With December’s Consumer Price Index Summary set to be released shortly by the Bureau of Labor Statistics, Wall Street is turning its attentions once again to what the final CPI print of 2022 will hold—and, by extension, what the Federal Reserve’s next interest rate hike will be.

The Wall Street consensus is that consumer price inflation is likely to continue the downward trend of the last half of 2022.

On Thursday, the Labor Department will release the consumer price index for December. Analysts are hoping it will reinforce November’s positive trendline of receding inflation with a year-over-year number of 6.7% compared to 7.1% in November. Expectations are that the core rate excluding food and energy will be 5.6% annually, down from 6%.

With November’s consumer price inflation percentage already below where it was in January 2022, and roughly where it stood in December of 2021, a half-percentage point decline in the headline inflation metric would mean that inflation actually fell during calendar 2022—the clearest endorsement yet of the Fed’s campaign to crush inflation by crushing the economy.

That consumer price inflation has been heading south in recent months is undeniable, at both the headline figure and the “core” inflation gauge.

Certainly the Cleveland Federal Reserve’s inflation nowcast aligns with the consensus view that inflation is on the decline, with headline consumer price inflation projected to be 6.6%, and core inflation projected to print at 5.8%.

Somewhat counterintuitively, the decline in consumer price inflation has come as the economy has presumably grown significantly, posting a 3.2% growth rate in the third quarter of last year after having shrunk in both the first and second quarters.

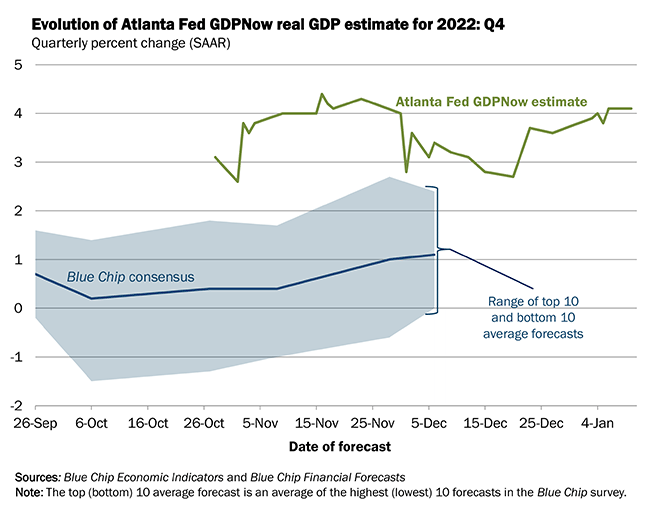

For the fourth quarter, the Atlanta Federal Reserve’s GDPNow nowcast is projecting even more growth, printing at 4.1% as of Tuesday.

The prevailing economic wisdom holds that inflation tends to increase as GDP grows due to rising demand, and falls when GDP contracts, due to falling demand. Certainly that has been the case over the past two years.

With nominal GDP forecast to increase by even more than in third quarter 2022, one should expect to see inflation rising, with increased demand bumping up against constrained supply across the economy. Instead, Wall Street is expecting inflation to fall despite rising demand.

This view of inflation presumes that the economy is in fact growing, and that demand is therefore rising. As I detailed yesterday, despite last week’s optimistic (and phony) jobs report, there continue to be multiple signs the economy has been contracting, and that the US has been in a recession since before the start of 2022.

Additionally, despite the “official” GDP estimates for 2022, the roller coaster decline in shipping rates, as measured by the Baltic Dry Index (as well as its various subindices), is a potent argument for declining demand in 2022, which should definitely explain the drop in headline inflation.

The Baltic Dry Index decline has been consistent even among the subindices which break shipping rates down by size of the vessel (capesize, panamax, supramax).

The overall index, which factors in rates for capesize, panamax, and supramax shipping vessels, was down 43 points, or 3.8%, to 1,096.

The capesize index lost 60 points, or 3.8%, to 1,536.

Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as iron ore and coal, were down $496 at $12,741.

