OPEC+ Oil Cuts Have Backfired

Less Production And Falling Prices Mean Less Money All Around

In less than a month since the OPEC+ oil cartel announced a surprise production cut, nearly all of the price appreciation spurred by that announcement have evaporated.

Oil prices ended Thursday lower than they were when the production cut was announced on April 2.

OIL prices have fallen back after a brief spike triggered by the surprise production cuts announced by Saudi Arabia and other members of the Organisation of Petroleum Exporting Countries and its allies (Opec+) on April 2.

A recently as just a few days ago, this was not supposed to happen.

Oil prices are rising again, and for reasons (hopes?) that sound vaguely familiar: China demand for oil is soon to accelerate, this time because of an upcoming holiday travel period.

In the mid-Monday North American session, WTI crude oil prices continued to climb, trading at $78.78 per barrel, marking a gain of 1.13%. The price has pierced the 20 and 50-day Exponential Moving Averages (EMAs), indicating bullish momentum, with buyers now setting their sights on the $80.00 per barrel mark.

Growing optimism that China’s May Day holiday will increase travel and fuel demand boosted the market. Booking for overseas trips for the May Day holiday continued to recover, but numbers remain far from reaching pre-Covid levels. Although oil prices jumped, the uneven economic recovery in China from the Covid-19 pandemic keeps oil prices fluctuating.

And then reality set in….

Instead of West Texas Intermediate closing above $80/bbl, both WTI and Brent Crude closed on Thursday not only well below that threshold, but below even the price levels in place when the OPEC+ nations announced their surprise production cuts.

On Friday prices recovered somewhat, with Brent Crude closing at $80.26/bbl, although it is uncertain if there will be much further price appreciation when the markets open come Monday morning.

Far from being the pricing power grab the financial media made the cuts out to be, they turned out to be exactly the defensive maneuver I said they were.

While the corporate media hyperfocused on the narrative that the Saudi decision was a plus for Putin and Russia while being a negative everywhere else, and that this must be due to waning US influence in the Middle East, the reality is likely far more mundane: the OPEC+ nations need to produce less oil if they want to see higher prices per barrel. The production cut is more about a growing glut in oil than it is any geopolitical power game between Saudi Arabia, Russia, and the United States.

If the goal was to eliminate an oil supply glut, it has failed to do so, certainly for the United States. Per the Energy Information Association, oil stocks in the US are higher now than they were when the production cuts were announced.

The global glut in oil is increasing. The production cuts have not had the desired effect.

Even Wall Street commodities analysts are conceding the production cuts were not the pricing power play they were touted as being.

"Those who were predicting over $100 oil did not understand how weak markets were looking," Citi's head of commodities research Ed Morse said.

The cuts have even failed to keep Russian oil above the EU/G7 price cap of $60/bbl. Russia’s benchmark Urals Crude had surged above the price cap threshold in the wake of the OPEC+ cuts, peaking above $68/bbl in mid-April.

At Thursday's close, Urals Crude had retreated to $59.79/bbl, below the price cap threshold. While the Friday uptick in Brent Crude is likely to translate into Urals Crude moving back above the $60/bbl price cap, Urals Crude is showing no momentum towards regaining its mid-April peak. By Monday’s close (after this article has published), Urals Crude will almost certainly be above $60/bbl, but not by much—$62/bbl is probably close to the top end of the likely price appreciation.

Even Russia’s other benchmark blend, the ESPO blend delivered from Russia’s Asiatic ports, has plunged from an April peak of $76.78/bbl to an April 27 close of $68.37/bbl, less than a dollar per barrel above its March 31 closing price.

Any benefit Russia had received or expected to receive from the OPEC cuts—which were in addition to Russia’s earlier announced production cuts—has for now faded.

China’s boost in oil demand due to increased air travel will be pushing against some mighty strong recessionary headwinds just on global oil prices alone.

How big a push that will actually be is itself somewhat problematic. Air travel has, by some accounts, already seen significant recovery. China in March had nearly three times as many air travelers as it did last October, during the Zero COVID madness.

That increase in demand has failed to produce any lasting upward pressure on global crude oil prices. China’s May Day traffic would have to not only surge far beyond March levels to produce a meaningful effect on global crude oil prices, but that level would have to be sustained—something which is distinctly at odds with the inherent transitory nature of holiday-related travel patterns.

Working even further against a significant boost from China’s upcoming holiday period is that traffic on Asia’s air routes has already recovered. Brian Sumers, writer of The Airline Observer Substack, describes current air travel, including around Asia, as “on fire”.

Demand almost everywhere is on fire, including in some Asian countries that were closed to the outside world until recently (something I learned while speaking to CEOs last month in Singapore). But Japan continues to vex U.S. airlines. Japanese tourists are traveling but they’re generally staying close to home. And tourism to Japan is booming, a nice tailwind for every U.S. airline — except Hawaiian.

