Cooling Inflation Shows Trump’s Disruptive Impact

Predictions Are Futile In An Era Of Change

For last month’s Consumer Price Index Summary, along with the Producer Price Index Summary, I was talking about inflation getting hotter. I explored all the facets that were pushing prices up, and were likely to continue to push prices up.

Naturally, this month I am talking about inflation getting cooler!

Yet that is what the data has presented for February.

Inflation eased noticeably in the CPI report, rising just 2.8 percent year on year after posting 3 percent year on year in January:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis in February, after rising 0.5 percent in January, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.8 percent before seasonal adjustment.

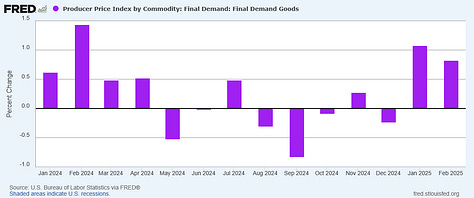

That cooler inflation was then backed up by easing in factory gate inflation, which pulled back to 3.2 percent year on year:

The Producer Price Index for final demand was unchanged in February, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.6 percent in January and 0.5 percent in December 2024. (See table A.) On an unadjusted basis, the index for final demand advanced 3.2 percent for the 12 months ended in February.

What happened to reverse the consumer price inflation signals so dramatically?

The short answer: Donald Trump reclaimed the Oval Office.

Which is not to say that Donald Trump has a magic wand capable of cooling consumer price inflation in an instant. He does not.

Rather, it is to recognize that Donald Trump has begun his second Administration by being a disruptor and an agent of change. The world is struggling to keep up with his changes.

Inflation Down Across The Board

There is no denying that the BLS’ inflation report printed significantly cooler for February.

Year on year, headline inflation dropped to 2.8%, and core inflation dropped to 3.1%.

Even at the month on month level, headline and core inflation eased off.

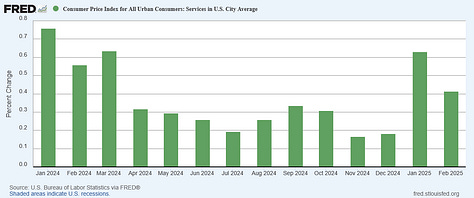

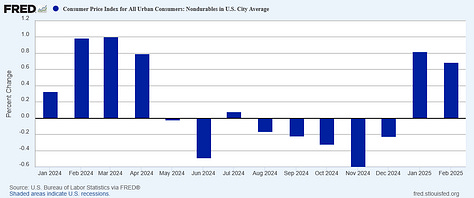

The disinflation trend was pretty much across the board. Energy, food, shelter, durable goods, non-durable goods, and even services all posted month on month lower increases in February than in January.

Short of outright price declines, these are encouraging inflation numbers—and they are unexpected. After all, last month my prognosis was that inflation was rising, and, based on factory gate prices, it was likely to continue to rise.

Because the PPI is focused more on the producer side of the economic equation, it is broadly presumed to serve as a leading indicator for the CPI, with price changes as reflected in the PPI often being replicated in the CPI a few months into the future.

As a result, the rises charted within the January PPI are consistent with a view of the global economy where a number of supply constraints are converging to push prices up for nearly all goods and services.

If that is the case, then we could very well be looking at a period of rising prices that will extend for the next several months at least. Perhaps more crucially, if global supply chains are under duress then prices are going to be pushed up globally as well. Inflation will be not just an issue in the United States but worldwide.

Obviously, that did not happen. Is this simply an aberration and not a shift in the trend? Or has something shifted within the economic landscape?

Wall Street Did Not Expect This

Suffice it to say, Wall Street was not looking for this outcome in the February inflation data either.

Indeed, CNN fully expects this to be a one-off because that dastardly Trump is sure to push prices up next month!

Inflation slowed in February for the first time in four months, but that progress may be short lived as President Donald Trump ramps up his trade war, which threatens to increase prices for Americans.

