When tomorrow’s Consumer Price Index Summary for November is released, Wall Street will once again have to grapple with the question of whether inflation is getting better or worse for the US.

If the latest commentary from financial site Seeking Alpha is any indication, Wall Street may be coming to realize what the data has been screaming for over a year now: that the economy is not doing at all well, and that “growth” is far more problematic than the narratives have claimed (emphasis mine).

The stock market (SP500) (SPX) (SPY) reaction to the CPI report will depend on the actual number released on Tuesday. It is possible that monthly core inflation comes at 0.2%, just like in October, which could trigger a rally. But the short-term move ignores the long-term reality - which is stagflation, caused by deglobalization. Fundamentals for the stock market are negative, the current inflation data still supports "higher for longer" interest rates, while the market is pricing cuts. GDPNow says Q4 GDP is 1.2%, while core CPI is at 4% - that's already stagflation, and it's going to get worse. Growth is likely to continue to decelerate while inflation is likely to stay above 3%. Tough environment.

Specifically, what analyst Damir Tokic is highlighting is that core inflation in particular has been showing only incremental downward movements, leaving it “stuck” well above the Fed’s 2% target. Further, this is happening even as economic growth is either decelerating or nonexistent.

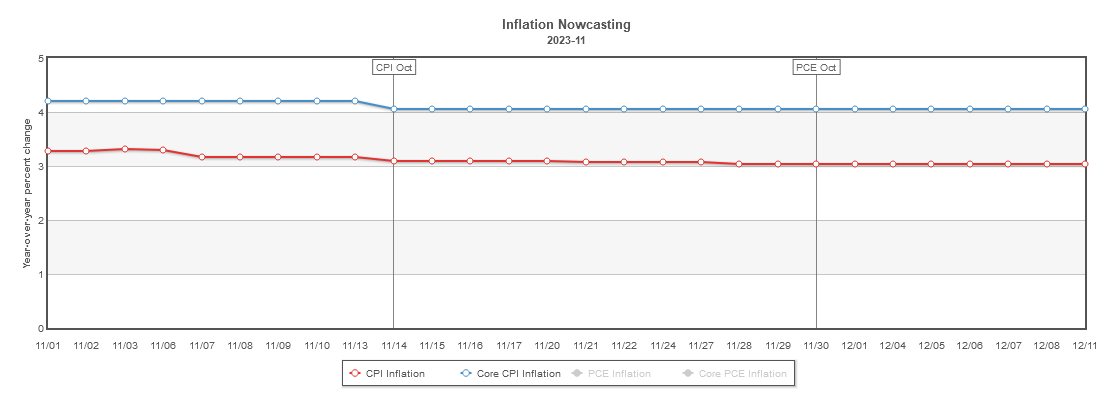

Going by the Cleveland Fed’s InflationNow nowcast, tomorrow’s CPI report will show core inflation printing around 4% year on year, and above 0.3% month on month.

Inflation printing at that level would also mean there has been little improvement in inflation over the past month.

Indeed, inflation stopped improving in June, when inflation year on year was at 3.09% (remember, October inflation printed at 3.2%).

Even month on month inflation has not managed to post any lasting gains since June.

Meanwhile the Atlanta Fed’ GDPNow nowcast is showing the fourth quarter GDP printing at 1.2%.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2023 is 1.2 percent on December 7, down from 1.3 percent on December 6 after rounding. After this morning's wholesale trade release from the US Census Bureau, the nowcast of fourth-quarter real gross private domestic investment growth decreased from -2.9 percent to -3.0 percent.

As the Seeking Alpha article points out, this is pretty much by the numbers stagflation.

Of course, longtime readers will recall that I have been arguing the data shows significant stagflationary trends since June of last year, and have done so multiple times since last June.

It was in June of last year when the PMI metrics on manufacturing activity in this country first began flashing a serious stagflation signal.

While the deflationary signals of the PMI and Dallas Fed Business Survey might seem contrarian to the inflationary signals of the Consumer Price and Producer Price Indices, such a combination of indicators generally points to what has been labeled “stagflation.”

Stagflation is characterized by slow economic growth and relatively high unemployment—or economic stagnation—which is at the same time accompanied by rising prices (i.e., inflation). Stagflation can be alternatively defined as a period of inflation combined with a decline in the gross domestic product (GDP).

Rising inflation and declining manufacturing and production activity certainly qualifies as stagflation.

Put simply, the wheels are coming off the economy. The distortions and dislocation within the US economy that have been growing for months, with each rising measure of the CPI, are taking their toll. Even though there is likely still inflation yet to move through the economy, there are indications of a deep decline in overall demand, which is becoming increasingly clear in the PMI data and now the Business Survey.

At late as September of this year, that prognosis had not changed.

When inflation and strong demand coexists with deflation and soft demand, those are the broad parameters for stagflation, and stagflation is exactly what we have within the US economy. Demand for goods has softened significantly outside of energy, demand for construction has softened across the entire category, with demand for services proving to be fairly resilient.

Nor did the October PCE report offer any hope for improvement—stagflation remains the order of the day.

The point here is not to toot my own horn and arrogantly say “I told you so!” (Okay, the point here it not just to toot my own horn!). The point here is that the data has been signaling stagflation for quite some time, and it is only now that Wall Street is coming around to acknowledge the reality of what the divergent and distorted economic data of the last several months has shown.

The “experts” have alternately had their head stuck in the sand (or stuck somewhere else) for months, if not years. They have ignored crucial data—publicly available data—and consistently drawn the wrong conclusions about the state of the US economy and where inflation is likely to be headed next.

Yet, as is so often the case, the data is out there. The facts are known and in most respects knowable. Both the “experts” and the ordinary American can see what has been unfolding in this economy, and that it is hardly all good.

The reality of stagflation is not here because I say it is here, or because Wall Street says it is here, but because the data says it is here. Based on the available nowcast data, the reality of stagflation is going to continue to be here for at least another month, and the “experts” are just now coming to realize that.

The moral of the story, even before tomorrow’s CPI report comes out: do not listen to the “experts”. Follow the data instead—the data is always more reliable than the “expert” analysis.

Hopefully people have not been waiting for data confirmation before making moves to protect themselves or buffer themselves against the coming storm. Hopefully they are using their instincts (processing their own data based on many different information points in their environment)😉 but nice to know that your work is hopefully shining a light on what they should be paying attention to. Nice work sir.😉👏👏😊

#braceyourselves #buckleup424 #payattention2whatisnotsaid #practicalskills #skillsRcurrency #getlocalised #communitycurrency