Albert Einstein is widely believed to have said “Everything should be made as simple as possible, but not simpler.”1

When digesting the December Consumer Price Index news release by the Bureau of Labor Statistics, remembering the “but not simpler” part of Einstein’s aphorism should always be kept uppermost in one’s mind, making nearly every assessment of the inflation report start with “Yes, but….”

Certainly the top-level numbers are simple enough:

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent in December on a seasonally adjusted basis, after increasing 0.1 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 6.5 percent before seasonal adjustment.

Yes, but…not everything went down, and not every decrease is good news.

No doubt more than one Wall Street analyst took a victory lap over the headline consumer price inflation numbers, as they were in line with most analysts’ expectations.

Certainly Michael McDonough, Chief Economist for Financial Products at Bloomberg, must be pleased, as Bloomberg’s December inflation estimate was practically right on the money.

President Asterisk’s handlers dutifully crafted a victory lap tweet for him, showing once again their fundamental economic illiteracies.

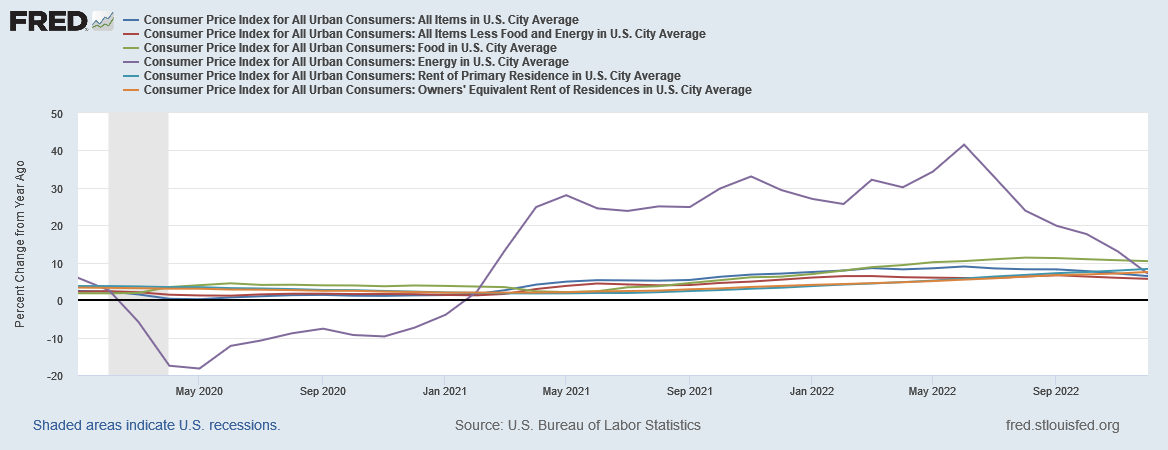

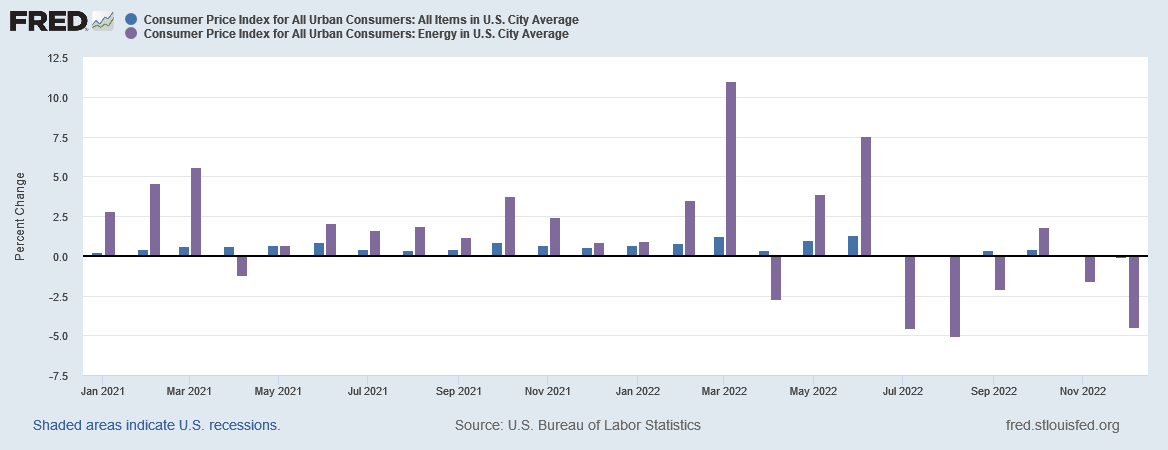

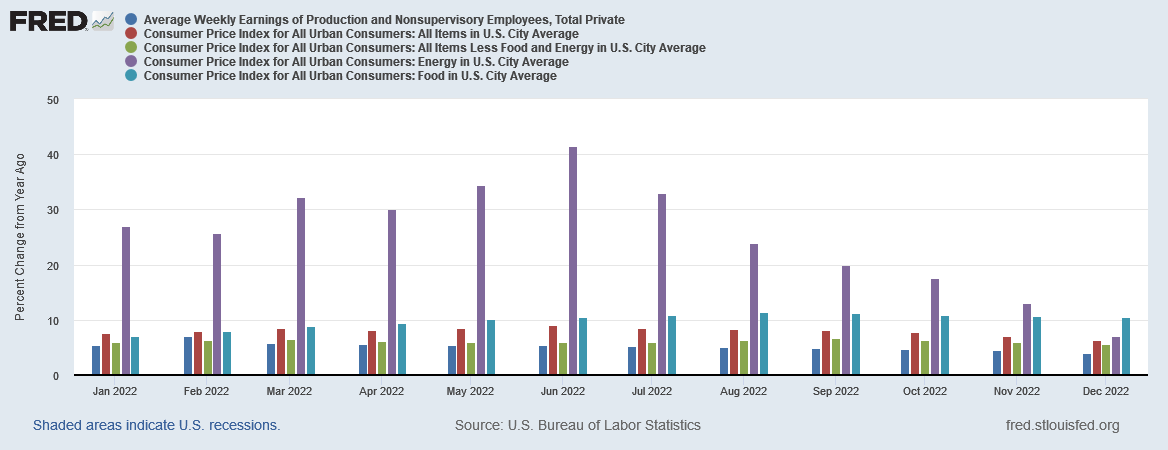

Yes but…food price inflation and energy price inflation are both still higher than headline consumer price inflation.

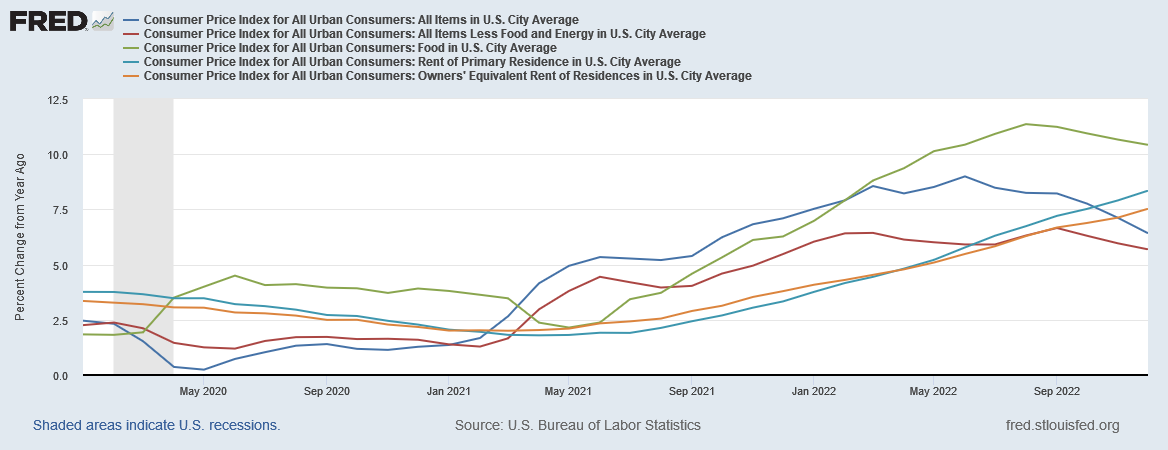

Moreover, shelter price inflation is still rising.

