.

From the preceding month, the PCE price index for June increased 0.3 percent. Excluding food and energy, the PCE price index also increased 0.3 percent.

From the same month one year ago, the PCE price index for June increased 2.6 percent. Excluding food and energy, the PCE price index increased 2.8 percent from one year ago.

We are not seeing a return to inflation such as we saw during the 2022 hyperinflation cycle, but consumer price inflation printed hotter in June than in May. The PCE Price Index data confirms what the Consumer Price Index data reported earlier.

However, despite the pearl-clutching of the corporate media, rising inflation does not mean the Liberation Day tariffs are to blame. To the contrary, we have already seen an abundance of data points which argue against tariffs having any inflationary impact.

While a tariff will always act as an inflationary pressure on prices, the degree to which tariffs can actually push prices higher will always depend on how other inflationary and deflationary forces resolve themselves. The caveat that applies to all depictions of individual forces—”all things being equal”—is invariably not applicable; all things are never equal.

As with all data sets, we have to peel back the layers to appreciate what the rising consumer price inflation data tells us about the state of the US economy.

Unfortunately, what the data says is that June was not a good month for the US economy.

Contents

Inflation Has Been Rising For Some Time

One reality we must face about inflation is that it did not merely rise in June. The PCEPI has been printing rising inflation year on year for some months, with a broad rising trend going back to September of last year.

Even month on month, the PCEPI has been moving higher for several months now.

From both the year on year and month on month perspective, inflation’s rise predates the Liberation Day tariffs. The calendar alone means there are more forces at play than the tariffs.

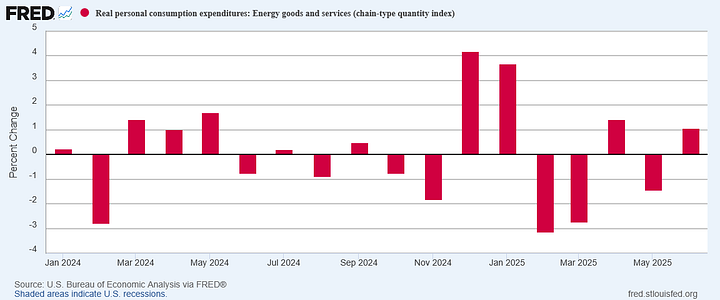

Tariffs do not explain, for example, the rise or the fall of energy price inflation—which for June has been a rise, month on month.

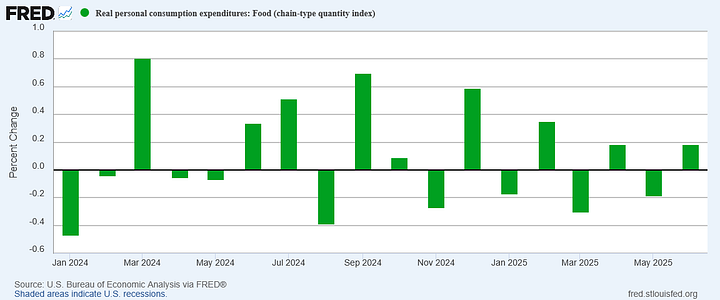

While a number of economists and economic think tanks argue that Trump’s tariffs will ultimately lead to food price inflation, even those arguments concede the tariffs have yet to take effect, which means the driving forces behind food price inflation over the past few months is something over than tariffs.

