The word of the moment on Wall Street is “recession”.

Over the past month, declining equities have succeeded in spooking an increasing number of stock market analysts and prognosticators, all of whom are seeing an increasing number of “recession” signals everywhere—but chiefly in the fact that stock markets are declining.

As those who follow my Substack are already aware, I’m not worried about a recession “happening” in the near future—I contend the recession arrived months ago, and that it is getting steadily worse, not better.

This is not an economy that is doing at all well. You know that because your paycheck and your grocery bill tells you that on a regular basis.

The data agrees with you.

Yet while the economy has not been doing at all well with respect to Main Street, Wall Street was doing well up until the start of 2025. Then equities started moving down, and while they have gone up and down, the overall trend is not a good one.

What is happening that is giving Wall Street such a case of the vapors? Let us dig into the numbers and see what we can uncover.

Stock Market Not Off To A Great Year

Anyone with an investment portfolio or even a 401(k) plan knows that 2025 has not started off well for stocks.

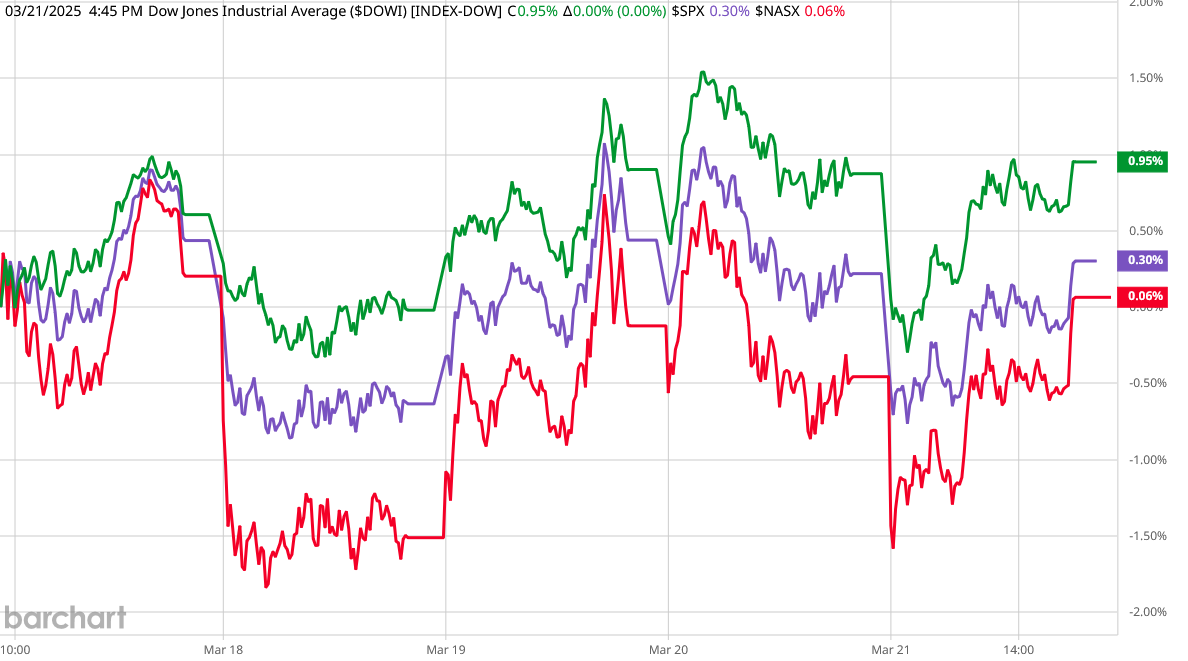

The Dow Jones index is down nearly 2% on the year, the S&P 500 index is down nearly 4%, and the NASDAQ is flirting with “correction” territory at just over 8%. While the indices have recovered somewhat over the past week, it has been a rollercoaster ride for March, as the financial media reporting has made clear.

On the 14th, Bloomberg winced as the market gave up some $5 Trillion in equity.

“This does feel pretty violent, mostly because the market had been pretty tame for a couple of years,” [Ben Inker] the 54-year-old co-head of asset allocation at Grantham Mayo Van Otterloo said in an interview, in the aftermath of the more than $5 trillion equity rout. “I’m very sympathetic to what the market is doing.”

On the 18th, the Associated Press was lamenting the fall of Big Tech, with high profile stocks such as Tesla and Google parent Alphabet coming up short yet again.

On the 21st, Business Insider tracked what it viewed as 4 markers of a coming recession:

Household finances are deteriorating

Small and mid-cap stocks are doing poorly

More companies are warning of weaker earnings

The bond market is pricing in more risks.

It was not until Friday that the markets received some welcome relief, with stocks managing to eke out some positive gains on the week.