NPR felt that Donald Trump had not done enough to cool off inflation.

How unexpected was the low inflation print? Sufficiently unexpected that the normally accurate Cleveland Fed InflationNow nowcast missed by a suprisingly large amount.

The Cleveland Fed’s nowcast updates daily based on the ever-shifting economic data. In normal months, by the time the BLS releases its inflation numbers, the Cleveland Fed has largely triangulated on the inflation level for the month. For the Cleveland Fed to miss is a fairly unusual event.

Inflation Still Rising Globally

Making the cooler inflation numbers even more remarkable is the reality of rising inflation elsewhere in the world.

Inflation is still rising in the European Union.

Inflaton is still moving higher in Japan.

Even right next door, in Canada and Mexico, inflation printed hotter.

To be sure, inflation isn’t universal, as China found itself once again grappling with the demon of deflation.

Whle inflation is still on the march in most of the world, China does show that it need not be a given.

About That Supply Chain Squeeze

The unexpectedly cool inflation print does invite us to reconsider the “supply chain squeeze” that seemed to be confirmed last month, with a slew of rising commodity prices.

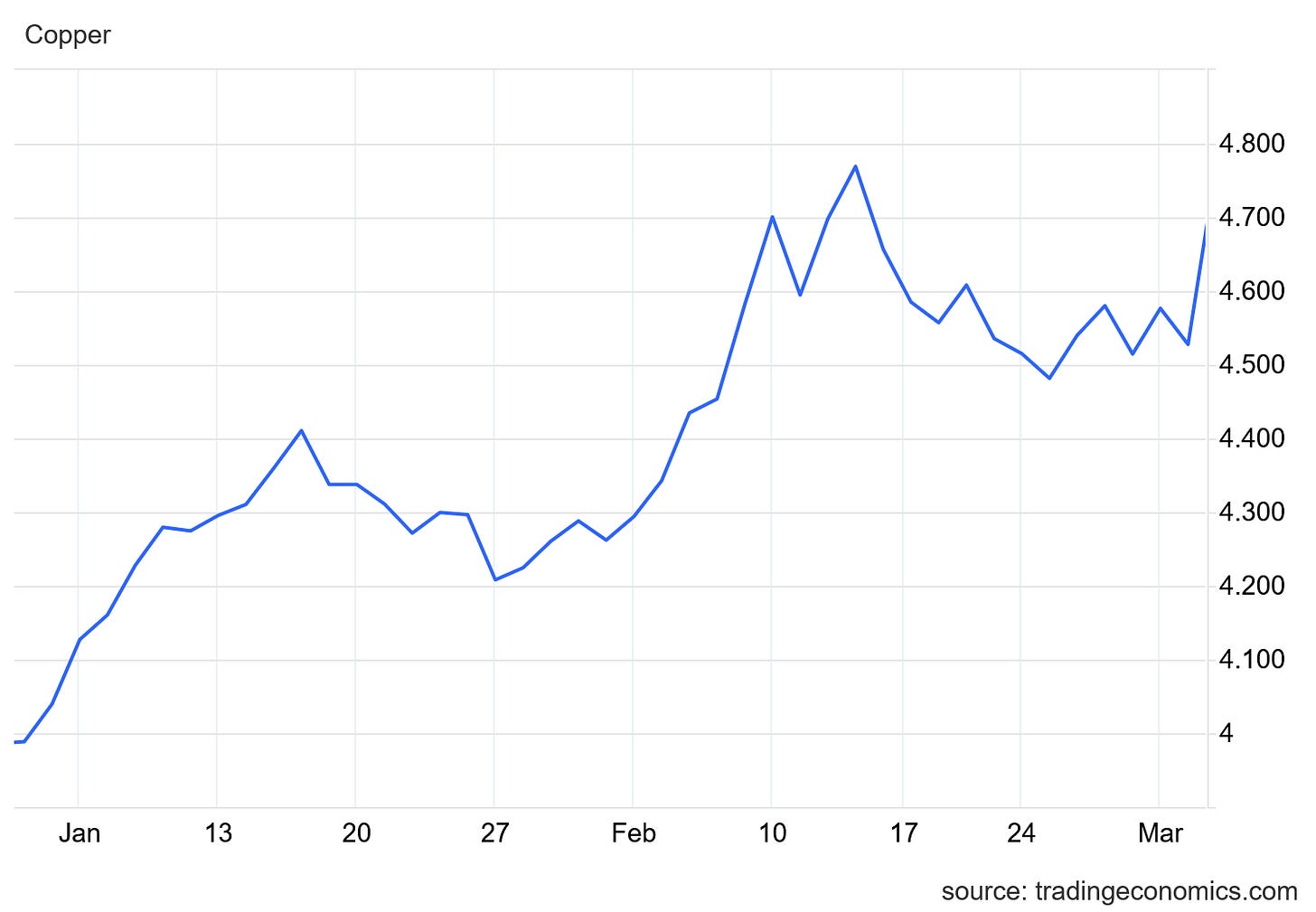

