The Bureau of Economic Analysis has released the September Personal Income And Outlays Report, and the numbers are not exactly “good.”

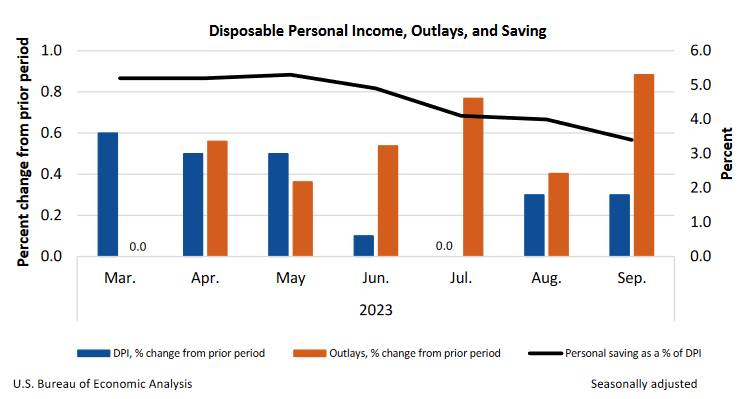

Personal income increased $77.8 billion (0.3 percent at a monthly rate) in September, according to estimates released today by the Bureau of Economic Analysis (table 2 and table 3). Disposable personal income (DPI), personal income less personal current taxes, increased $56.1 billion (0.3 percent) and personal consumption expenditures (PCE) increased $138.7 billion (0.7 percent).

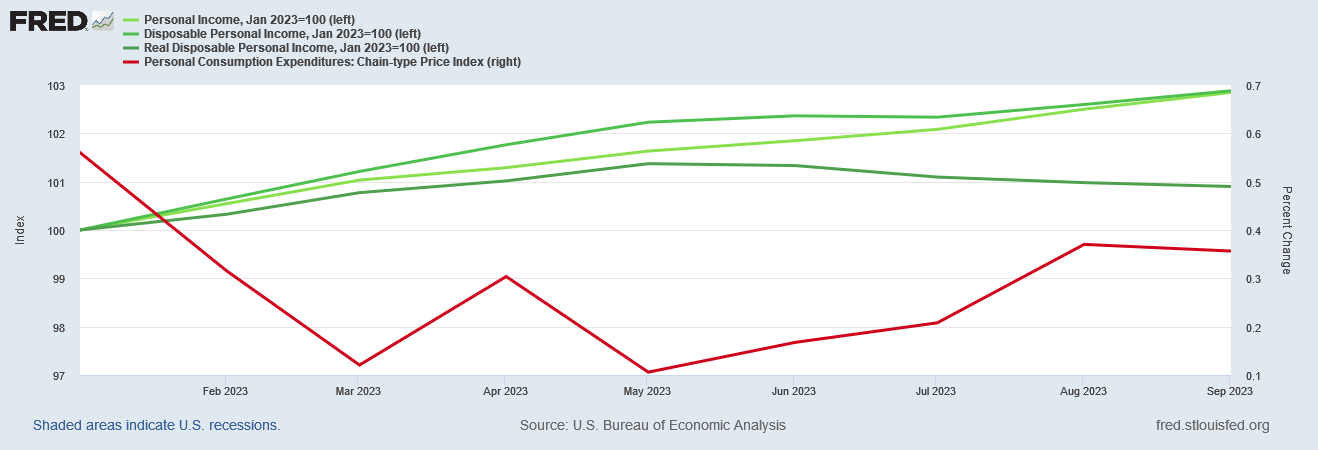

The PCE price index increased 0.4 percent. Excluding food and energy, the PCE price index increased 0.3 percent (table 5). Real DPI decreased 0.1 percent in September and real PCE increased 0.4 percent; goods increased 0.5 percent and services increased 0.3 percent (table 3 and table 4).

Personal expenditures grew more than twice as much as disposable income, and nearly as much for overall personal income. Real disposable income shrank—again.