Wall Street’s performance year-to-date has been quite the reversal from the past few years, with the Dow climbing over 30% since the start of 2021 before commencing this year’s dramatic retreat.

With Donald Trump having announced a “Golden Age” for the country in his inaugural address in January, where equities have gone since then understandably has a few investment types scratching their heads.

But perhaps they should not be surprised. Stock markets have long obeyed their own law of gravity, where what goes up invariably comes back down again.

Stock Market Has Had Great Run. Or Has It?

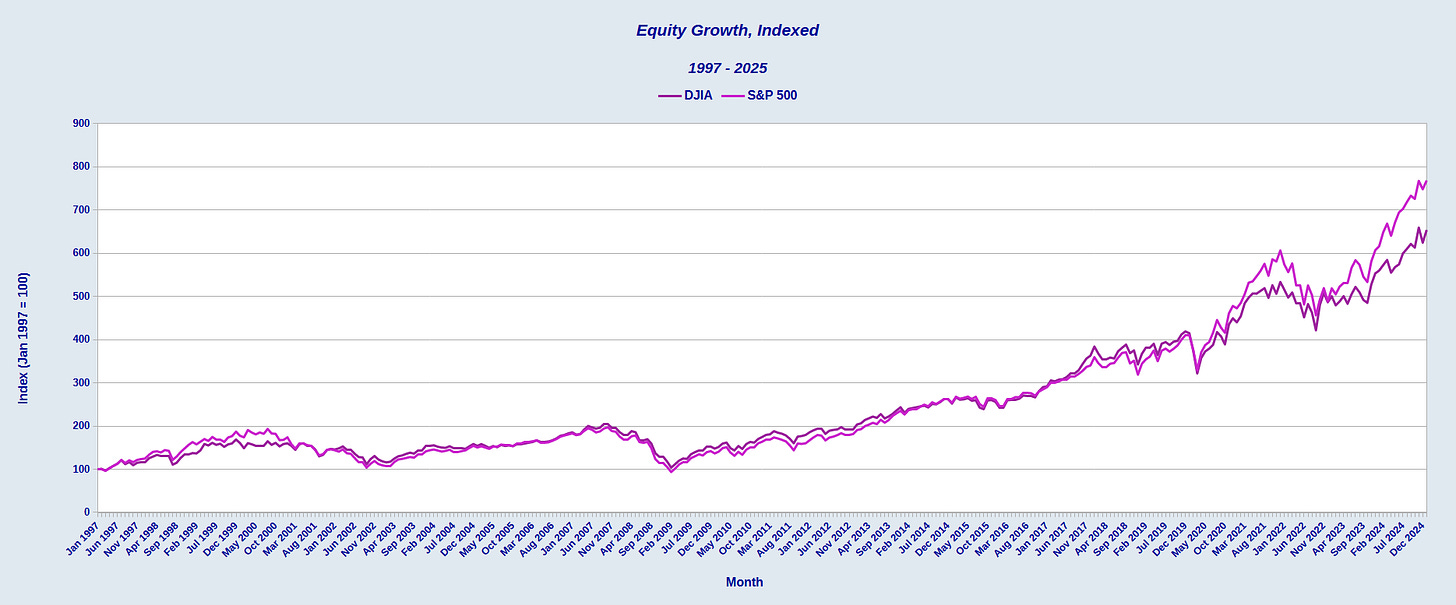

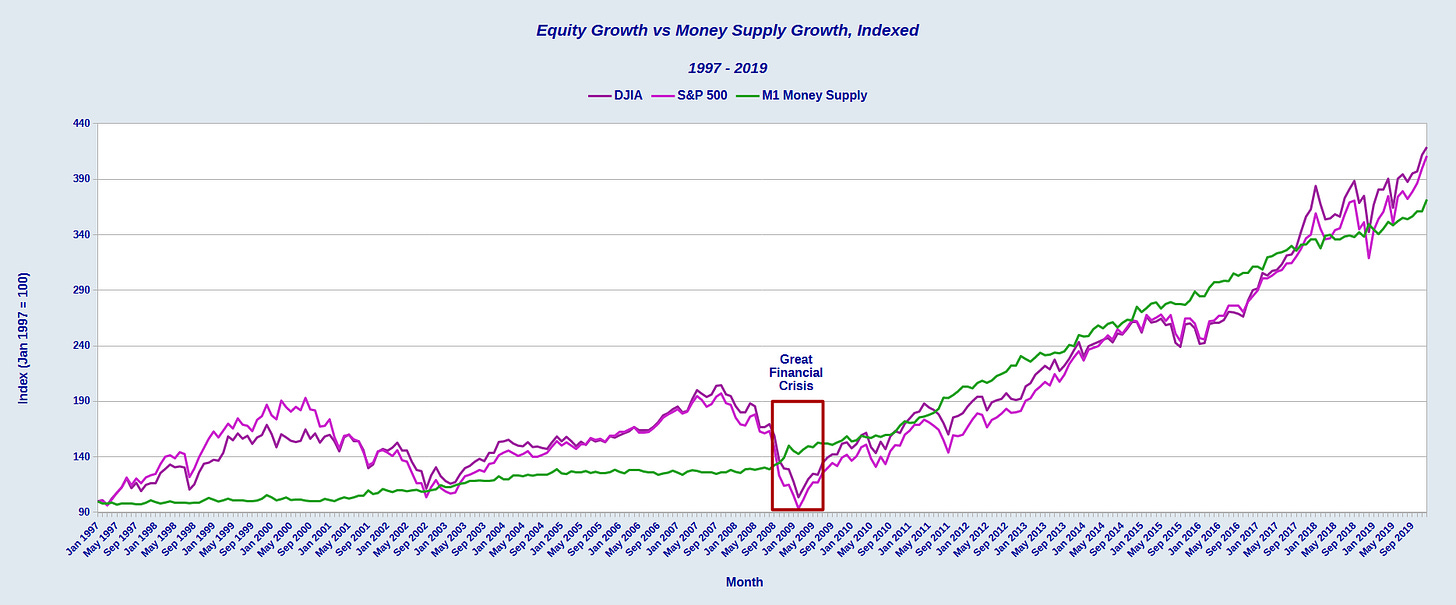

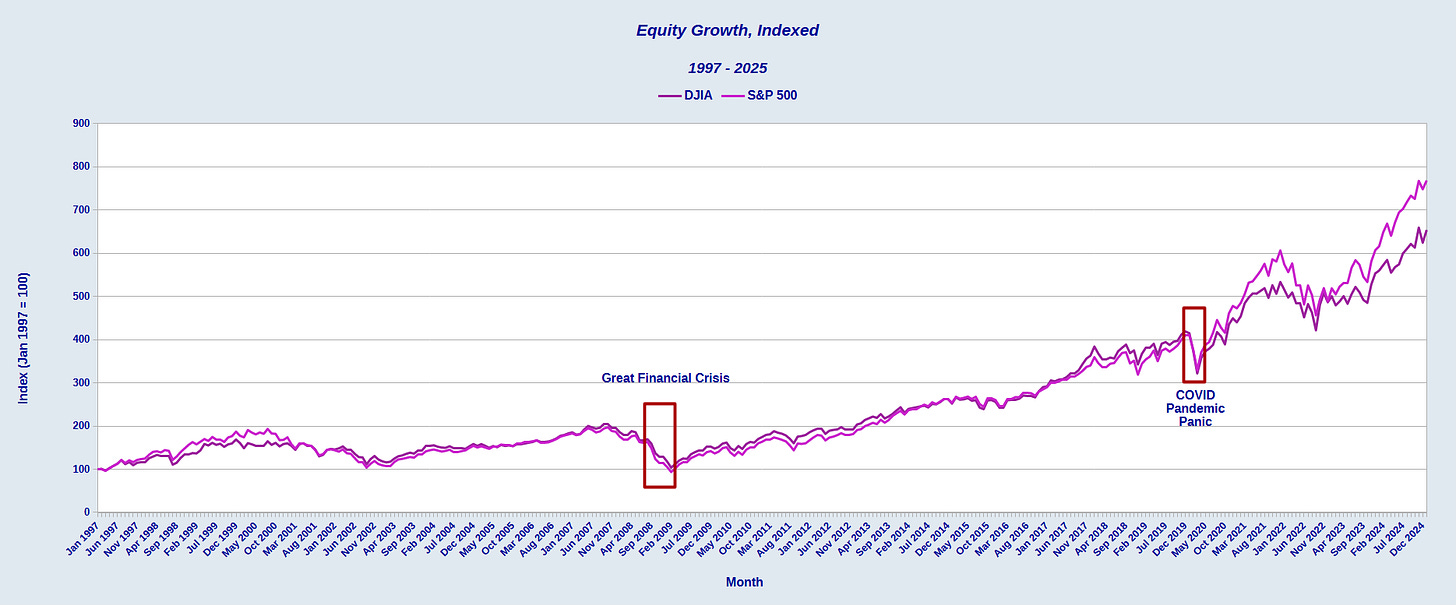

If we take a step back and look how the Dow Jones and the S&P 500 have fared over the years, there is no denying that the stock market has done quite well over time. If we baseline index both the Dow and the S&P 500 to January 1997, we see that the Dow has risen some 600% and the S&P 500 has risen some 700%.