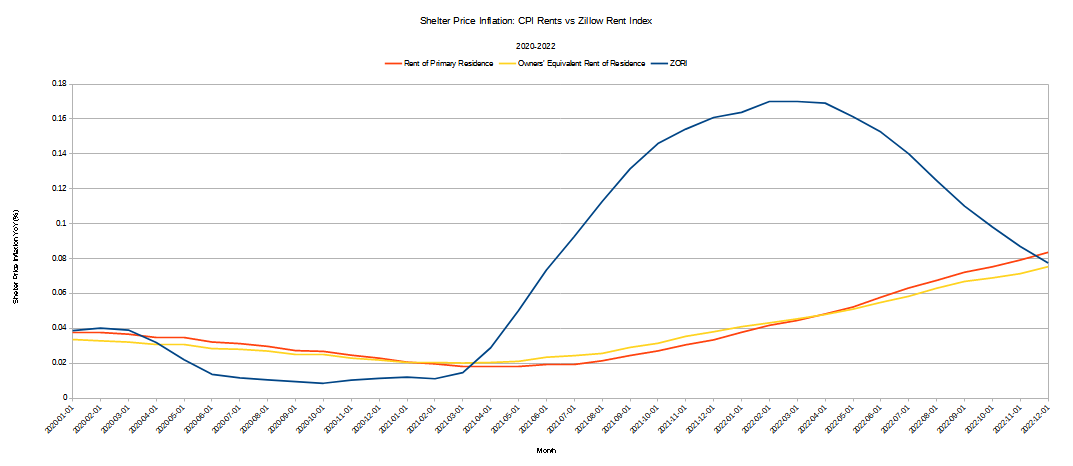

Even the private sector Zillow Observed Rent Index (ZORI) is only just now converging on the CPI rent indices.