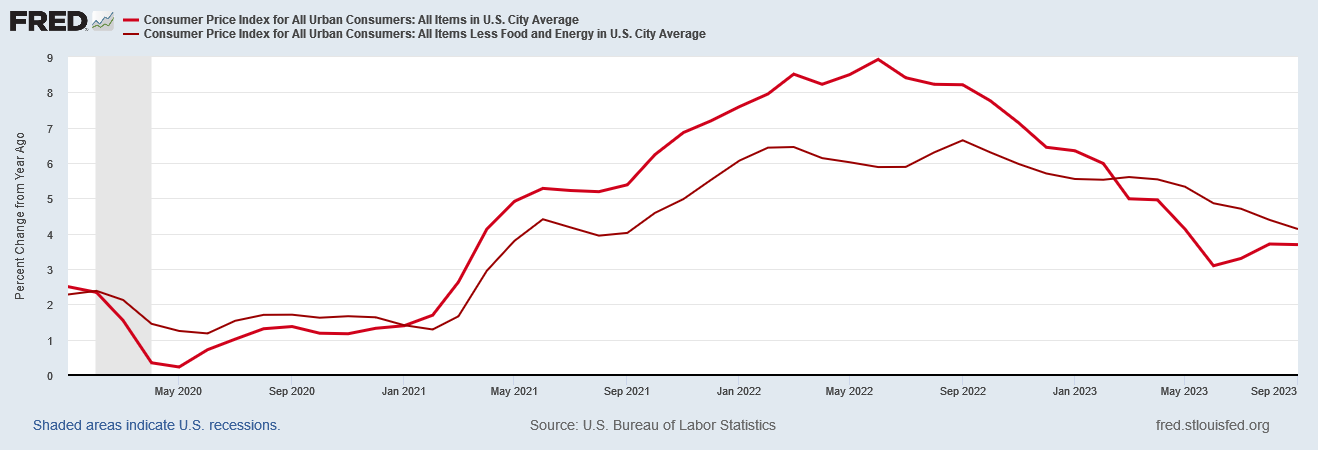

Core inflation dropped a little year on year, rose a little bit more month on month, and was largely mooted by rising energy costs (again).

Naturally, Dementia Joe’s handlers completely misread the report and gave the President yet another completely out of touch Twitter victory lap.

Since incomes are falling and inflation is rising (not falling), it is laughable and lame for the current regime to speak of “invest[ing] in working Americans.” Working Americans are getting shafted by the current economy, and policies coming out of the Oval Office play a role in that.

For its part, corporate media received the BEA numbers with a collective “Meh”.

Markets mostly shrugged off the report, with stock market futures pointing slightly higher and Treasury yields mixed across the curve.

“Although consumer prices rose faster than expected from a month ago, core inflation continues to lose speed and this report will not likely change the Fed’s view that inflation will slow in the coming months as demand slows,” said Jeffrey Roach, chief economist at LPL Financial. “Eventually, spending will moderate after several months of consumers spending more than they earn.”

Yet there are two data points that are undeniable and which overshadow the rest of the report: core inflation continues to rise month on month, and real disposable income continues to fall. Neither trend is what counts as “good news.”

Nothing actually improved in the report since August. Nominal income growth declined, headline inflation remained the same, and core inflation only diminished year on year while rising month on month.

These are not horrible numbers, but they are not good numbers. They certainly are not numbers to showcase the success of “Bidenomics.” The year on year improvement in core inflation is countered by headline inflation choosing not to move any further down.

That headline inflation is stuck on a plateau after rising slightly in June does not augur well for the Fed’s goal of achieving 2% year on year consumer price inflation.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.

Indeed, although consumer price inflation had been cooling for some time, over the past two months the trend has decidedly reversed, with month on month inflation moving up.

This trend is a confirmation of what we have seen just yesterday in the quarterly GDP estimates: inflation is on the rise.

However, returning to the indexed data as of the second quarter of 2020, we also see that the disparity between nominal and real GDP growth has been increasing over recent quarters, and for the third quarter is greater than it has been since the third quarter of last year.