These are not returns about which one would ever complain!

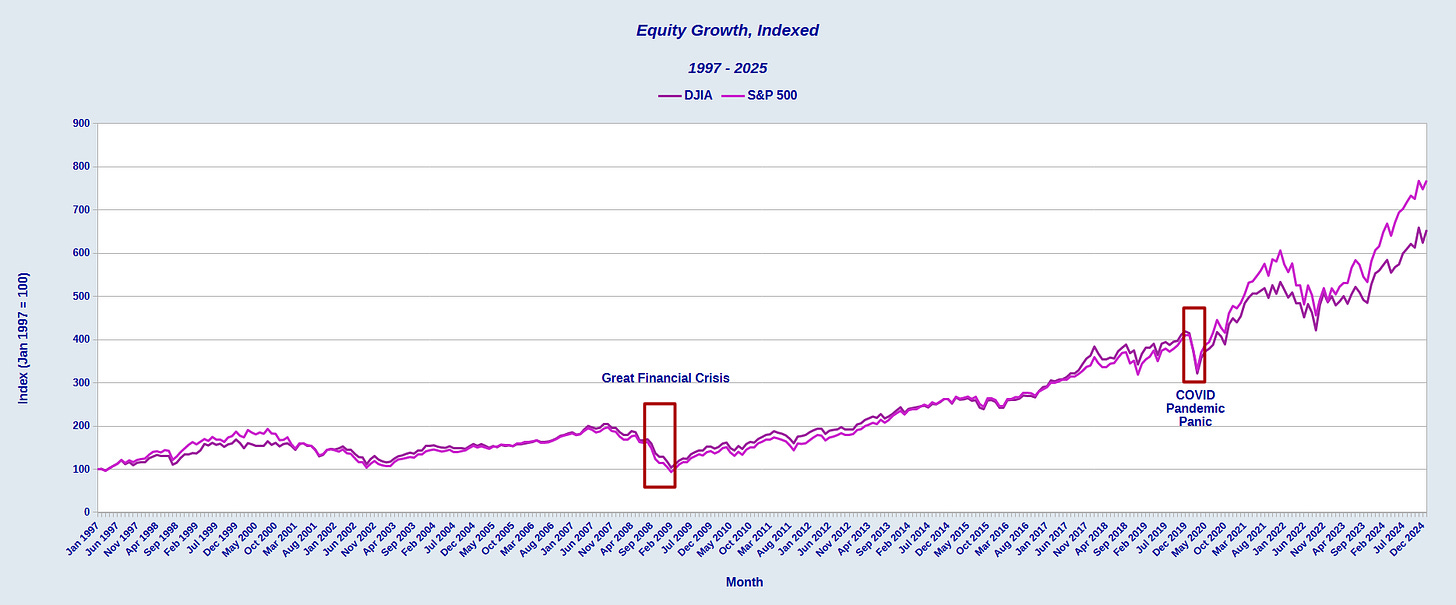

Even two major economic reversals—the Great Financial Crisis in 2008-2009 and the COVID Pandemic Panic Recession of 2020—has not succeeeded in derailing Wall Street.