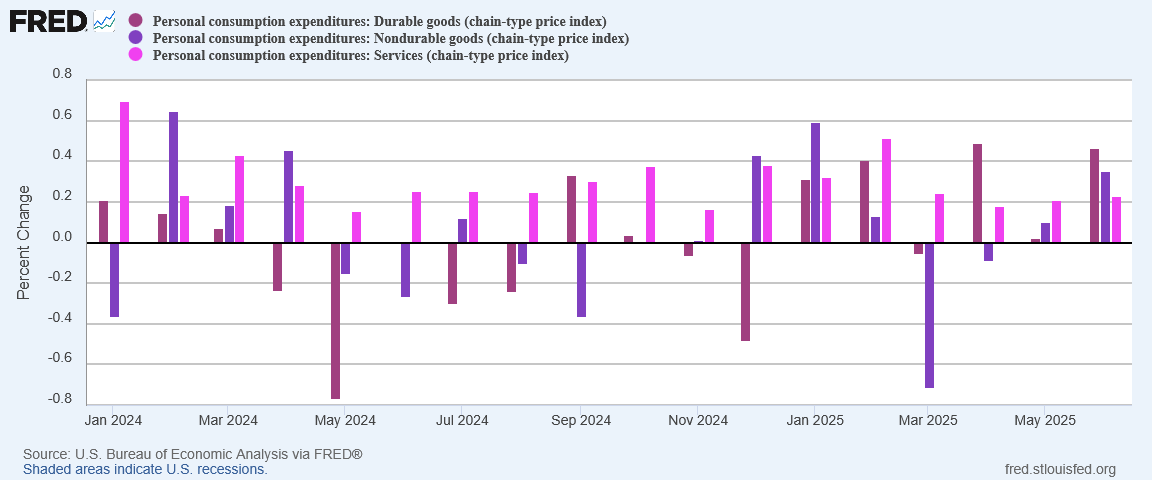

Are tariffs responsible for the rise in durable and non-durable goods prices?

We cannot exclude tariffs altogether (as tariffs are an inflationary price pressure by definition), but neither can we ignore other likely forces pushing prices up.

For the typical consumer, the bottom line is that prices generally rose in June, per the PCEPI. That is not good news. That is not politically good news for President Trump, and it is not economic good news for ordinary American consumers.

With that in mind, we do well to explore some of the likely forces behind June’s price rises.

Tariffs Are Still Not What Drives Inflation

It cannot be said often enough that inflation is always due to more than just tariffs, and often is not due at all to tariffs. There are innumerable inflationary and deflationary pressures driving consumer prices.

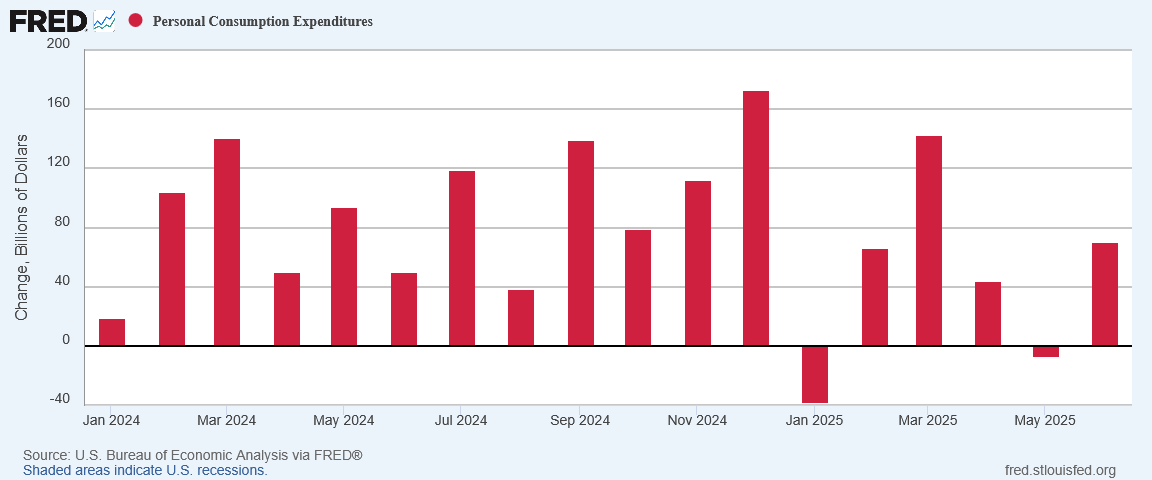

One important force driving up prices during June is increased consumption.