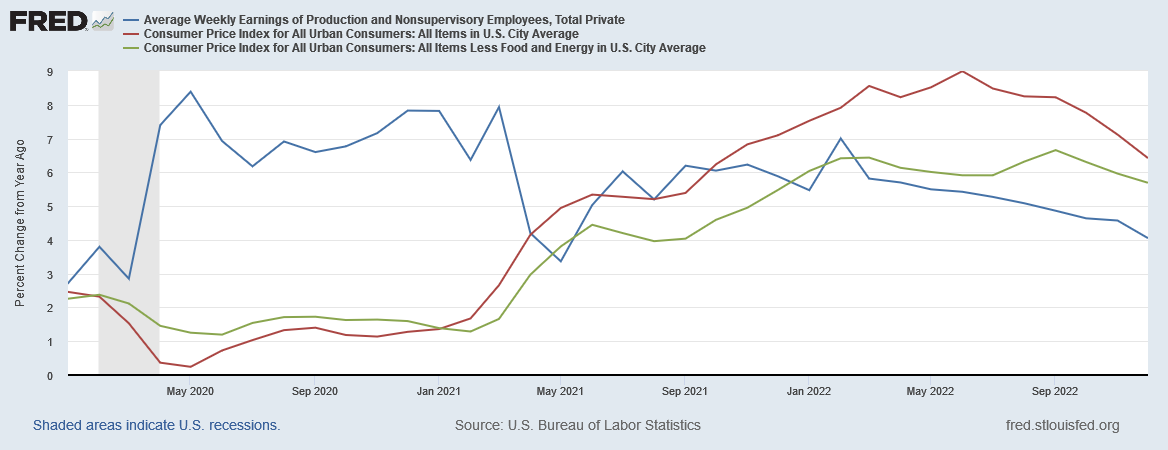

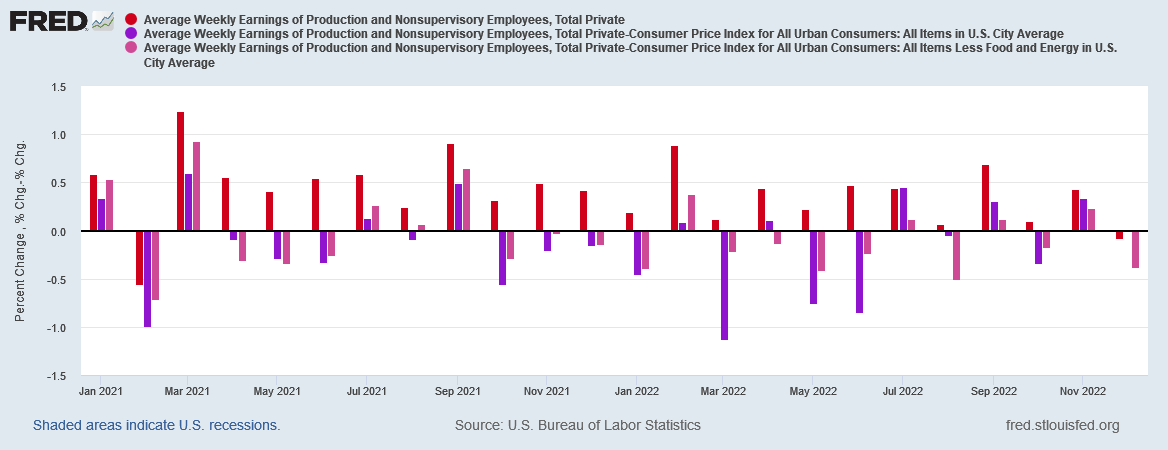

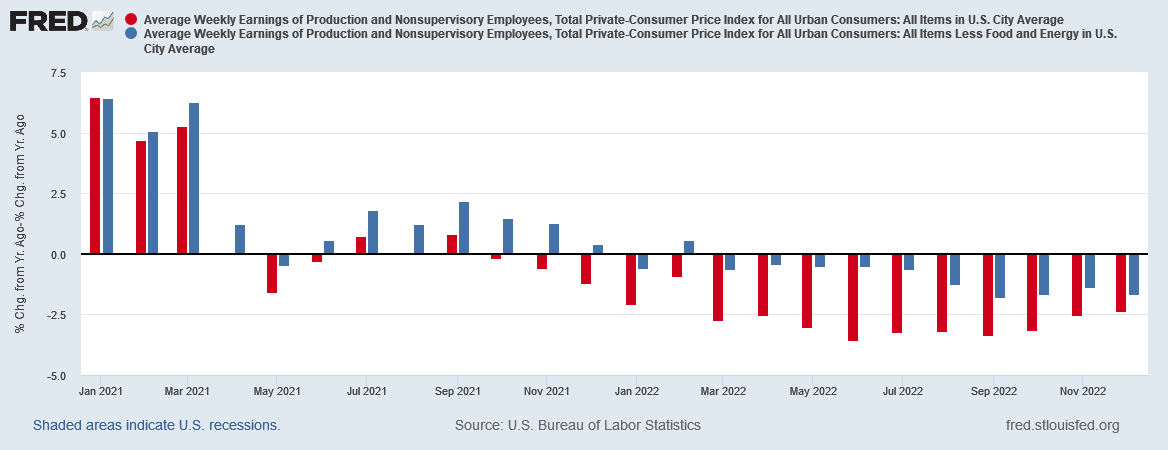

Additionally, average real earnings slid even further negative, with the gap between nominal wage growth and both headline and “core” consumer price inflation getting wider.

In 16 of the past 24 months, either headline or core consumer price inflation has outpaced nominal wage growth, causing real earnings to decline month on month.

Even though headline consumer price inflation is trending down, the overall economy remains as distorted and off-kilter as ever, to the detriment of everyone.

Corporate media added their economic ignorance to the mix by suggesting that, coupled with last week’s jobs report, this latest update on consumer price inflation indicated the Fed may yet achieve a “soft landing” of raising interest rates without causing a recession.

Last week’s jobs report for December bolstered the possibility that a recession could be avoided. Even after the Fed’s seven rate hikes last year and with inflation still high, employers added a solid 223,000 jobs in December, and the unemployment rate fell to 3.5%, matching the lowest level in 53 years.

At the same time, average hourly pay growth slowed, which should lessen pressure on companies to raise prices to cover their higher labor costs.