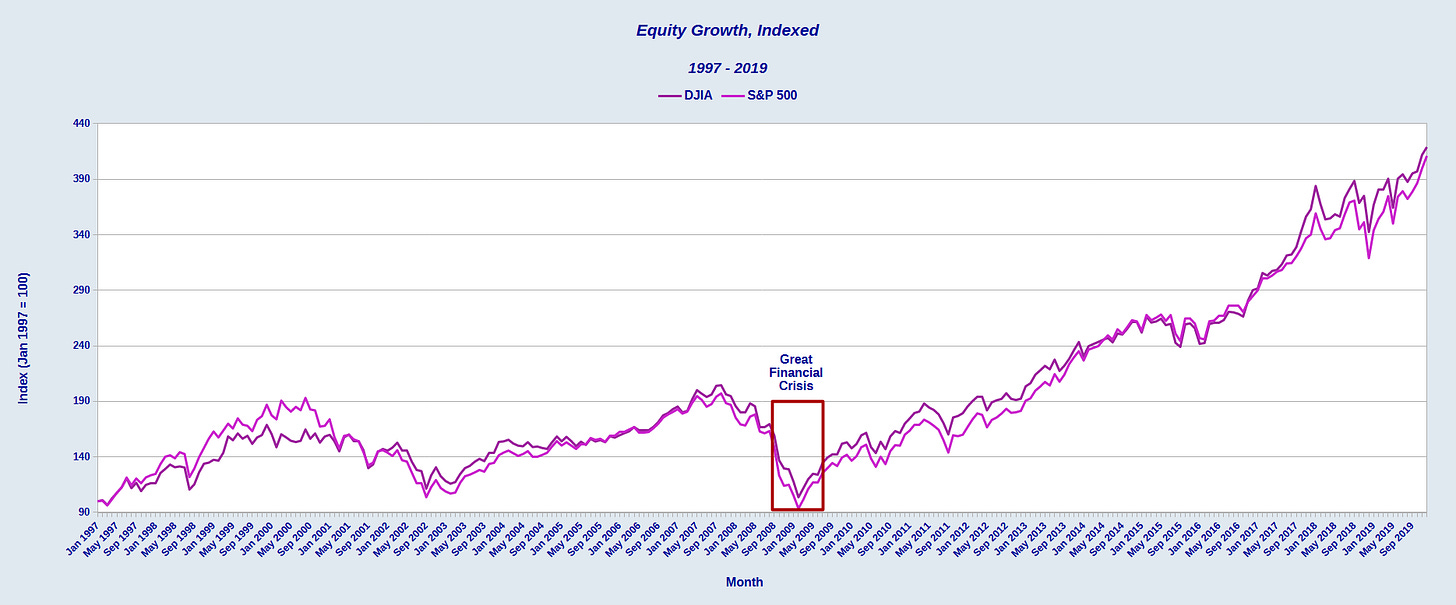

Indeed, if we zero in on the pre-COVID era, we see that the GFC was the start of a dramatic rise in stock valuations.

However, there is a small problem with that thesis: The GFC also was the start of a very expansionist shift in the Fed’s monetary policies.

Indeed, I first explored what has happening on Wall Street before COVID upended everything.

The data does not paint a healthy picture of Wall Street gains. Virtually all of Wall Street’s equity gains from 2009 through 2016 are almost entirely due to the Fed’s rapid expansion of the money supply (“quantitative easing”) after 2009. If we try to adjust for the expansion of the money supply, virtually all share price gains during this period are inflationary—they are the result of money growth, not valuation growth.

In other words, virtually all stock gains during these years were the result of asset price inflation. For the strict monetarists in the world, this asset price inflation was why the Fed was able to print so much money without triggering “inflation”. There was inflation, just in asset markets rather than in consumer markets.

Only during Donald Trump’s first term did we see stock prices rise by more than the money supply expansion.

Has the stock market therefore been in a “bubble” phenomenon? Arguably yes. Certainly money supply expansion has driven much of the gains in asset prices since 2009, and that would be the definition of a bubble.

