The contagion effect from China’s collapsing housing bubble that many economic “experts” said would not impact China’s largest banks is now impacting China’s largest banks.

The banking industry’s outstanding non-performing loans rose to a record 2.95 trillion yuan as of June. The lenders’ exposure to real estate is bigger than that of any other industry, with 39 trillion yuan in outstanding mortgages and 12 trillion yuan in loans to developers, official data show. In particular, Bank of China’s exposure to mainland property is higher than its peers, at about 38% of total loans.

Yet as bad as that news is for China, the recurring lockdowns from the lunatic Zero COVID policy, drought-ravaged crops threatening a failed fall harvest, and a contracting manufacturing sector are also grim tales being told, and their totality is an economic outlook that lies somewhere between catastrophic and apocalyptic.

That is not an exaggeration. China’s economy is collapsing, with contraction and chaos emerging on all sides.

The Banking Crisis Grows Ever Larger

Since the start of the Evergrande debt crisis last fall, the recurring assurance from economic prognosticators and China watchers has been that any hiccup in real estate markets would not contaminate the banking and finance sector as well. As late as July, credit ratings agency Fitch assessed that only a miniscule fraction of Chinese mortgages would be caught up in the housing crisis and subsequent mortgage boycott—so miniscule the numbers did not even really chart.

We do not believe the defaults will directly affect Fitch-rated Chinese banks, with most disclosing that affected mortgage loans amount to less than 0.01% of their outstanding residential mortgage loans. However, should defaults escalate, there could be broad and serious economic and social implications.

Barely six weeks after that naive optimistic take on the housing crisis, Industrial and Commercial Bank of China (ICBC), a Fitch-rated bank and the world’s largest bank by assets, reported slumping earnings and shrinking net interest margins due to…wait for it…distressed debt from the housing crisis.

ICBC, the world’s biggest bank by assets, reported net income grew 4.9%, the slowest in two years, in the first half of the year, while earnings at Bank of China Ltd. and China Construction Bank Corp climbed 6.3% and 5.4% year-on-year, respectively. ICBC’s net interest margin slid to 2.03% from 2.12% and CCB’s narrowed to 2.09%, while BOC’s was unchanged at 1.76% from a year earlier.

The $52 trillion banking industry is facing an increasingly difficult year, with its largest lenders cutting loan rates while bad debt is piling up amid a property crisis. Authorities in Beijing are expecting them to help economic growth at the cost of earnings as they contend with falling home prices, stalled developments and a nationwide consumer mortgage boycott.

Additionally, Fitch-rated China Construction Bank and Bank of China, Ltd, along with ICBC, reported significant rises in bad real estate debt.

China Construction Bank Corp (CCB) (601939.SS) and Bank of China Ltd (BoC) (601988.SS), reported a 68% and 20% increase in bad real estate debt in the first half of this year on Tuesday in exchange filings.

Meanwhile, the world's largest commercial lender by assets Industrial and Commercial Bank of China Ltd (ICBC) (601398.SS) posted a 15% rise in real estate sector soured debt over the same period.

The debt Fitch said would not be an issue has become a major issue.

The stress on the banking sector is a particular problem for China’s embattled property developers, who need fresh bank loans to cover the costs of completing the vast numbers of unfinished pre-sold housing developments spread across China. While Beijing has been putting together a bailout program of roughly 200 billion yuan (29 billion US$), China’s banks are reluctant to participate without explicit backstops from Beijing.

Without explicit financial backstop from Beijing, senior executives at some of the institutions are wary of engaging with cash-strapped developers and later dealing with potential losses of their own, said two of the sources.

Bank reluctance to advance loans to developers is almost certainly a factor in the collapse in overall lending activity in China during July.

When banks are scared to lend money, that is a banking crisis by definition.

Housing Markets Are In Freefall

Banks have reason to be leery of lending to developers. Not only are most of the leading developers facing debt and liquidity problems (an ironic development itself given the pre-sales model that undergirds the Chinese residential real estate markets), but prospective home buyers are now shying away from the market altogether.