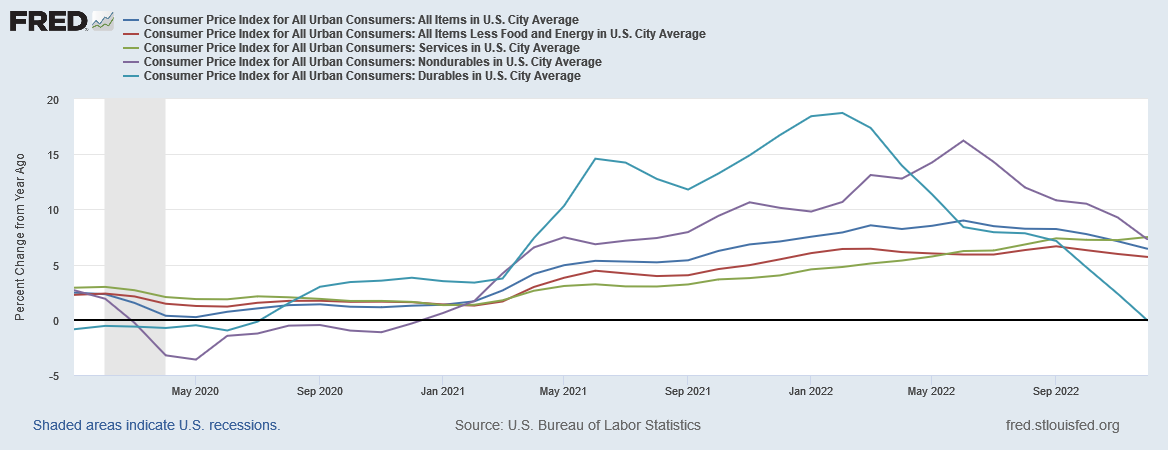

Reality check: The Fed has already failed, as the recession is here and happening. One only has to look at how several of the CPI sub-indices fell off a cliff in July to recognize that a significant level of “demand destruction” has been taking place.

After rising steadily for the first part of the year, energy price inflation went into deflationary freefall in July.

Additionally, the indices for consumer price inflation among durable and non-durable gods declined sharply beginning in March and July of last year, respectively.

When this much disinflation occurs at the same time, the most likely cause is demand destruction—aka, “recession”. The Fed hasn’t avoided a recession, it has either caused it or exacerbated it.

Nor does crowing about the decrease in headline and “core” consumer price inflation take into account the reality that inflation means nominal wage increase is real wage decrease, and has been for most of the last two years.

The impact of declining real wages is easily shown, as nominal wage growth through all of 2022 has been outpaced by consumer price inflation (headline and core), energy price inflation, and food price inflation.

Adding insult to injury is the reality that these declines in consumer price inflation are almost certainly more transitory than the original increases. What does not appear in the December CPI report is the fact that gasoline futures have been rising throughout December.

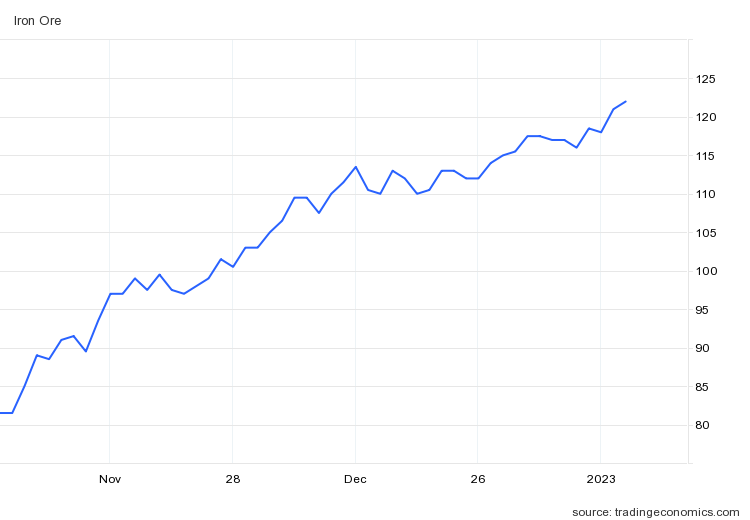

Also, basic commodities such as copper and iron ore have also been rising over the past month.

Commodities are the raw inputs of most manufacturing processes, and if the cost of inputs is going up, eventually so too will the price of outputs—and thus inflation will heat up.

When one peels back the layers of the Consumer Price Index data, one quickly realizes that the US economy remains distorted and off balance. While the percentage declines in year on year growth among many of the CPI sub-indices (as well as the CPI itself) do indicate that a new equilibrium position is slowly being reached, there is still quite a bit of rebalancing that must happen before a new equilibrium position can be established.

Meanwhile, that there are developing supply-side forces which are likely to disrupt that nascent equilibrium in the not-too-distant future should be of great concern, for they not only confirm that supply-side forces continue to play a significant role in current consumer price inflation—thus limiting and by now largely negating the Fed’s efforts to raise interest rates beyond the Federal Funds rate—but they herald a future resurgence in consumer price inflation somewhere in the summer/fall time frame.

The “experts” in the White House and on Wall Street might enjoy crowing about how “good” the headline consumer price inflation number is. Unfortunately, the rest of the analysis goes something like this: "Yes, but the underlying detail numbers and the forces driving them all still suck.”

The actual Einstein quote is generally held to be from his June 10, 1933 lecture at Oxford University “On The Method Of Theoretical Physics”:

It can scarcely be denied that the supreme goal of all theory is to make the irreducible basic elements as simple and as few as possible without having to surrender the adequate representation of a single datum of experience.

In subsequent retellings it became “simplified” to its present form. Irony abounds.

Write to whitehouse.gov