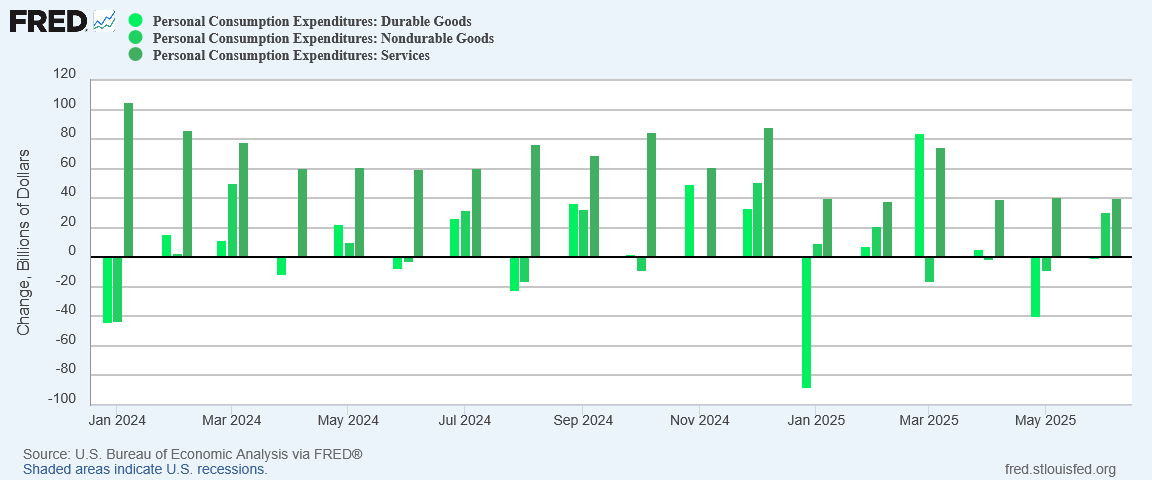

The Personal Incomes and Outlays report shows a marked increase in personal consumption expenditures for the month.

This data correlates to US Census data showing rising consumption in the US.

People spending more means increased demand, and increased demand means higher prices. Even before we consider tariffs we have a very powerful inflationary force in just ordinary consumption.

Tariffs probably should not get a complete pass, as durable goods did not see an expenditures rise in June.

Still rising consumption in nondurable goods and services indicates again a non-tariff basis for rising prices within those categories. More consumption will always push prices higher, with or without tariffs.

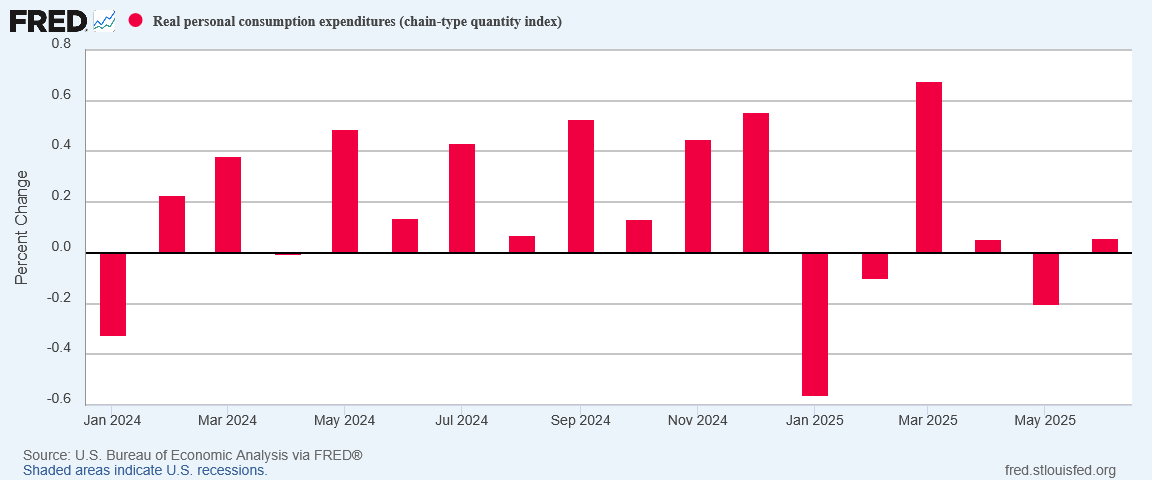

That real expenditures rose means people consumed more even accounting for June’s price rises.

People consumed more in real terms. We should not be surprised that prices rose as a result. Increased consumption must be counted as the prime suspect for both energy and food price inflation.