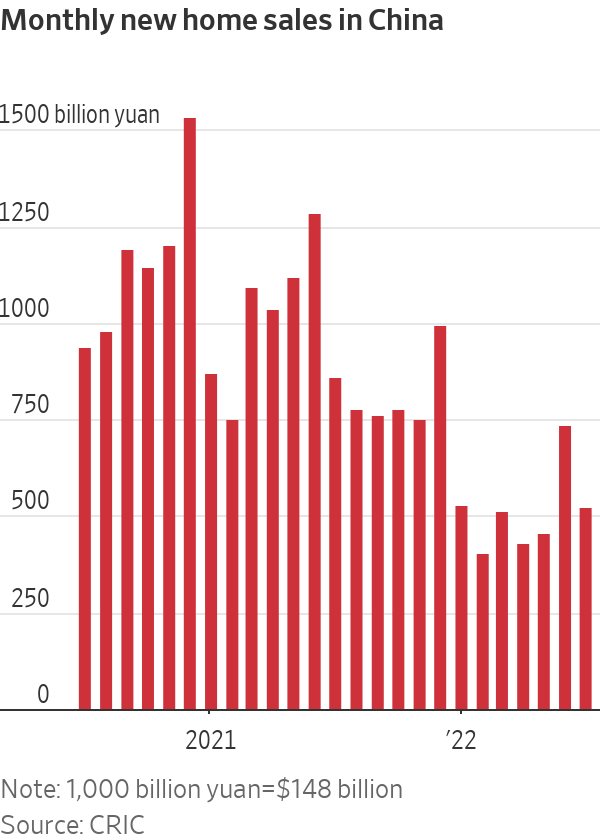

Home sales declined sharply in July for China, with sales among the top 100 developers dropping by nearly 40% from a year ago, and July sales coming in nearly 30% below June levels.

Sales at the country’s top 100 property developers fell 39.7% in July from the same period last year to the equivalent of $77.6 billion, or 523.14 billion yuan, according to data released Sunday by CRIC, a Chinese real-estate data provider.

July sales were down 28.6% from June, ending a two-month recovery in month-to-month sales growth. Apartment sales showed increases in May and June from the previous months, as activity picked up following Covid lockdowns in Shanghai and other Chinese cities earlier this year.

The collapse in sales is perpetuating a long-term decline in home prices, which in July declined for the 11th straight month.

The decline in home prices carries an additional threat for China, as 70% of Chinese household wealth is tied up in real estate. With new home prices in July declining 0.11% from June, and existing home prices declining 0.21% (after having fallen that much already in June), the Chinese middle class is watching its wealth literally vanish into thin air.

Declining sales and declining home prices converged to eviscerate developer Country Garden’s revenues during the first half of 2022. China’s largest developer saw its earnings drop by an apocalyptic 96% during the first half of the year, with net profit coming in at a relatively meager 612 million yuan ($88 million).

What makes the housing crisis particularly intractable is that virtually all homes in China are “pre-sold”. Homeowners buy the homes and take out mortgages before the housing units are even built. The property developers currently facing bankruptcy have already been paid for the homes they have yet to build—only 60% of homes pre-sold between 2013 and 2020 have been completed, which means developers lack the funds to complete nearly half of the units they have notionally already sold and for which they have already been paid in full.

With Chinese residential real estate estimated to be a $55 trillion market, and the largest asset class in the world, for 40% of homes to be unfinished yet paid for in full also means Chinese residential real estate is the world’s largest Ponzi scheme ever, outstripping even the infamous Bernie Madoff.

Small wonder Chinese home buyers no longer have any confidence in the housing market.