This suggests that inflation is showing signs of heating up again.

The GDP data was itself a confirmation of a trend observable within the most recent Consumer Price Index Summary.

When we look at headline consumer price inflation and “core” inflation together, we immediately see that a dichotomy has emerged in the past few months: headline inflation is increasing and core inflation is decreasing.

Inflation is not merely still lurking in the background, increased inflation is looming over the economy, promising higher prices, reduced incomes, and economic stagnation overall.

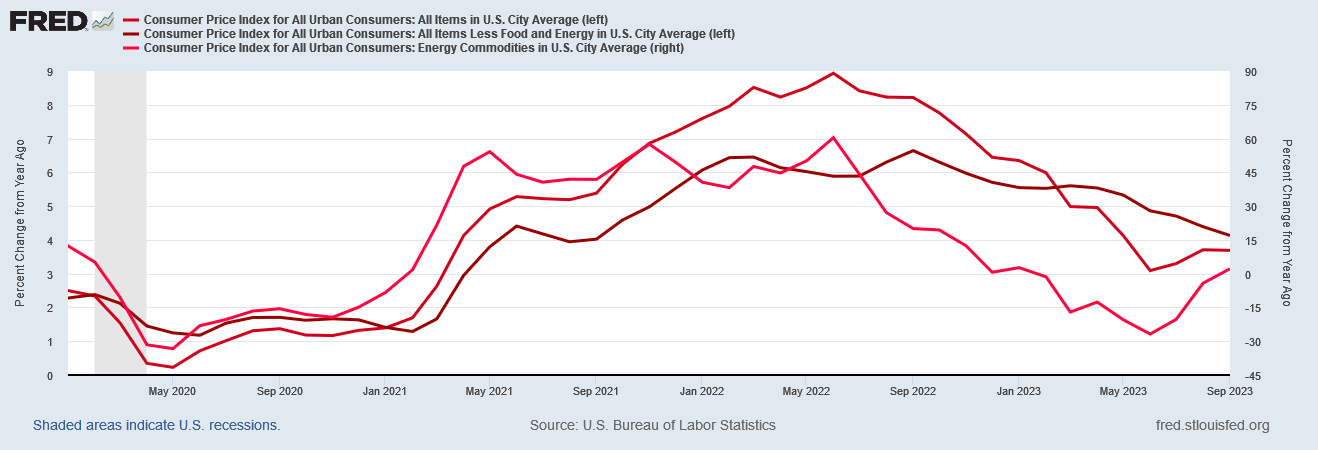

As with the CPI data, we are seeing the same culprit driving the PCE inflation data up: energy prices. To reiterate from the CPI data, we easily see the impact of energy price inflation when we overlay the CPI’s energy price index against the headline and core inflation charts.

The PCE data shows the same impact of energy price inflation.

Unsurprisingly, energy price inflation prints largely the same in both inflation metrics.

While energy price inflation has for most of 2023 been energy price deflation, as of September that trend has all but been erased, and energy price inflation is resuming once more.

Nor is it hard to fathom why energy prices are moving up, particularly in the wake of recent events in the Middle East, which has stymied Wall Street prognosticators in recent days.

The Middle East chaos alone explains the most recent rises in crude oil prices, including the recent retreats from the most recent peaks.

As oil goes, so goes energy price inflation. Both look to be trending up in the near term.