Previously, Brian has described airline expectations for summer travel across the Atlantic as “strong”—which expectation should already be putting upward pressure on crude oil prices. It has not been enough to sustain oil prices. Anticipating a strong surge in oil prices just from China’s holiday travel seems more like wishful thinking at this juncture.

What oil bulls fail to grasp is something I’ve said before about oil prices: you can’t push a string.

However, as we can see from looking at just the past 25 days, the upward trend in spot oil prices comes to around latest prices as of April 6 for both blends.

Much like the Red Queen in Through The Looking Glass, OPEC’s cuts at this juncture look an awful lot like running and running just to end up staying where you are. Cutting production and causing a stir in the financial media just to end up a week later with roughly the same price OPEC might have had otherwise is a curious display of market muscle or strategic thinking.

OPEC’s production cuts were always more calibrated to stave off a more severe downward trend in oil prices, and for the month of April at least, it appeared to have succeeded—only now sagging demand is pulling oil prices down yet again despite the production cuts.

Why? Because despite rebounding airline travel, there are still numerous weak spots in the global economy.

While China touted strong first quarter numbers for its economy, to accept them at face value one has to believe that China is not lying about them, as it has done so often in the past.

However, we have at least two problems with these economic figures.

The first is that China is notorious for fudging and outright lying about their economic data, and there is more than a little chance that the extremely good news for Q1 of 2023 may be more of the same.

China announced its massive economy grew by 4.5% in the first quarter. It rebounded from the setback created by the COVID-19 pandemic. However, the data from China’s National Bureau of Statistics may be too good to be true.

Recently, Barron’s covered a study from Yale and China’s Fudan University. The conclusion regarding the GDP data was that “the evidence is very clear that the numbers have been manipulated.”

If Beijing is cooking the books, then China’s economy very likely did not grow by an annualized rate of 4.5%, or even a quarterly rate of 2.2%, during Q1 of 2023.

The second problem is that an expanding Chinese economy would almost certainly show up as a significant increase in global demand for oil, and the necessary telltale signs of such an increase are simply not there.

It should be noted that, during China’s “strong” first quarter, the Caixin Purchasing Manager’s Index for manufacturing dropped to 50 in March.

Add to the problematic veracity of China’s economic claims the possibility that its manufacturing base is on the verge of another contraction (as always, time will tell).

On the other side of the Pacific, US industrial production, while still increasing, has slowed dramatically, the increase dropping to just over 0.5%.

South Korea’s industrial production, on the other hand, continues to decline.

The United Kingdom’s industrial production has been in decline for over a year.

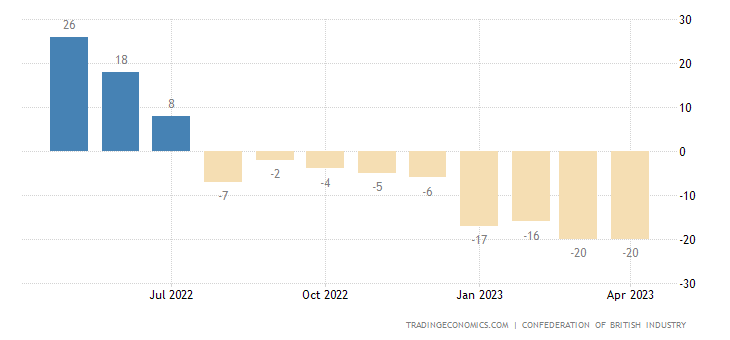

According to the Confederation of British Industry, new orders for the United Kingdom are in their 9th month of decline.

Which is confirmed by the United Kingdom’s own manufacturing PMI, which has been at sub-50 levels (indicating contraction) for…wait for it…nine months.

The Euro Area’s PMI has not fared any better, at 10 months of straight contraction readings.

Germany’s economy as a whole is just stagnating at the moment (which is to say it’s really contracting but the stats have been massaged to show otherwise).

The German economy stagnated in the first quarter, as a decline in government and household consumption was balanced out by an increase in exports and capital investment, data showed on Friday.

Gross domestic product was unchanged quarter on quarter in adjusted terms, the federal statistics office said. A Reuters poll of analysts had forecast growth of 0.2%.

With so many signs throughout the global economy of stagnation, stagflation, and contraction, OPEC’s production cuts are proving to be not enough to get ahead of downward global demand trends. Contrary to the hopes of oil bulls everywhere, oil demand is just not stepping up as predicted.

There will be a rebound in oil prices, and there will be a rebound in oil demand. Those rebounds may even happen this year.

Yet they are not happening now, and the data gives little reason to hope they will happen in the next few weeks or months, either.

Right now, the global economy is contracting, and it is taking oil prices down with it.

OPEC+ tried to get ahead of the shrinkage. For now, they have failed to do so.

Chaos Theory comes to the Middle East.

So goes America so goes the World.

It should be obvious, elect Trump (too late).