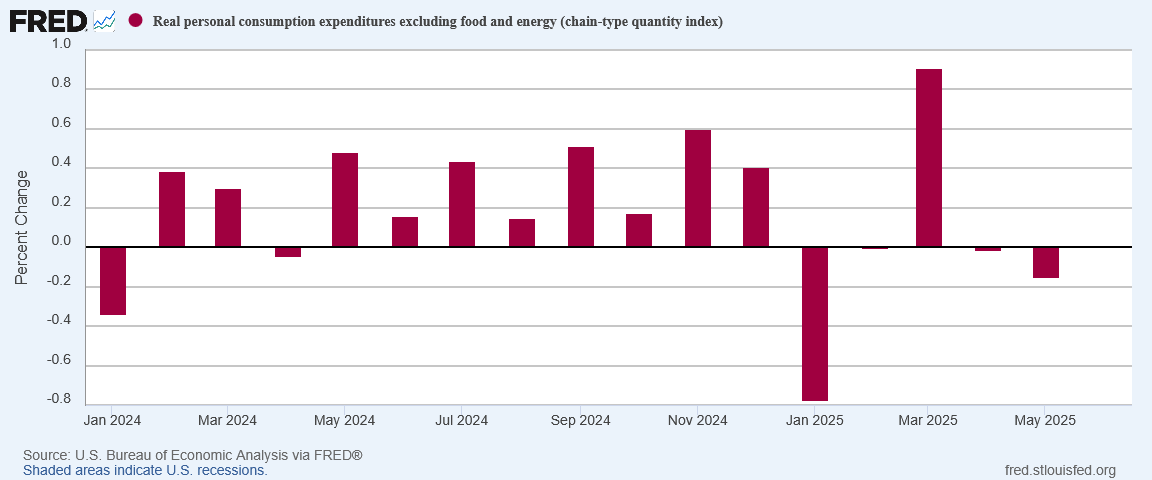

We should note that increased consumption is not a complete explanation, as real expenditures did not rise among core items.

Does that mean that tariffs are to blame for core prices?