Is the “super squeeze” real? Ultimately, that is Wall Street’s take on what is happening within commodities markets. However, what is happening within commodities markets is that prices are rising.

Yet copper prices largely stopped rising in February.

Lumber prices continued to move up, however.

Wheat futures fell sharply in February.

In fact, commodity prices overall reversed course in the last half of February and began moving significantly down.

Oil prices continued to trend lower in February.

Even gasoline futures prices moved lower on the month.

While commodity prices in January did point to a supply chain squeeze that was pretty much across the board, February prices point to a significant easing along virtually all supply chains. That easing in supply chains is being reflected in consumer prices.

Factory Gate Prices Confirm Supply Chain Easing

Once again, the Producer Price Index appears to confirm this assessment.

PPI for Final Demand across all commodities showed significant easing last month.

Just as the subindices within the PPI sustained the existence of supply chain pressures pushing prices upward last month, this month those same subindices also show those pressures to be easing. Energy, goods, and services all showed cooler inflation levels for February.

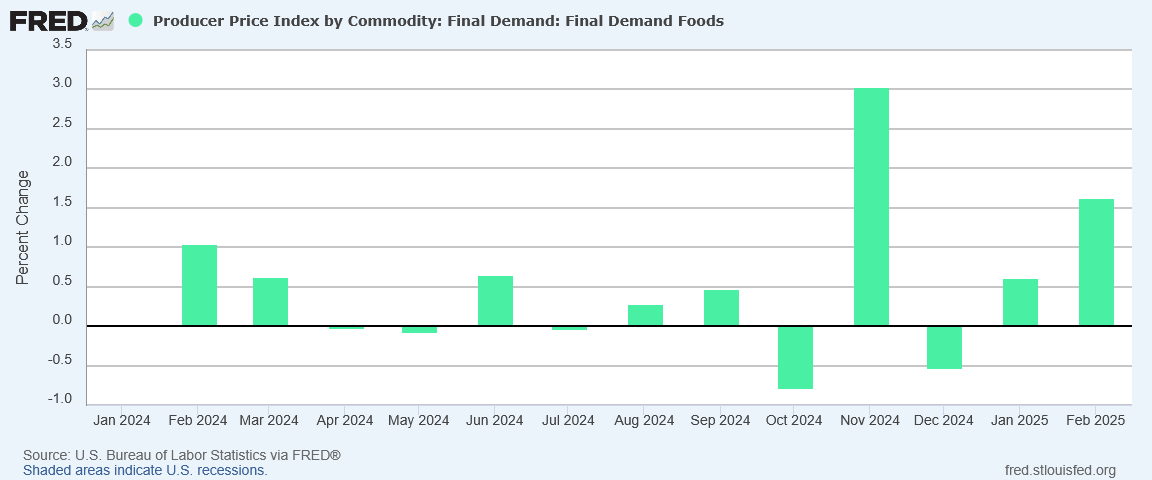

Only food showed increased inflationary pressures at the factory gate level.