The panamax index extended its fall for the 12th consecutive day, dropping 61 points, or 4.9%, to 1,189, lowest since November 2020.

Average daily earnings for panamaxes, which usually carry coal or grain cargoes of about 60,000 to 70,000 tonnes, fell by $547 to $10,705.

Among smaller vessels, the supramax index fell for the 13th consecutive session by 22 points to 803.

Moreover, the decline is anticipated to continue into this new year, as springtime is the season when major retailers (i.e., shipping “consumers”) typically renegotiate their shipping contracts for the subsequent 12 months.

Big shippers "go into their buying season ... wanting to know what their freight is going to cost. They're not interested in playing the (spot) market" by shopping for lower rates, shipping expert John McCown said.

At the same time, Maersk and other carriers told investors they would continue to prop up rates by cancelling voyages to match shrinking demand. They are also scrapping small, old "rust buckets" to cut capacity.

That means shoppers will suffer from higher prices a bit longer, experts said.

"The American consumer should not be expecting that this is going to lead to massive price relief. That's just not going to happen," said Jason Miller, associate professor of supply chain management at Michigan State University.

With shipping rates declining as global demand contracts, one has to wonder from whence the US economy got 3.2 percentage points of growth for the third quarter, and where it will get ~4.1 percentage points of growth for the fourth quarter of 2022.

However, not all of Wall Street is betting on inflation continuing to decline. BlackRock, Inc., for example, is forecasting a rocky 2023 on consumer price inflation, which is a further indication that the demand side of 2022’s inflation has already been addressed, and the remaining elements are all on the supply side, and will not be swayed much by further rate hikes by the Fed.

If the existing level of consumer price inflation is primarily being driven by supply factors, the volatile nature of the global economy could translate into “sticky” inflation or even rising inflation.

While they acknowledge that prices pressures are ebbing faster than expected, they contest consensus bets that see the rate tumbling toward the Federal Reserve’s 2% target. That’s leading the world’s biggest asset manager to recommend being underweight on government bonds in favor of inflation-linked debt and investment-grade credit next year.

French asset manager Carmignac has staked the position that consumer price inflation is becoming embedded in the economy, according to the head of their cross asset team Frederick Leroux.

“Inflation is here to stay,” said Leroux in a phone interview. “After the crisis central bankers thought they could decide the level of interest rates. In the past two years they realized they don’t: inflation does.”

This contrarian position might also serve to explain the Fed’s inability to move interest rates up in the fourth quarter of 2022—despite a November rate hike of 75bps and a December rate hike of 50bps, interest rates have moved down across the yield curve.

With inflation being driven on both the supply and demand side, the refusal of market interest rates to follow the Federal Funds rate higher could indicate that the demand side of the inflation picture has been addressed to the degree it can be, and the remaining inflation drivers are mostly on the supply side.

This also begs the question of whether it even makes sense for the Fed to bother raising the Federal Funds rate at all, as the market is pulling interest rates down regardless of the Fed’s rate actions.

If the market is going to resist the Fed’s rate hikes, there is little point in the Fed even bothering with rate hikes, particularly as there are indications of growing liquidity stress within the American banking sector. A rate hike now could push smaller banking firms in the US towards a true market-wrecking liquidity crisis down the road.

Given the totality of indicators that demand in the US economy is continuing to fall, the consensus forecast is probably close to accurate for December. Consumer price inflation is likely to come down by close to the projected half of a percentage point for December, as shrinking demand steadily sucks the wind out of inflation’s sails.

Whether the downward trend in consumer price inflation can be maintained for very much longer remains very much a question. While the global economy is unlikely to see much reversal in global demand any time soon, the many sources of geopolitical instability around the globe, from Putin’s war in Ukraine to China’s massive COVID outbreak, could very easily send inflation back up again.

Inflation is likely to come down in December. Whether that decline can persist or be preserved remains very much an open question.

Sure, it's down some, but it's still too damn high. :)

Price of fuel is down some too, but also still too high.