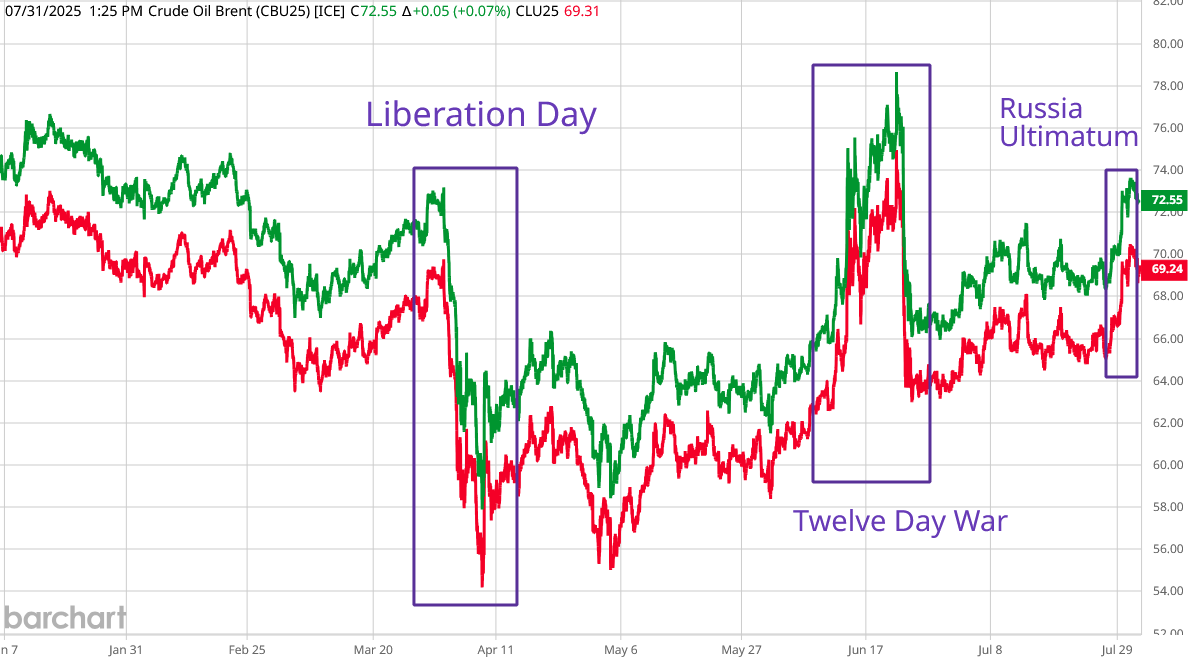

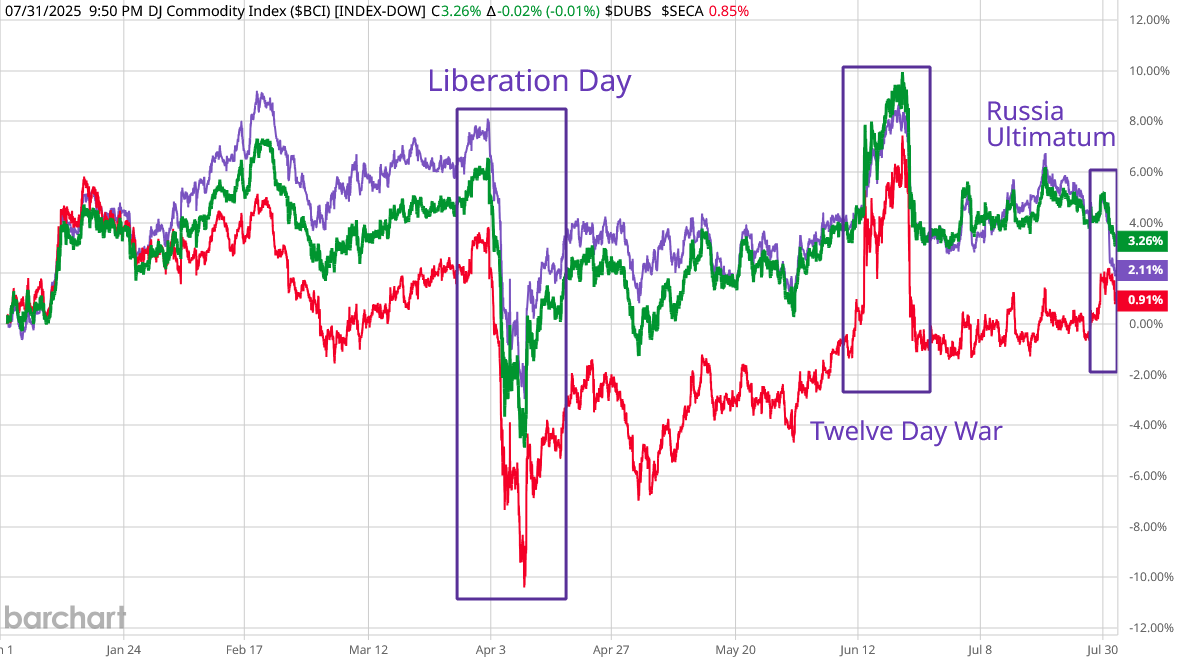

It is difficult to ascribe rises in energy prices to tariffs, when the Liberation Day announcement drove oil prices down.

Israel’s Twelve Day War with Iran and President Trump’s Russia ultimatum on Ukraine—both non-tariff events—are two events that pushed oil prices significantly higher. Straight away we can see that energy price increases have not been due to tariffs.

We see similar price movements among commodity prices as well.

Rising commodity prices mean rising input costs for a variety of manufactured goods. Those rising costs are thus a far more likely factor behind June’s price increases, especially among durable goods.

Rising input costs are made even more likely inflation cause given the fairly minor increase in import prices which occurred in June.

While corporate media pundits and everyone at the Federal Reserve from Jay Powell on down want very much to blame June’s price increases on President Trump’s tariffs, the data sets we have at hand simply do not support that narrative.

Rising input costs—rising energy and commodity prices—combined with an increase in overall consumption are a far more credible explanation of June’s consumer price inflation increase.

Heading Into Stagflation?

That President Trump’s tariffs are not a likely factor behind inflation’s June increase is a problematic diagnosis, as it raises the specter of a stagflation within the US economy.

As I mentioned yesterday in discussing the GDP estimate, when the drop in import volumes is removed, the US economy actually contracted in the second quarter.

In particular, investment shrank during the quarter. A lack of investment not only indicates less economic activity today, but also less economic output (that being the consequence of business investment) tomorrow.

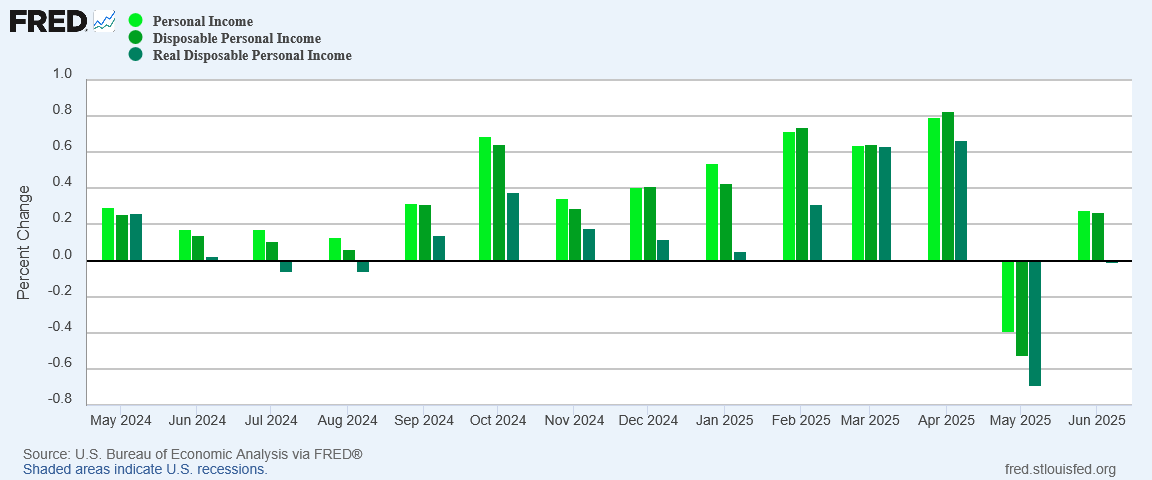

Economic contraction is especially troublesome when we realize that, while nominal income and disposable income rose in June, real disposable income fell.