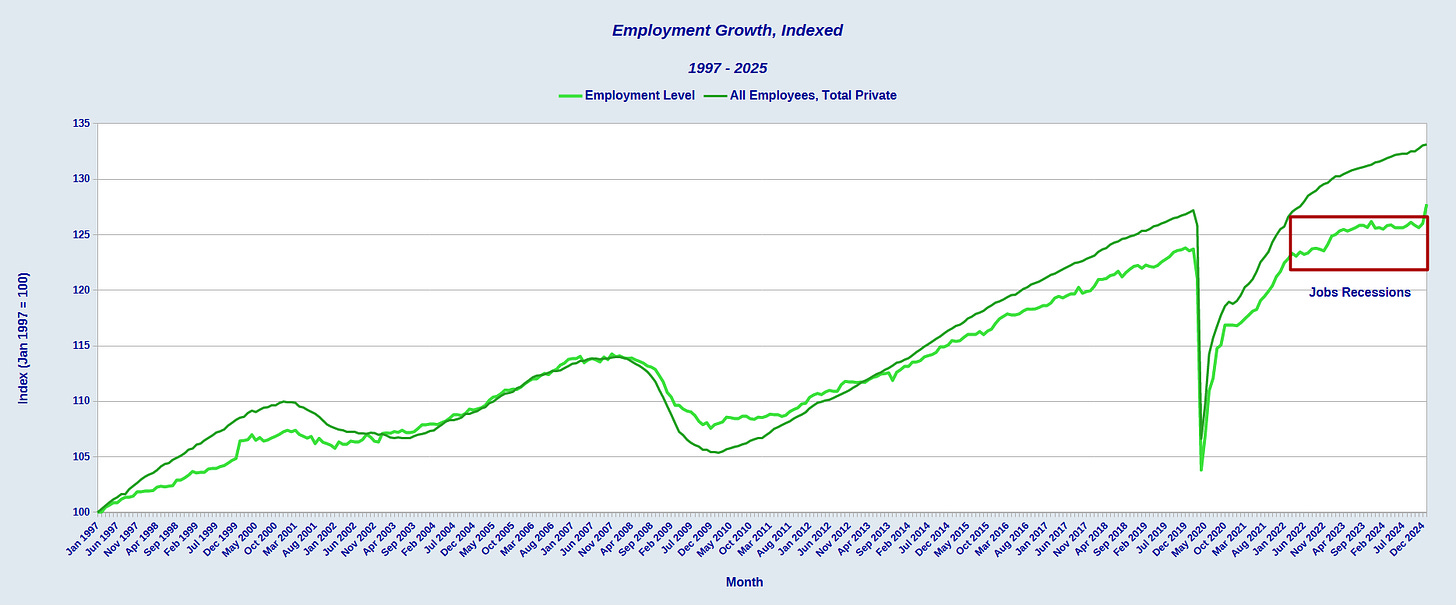

Recession Has Stalked Labor Markets, Not Stock Market

In the same way that inflation was confined to financial markets pre-COVID, recession has been concentrated in labor markets post COVID.

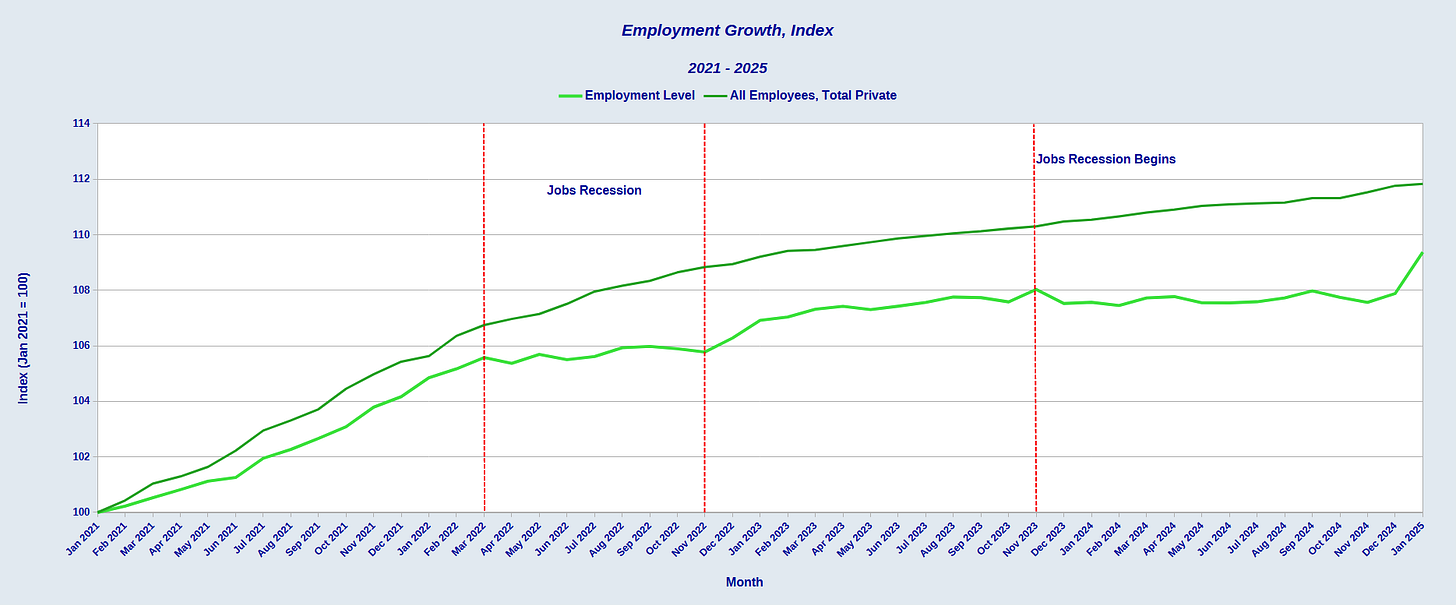

In addition to the obvious labor setbacks of the COVID Pandemic Panic Recession, we have seen in labor markets at least two pauses in employment growth since 2021.

The first such “jobs recession” occurred during the summer of 2022. The second began in the fall of 2023 and is ongoing.

These pauses in employment growth have been confirmed in both cases by the Philadelphia Federal Reserve’s independent analyses of the jobs data.