Manufacturing Slumping Due To Zero COVID

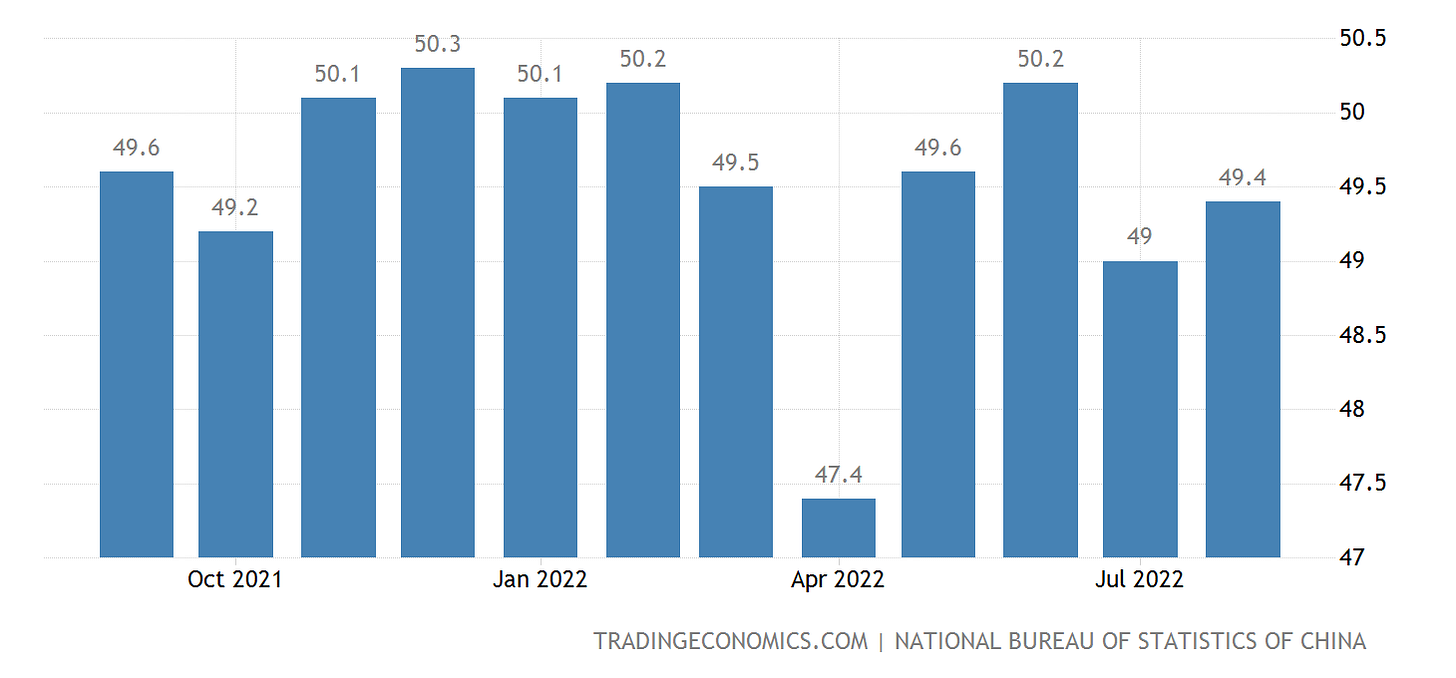

Adding to China’s economic misery from the collapse of its housing bubble markets is a manufacturing sector that alternates between anemic expansion and contraction. Caixin—a leading Chinese media group—charted its manfuacturing purchasing manager’s index (PMI) at 49.5 (indicating contraction), after declining steadily across May and June. The contraction signal was picked up by the official PMI metric from the National Bureau of Statistics (NBS), which at 49.4 marked the 5th month this year China’s manufacturing sector has shown contraction, and the 7th month during the past 12.

While the NBS attempted to put a positive spin on the numbers, anything below 50 represents contraction—meaning manufacturing’s July “increase” was in fact merely a slower shrinkage.

China's factory activity improved in August after a contraction in July, and industry insiders promptly reviewed the latest data and attributed them to intensified macroeconomic policy support amid COVID-19 pandemic resurgences and extreme weather in some parts of the nation.

The official purchasing managers’ index for China's manufacturing sector crawled up to 49.4 in August from July's reading of 49, the National Bureau of Statistics said on Aug 31.

On the services side, the PMI remained in the expansion region at 52.6, but still notched a third consecutive month of decline.

Nor is the reason for the declines hard to fathom: Zero COVID.

That weakness in services can be squarely laid at the feet of the same culprit that has dogged the sector all year: China’s tough measures to contain Covid-19, which have ramped up again recently as a new outbreak gained steam in August.

Regular readers are already well familiar with the damage the Zero COVID protocols have done to China’s economy. Zero COVID was a primary factor behind the sharp downturn in China’s economy during the second quarter.

The economic contractions caused by Zero COVID are being felt worldwide, as the reductions in China’s economy are causing significant drops in oil demand as well as industrial commodities such as aluminum.

Currently, cities contributing approximately 13% of GDP are locked down due to Zero COVID.

Yet despite the obvious and increasing economic carnage, the CCP is unable to turn away from Zero COVID, having staked its credibility as a governing entity on the policy. Faced with a choice between a functioning economy and Zero COVID, the CCP has chosen Zero COVID.

No Good News Anywhere For China—Or For The World

From housing, to banking, to manufacturing, the mainstays of China’s economy are all steadily deteriorating. Even China’s agricultural sector is being laid waste due to record drought, putting the fall harvest at extreme risk.

There is no good news here, there is no area where China can look for growth that will offset the carnage.

Contrary to both the China apologists who doubt a broad collapse in the Chinese economy and the China hysterics who have been putting out apocalyptic predictions of overnight disaster for China’s economy on YouTube, the reality of China’s economy is one of broad, persistent, unavoidable, unstoppable contraction and decline—ultimately, of economic collapse. There is no room for a “soft landing”, and no easy off-ramp to recovery.

Moreover, with China’s economy collapsing on multiple fronts, the question of contagion effects in the global economy are simply a matter of degree; contagion is already happening, and it is merely a question of how much and how fast will it come.

The collapsing housing markets are already triggering declines in China’s imports of many commodities—which is not good news for exporters of those same resources. While declines in China’s energy demand would bring a welcome easing in the rising cost of energy worldwide, there is no denying that energy producers at both the private and national level would prefer higher prices and greater revenue.

Just the mere synchronicity between China’s economic travails and those of Europe and the United States means there is no global offset to global recession, such as was the case during the aftermath of the 2008 Great Financial Crisis. With no buffer, neither Europe, nor the US, nor even China can avoid much greater economic pain than would otherwise be the case. Synchronicity means amplification for everyone.

The reality of China’s economic collapse is that it is already fueling a global economic contraction and will be a persistent drag on the global economy for some time to come.

What should the average American do to prepare.

Thanks

Yikes 😳

Thanks for all you do.