There’s no mystery as to why food is showing factory gate inflation: egg prices are still elevated.

Yet aside from egg prices, many of the supply chain pressures that were producing elevated consumer price inflation in January eased substantially in February.

Is this the start of a larger disinflationary trend that will at last bring consumer price inflation back to the Federal Reserve’s “holy grail” figure of 2% year on year?

While that would be a nice outcome, one month’s lower inflation does not a trend make. It is also possible that, just as corporate media has speculated, President Trump’s tariffs and trade war threats will combine to push prices up again.

Trump Is Disrupting

As the stock market’s recent rollercoaster performance demonstrates, Donald Trump is shaking up Wall Street just as he is shaking up geopolitical and trade relations.

Trump on Thursday threatened to impose a 200% tariff on alcoholic beverages from the European Union after the bloc on Wednesday imposed a 50% tariff on US spirits like bourbon. The EU’s tariff on US spirits was in retaliation for Trump’s sweeping 25% tariffs on steel and aluminum.

Markets initially shrugged off tariff news on Wednesday, but the slide resumed Thursday as the trade spat between Washington and Brussels escalated. It extends a rout in US markets that has been driven by the uncertainty around Trump’s tariff announcements.

The prevailing sentiment among the financial media is that President Trump’s tariff threats have thoroughly spooked Wall Street investors, creating bear market conditions for many stocks.

It is certain that Donald Trump wields the tariff threat as no President has done since the Gilded Age at the close of the 19th century.

It is also certain that no President has used tariffs as negotiating leverage on non-economic issues the way Donald Trump has done. We should not lose sight of the fact that Trump’s initial tariff threats to Canada and Mexico revolved entirely around border security as well as drug and human trafficking.

Donald Trump is determined not to leave the status quo in place. Whether its his tariff threats, his pursuit of peace in Ukraine, or the creation of DOGE, President Trump has been without a doubt an agent of change, and even of chaotic change.

Are Trump’s tariff threats spooking commodities markets the same way they appear to be disturbing equity markets? We certainly cannot rule that out, and as a theoretical proposition uncertainty over tariffs would create uncertainty in final commodity prices, which would in turn push commodity prices downward. Trumpian uncertainty may very well be what we are seeing in the cooler-than-expected inflation print for February.

However, it may also be that Trump’s disruptive presence is catalyzing a re-evaluation of actual demand for commodities, in much the way his disruptive presence is catalyzing a re-evaluation in Germany of its defense and economic policies.

If that is the case then the disruption arguably will have long-term benefits.

However, all such speculation is exactly that—speculation.

In the (Biden-)Harris era, predictions and prognoses were quite feasible, because the policies were so unoriginal and unimaginative that extrapolating their likely effects was a comparatively easy exercise. Not so with Donald Trump. For better or worse, his policies are highly original and highly imaginative.

Trump’s embrace of tariffs is quite a novelty for a post-WW2 President, and his willingness to engage in so-called “trade war” disputes with other countries is only spared the novelty label because it is consistent with his first term in the Oval Office.

Economically as well as geopolitically, Donald Trump has torn up the playbook. He is in every aspect an agent of change, and even a chaotic agent of change. That makes prediction and prognostication an exercise in futility.

It is quite possible that President Trump’s trade war threats will cause higher prices at least for a time here in the US. If those threats go off the rails they may result in an extended period of inflation. If they work perfectly they may result in bringing consumer price inflation down below 2% for every good and service imaginable.

We are not going to know which of these possibilities will become realities until they do.

Wall Street had better get used to the rollercoaster—Donald Trump is likely to keep them on that ride for a while yet!

Trump is disruption - that’s for sure! His first seven weeks in office have had us all settling in with popcorn, cheering “yeah!” and asking questions like “What’s taking Bondi so long?”

So one (speculative) question for you Peter: in light of the new data, any comments on its effects + tariffs + China’s deflation?

The Disruptor In Chief is exploding the heads of his adversaries. Daily. I love it!