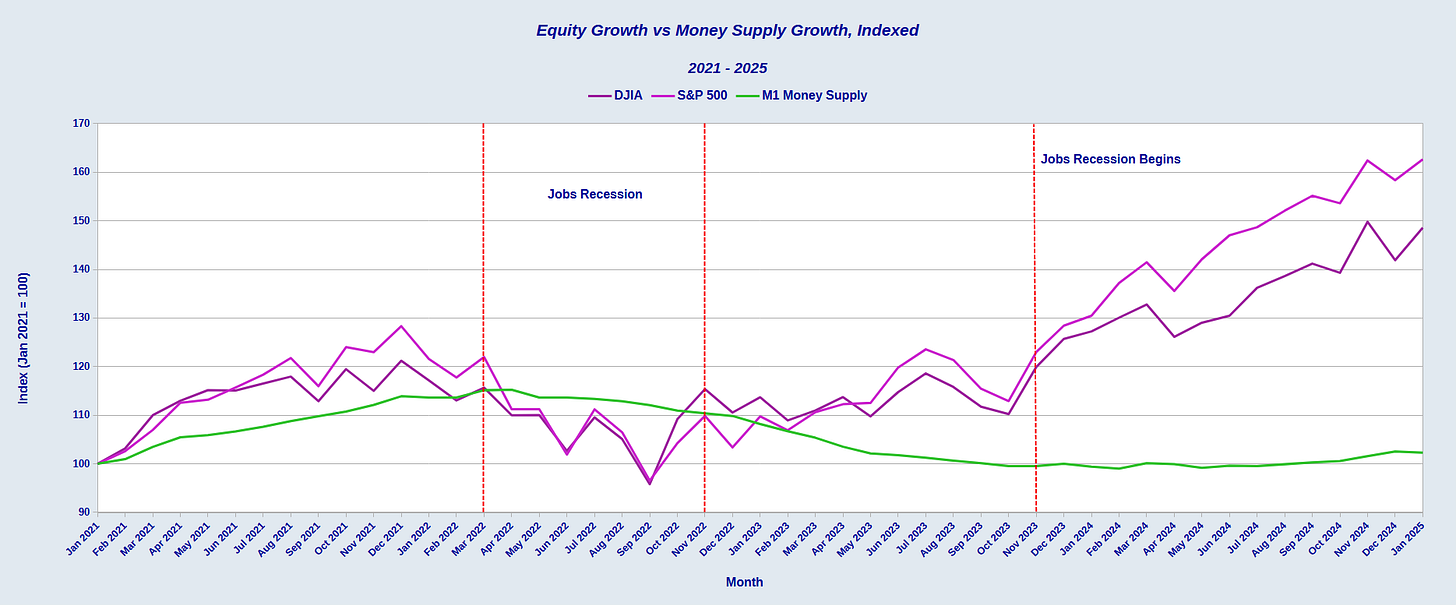

Yet while labor markets have languished, the stock markets held up rather well during these periods.

Wall Street experienced only a modest reversal during the 2022 jobs recession and, prior to the recent declines, had not experienced any reversal during the ongoing one.

Interestingly, stock prices have held up even as the Fed has begun to actively shrink the money supply in the wake of the 2022 hyperinflation.

Remember, money supply growth is what has powered much of Wall Street’s performance since 2009. If the money supply helped to inflate a bubble in stocks, is it really so surprising that pulling back on the money supply is going to deflate that bubble?

Wall Street is not facing imminent recession. Rather, the Federal Reserve’s policy decision to shrink the money supply is pulling Wall Street into the reality of the current jobs recession that has been plaguing Main Street for over a year.

Reality is starting to set in for Wall Street, as it has always been bound to do.