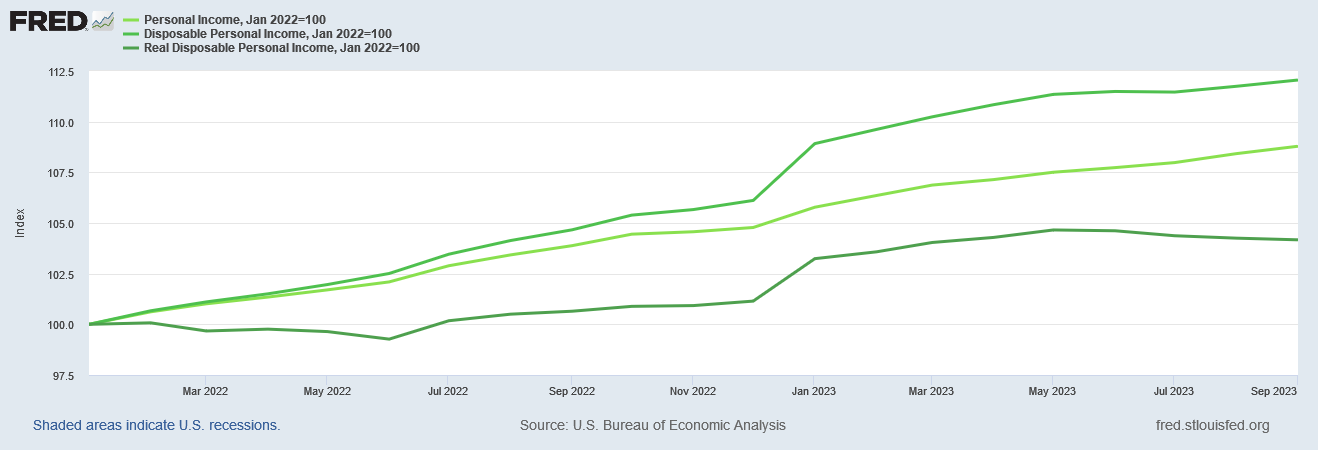

While inflation is rising, real disposable incomes are continuing to shrink.

Readers will note that I have discussed incomes at greater length just recently, and the September PCE report does not change the discussion in the slightest.

However, what the broad data unequivocally shows is that, since the economy was derailed by the lunatic lockdowns and the Pandemic Panic Recession, real wages have been savaged by inflation. On a national basis, and over the longer span of time, inflation has gobbled up every penny of nominal wage increase and come back for seconds, thirds, and fourth helpings of purchasing power.

The September PCE report in fact underscore the extent to which inflation has eroded disposable personal incomes. When we index personal incomes to the end of the Pandemic Panic Recession, we see that real disposable personal income has decreased by 7%.

Moreover, as we see if we shift the index to January of 2022, disposable personal incomes did not begin reversing that decline until June of last year—the same point at which consumer price inflation peaked.

Yet, if we bring the index forward again to January of this year, we see that real disposable personal incomes began decreasing again in May, and have been declining ever since.

Nor is there any great mystery why incomes are declining: inflation is rising, as the month on month PCEPI data shows quite clearly.

More precisely, energy price inflation is on the rise once again.

Energy prices are up. Energy price inflation is up. Consumer price inflation is up. Real disposable incomes are down. These are not coincidences.

We are eighteen months into the Federal Reserve’s campaign to corral consumer price inflation, and consumer price inflation is rising.

We are eighteen months into the Federal Reserve’s campaign to corral consumer price inflation, and the inflation reductions that have been achieved have been entirely the result of energy price deflation—which is not something which responds to the Fed’s interest rate manipulations.

We are going on thirty one months of Dementia Joe’s regime, and his much touted “Bidenomics” has resulted in higher prices and lower wages.

We are past forty-one months since the Pandemic Panic Recession, and not only have prices not stabilized, but neither have wages. Prices continue to trend up and wages continue to trend down.

That is the September Personal Income And Outlays Report in summary: inflation continues to rise and incomes continue to fall. That is not what anyone would call “good news”. That is merely the news we have.

My theory is the reason that the numbers are confusing is because we have a two tier economy . Newly retired above average earners have plenty of disposable income and paid off mortgages. They are spending like crazy. This is offsetting the reality that the working poor are going into debt to survive or sharing housing or going without medical care or living in vans .

Another cogent analysis, thank you so much again. Have you seen the recent work from David Webb; we wonder what you think of it, in particular any effective actions we can take, individually or together? https://img1.wsimg.com/blobby/go/1ee786fb-3c78-4903-9701-d614892d09d6/taking-june21-web.pdf