Even more disheartening are indications within the PCE report that wage increases did not keep pace with inflation, the first month since January where that has happened.

The reality is that weekly salaries have yet to overcome the effects of the 2022 hyperinflation circle.

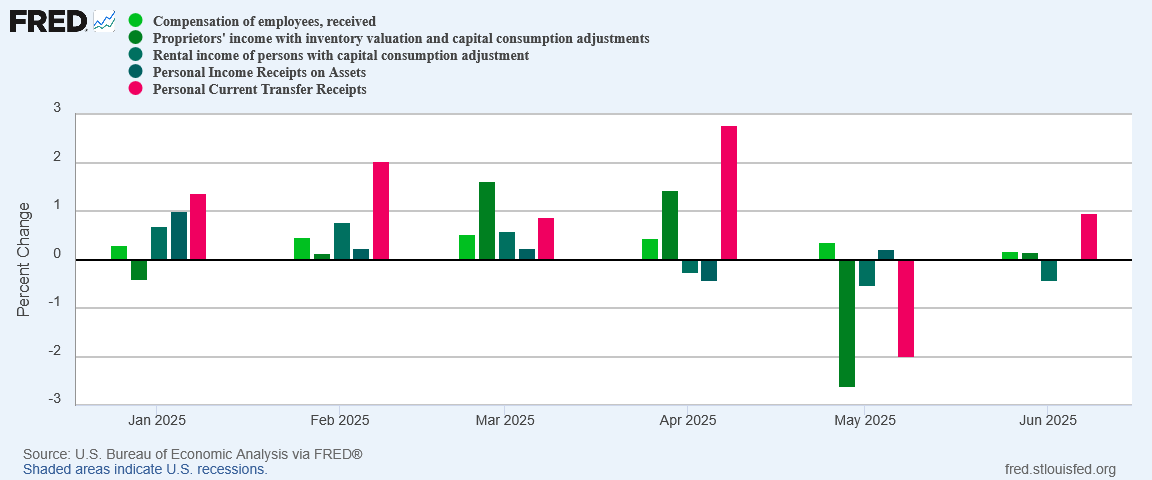

Adding to the bad news is the apparent reality that, once again, the major source of personal income growth has been not wages or rents—the results of actual economic activity—but transfer payments.

People got more money in June, but not because they did more or because their wages rose.

Rising prices, rising welfare payments, but stagnant wages and falling investment are a recipe for stagflation, a toxic brew of both inflationary and deflationary forces within the economy. While one month’s data is hardly sufficient to say that stagflation has descended over the US economy, more months like June will mean the US is heading into stagflation.

Die-hard Trump supporters will not like hearing such news, but this is the reality of what is being reported about the US economy. This is the economic news that the BEA has to report, and it is not good news.

The economy is not doing well.

Incomes are not growing as they should, and certainly not as workers need them to be growing.

Prices rose in an economic environment marked by falling private investment.

This is the outlook we have for the month of June. How much of this outlook is simply a one-off for June and how much is the result of longer-term trends we will not know for a few more months yet.

For the present, it is enough to understand that June was not a good month for the US economy.

Smart analysis on grounded data - thank you!

Peter, yesterday you wrote this: “ Perhaps also true to form, Trump made the right call—Powell needs to lower interest rates—but for exactly the wrong reason. Powell does need to lower interest rates, but because the economy is not performing at all well. The real economy is doing nowhere nearly as well as the top-level GDP numbers suggest.”

This got me pondering to what extent Trump understands the actual health of the economy. For political and leadership reasons, of course he will tweet that the economic news is good. And neither you nor I have any way of knowing what Trump is actually thinking. But have you seen anything in his pronouncements which indicates that he understands what you understand? Geez, I’d hate to think our supreme leader is economically clueless.

Another matter is the transfer payments. Those are mostly the result of Democratic Party policies, and the Trump administration will likely lower those amounts. Any comments on the short and long-term results?