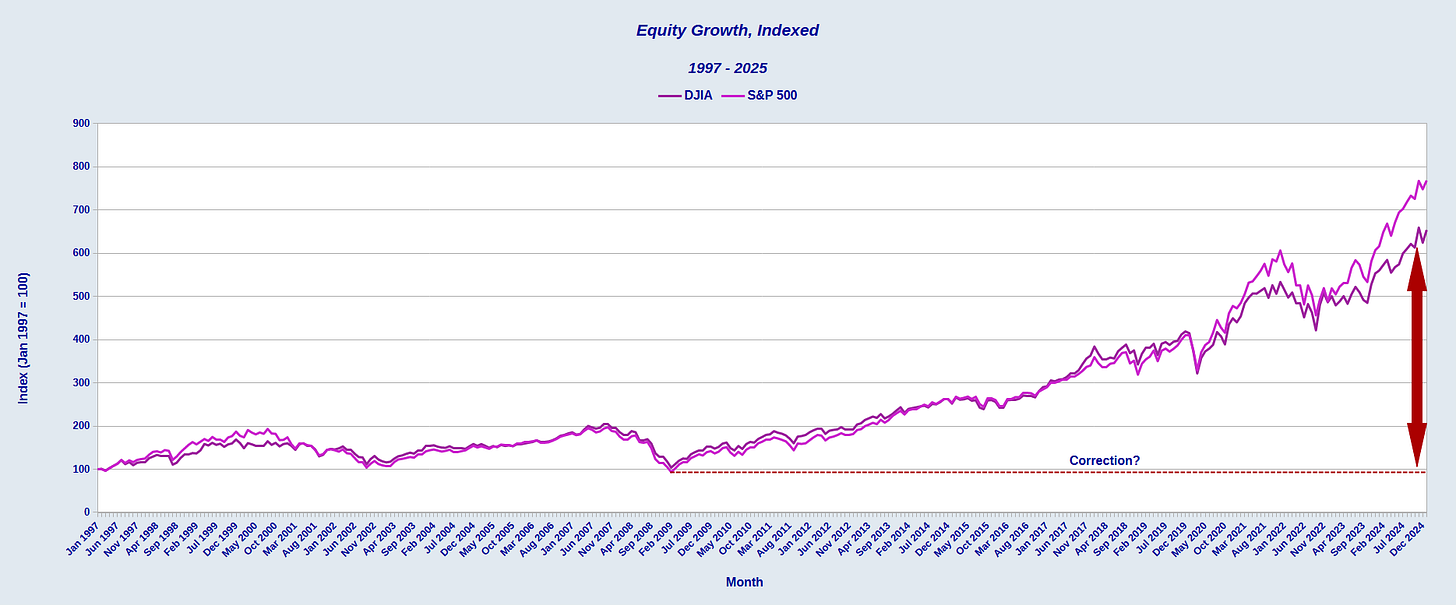

Correction Is Due

In one respect, Wall Street should be grateful the bubble is not larger—and it is clear just from looking at the behavior of stocks after the GFC that there has been a bubble.

What has not happened, however, is the Fed’s ginormous money supply expansion during the COVID Pandemic Panic translating into a corresponding level of asset price inflation.

By the summer of 2021, the Federal Reserve had expanded the M1 Money Supply by an eye-watering 2000%. Given the strong correlation we have seen between money supply growth and asset price inflation after 2009, how the Dow and the S&P 500 did not end up also having risen by more than a thousand percent arguably is a bit of a mystery.

This was an acceleration even above what took place after the GFC in 2009.

Still, we have seen asset price inflation in financial markets, not just since COVID but well before COVID also. We have an asset bubble in stocks that must be deflated at some point.

How far must that bubble deflate? That is somewhat uncertain. During the Pandemic Panic Recession we do see a slight dip in equities. At a minimum we could be looking at a correction of about 58% of the current valuation of the Dow, from the March 2025 levels of around 41,800 to the March 2020 level of around 23,300.

Calling a 58% drop in the Dow a “correction” might be the epitome of understatement, but when we consider that the asset price inflation began all the way back in 2009, depending on how much the Federal Reserve decides to shrink the money supply, a reversal back to pre-GFC levels is not out of the question.

That would be an 83% reduction from current levels!

Yet if we look at the market’s pre-GFC performance, both in the run-up to the Great Financial Crisis and the previous “dot-com bomb” recession of 2001, Wall Street in both of those instances surrendered virtually all growth going from peak to trough.

If that is what is to happen, Wall Street is looking at a market wipeout on par with what is fated to happen in China with housing prices and that orgy of wealth destruction.

A similar fate of wealth destruction is poised to unfold here in the United States over stocks.

No wonder Wall Street is in a panic over stock prices!

Why must this happen? Ultimately because that is the consequence of asset price inflation. With asset prices inflated by money supply growth, shrinking the money supply stops the asset price rises just as surely as Xi Jinping’s “Three Red Lines” stopped housing price appreciation in China. In both instances, the inflating factor is being curtailed, which removes the primary price support in both markets.

Will the markets retreat all at once?

That we cannot say. We should note that China’s housing market collapse has unfolded in the years since COVID and Xi’s’ “Three Red Lines”, and is still ongoing.

So long as the Federal Reserve pursues a policy of shrinking the money supply, however, Wall Street needs to accept that deflating the money supply is going to deflate asset prices as well.

Whether that turns into an abrupt market crash or a long drawn-out Chinese-style “correction” depends entirely on the pace of the Fed’s reduction in the money supply—and even the Fed does not know from one month to the next what it will be doing.

Perhaps most disturbing of all for Wall Street is the reality that Wall Street is no longer in command of its own destiny. Having become thoroughly addicted to loose monetary policy over the past 15 years, Wall Street is now dependent on the Federal Reserve maintaining that policy just to sustain current asset prices. The more the Fed shrinks the money supply and shrinks its balance sheet, the further asset prices—stock prices—are going to trend down. There is no amount of Wall Street caterwauling that will overcome that fundamental consequence of asset price inflation.

2025 is not going to be a kind year to Wall Street. Consequences rarely are.

"Consequences rarely are."

And we have some helluva consequences.

Could someone please tell people how 401Ks work? Allthat money you thought you had? You get that only if you sell off the funds. Stock markets go up and down. Maybe you should look at how you are invested. And finally, even with a decrease, if inflation is under control, that money will go farther.