Credit Suisse: The Next Banking Domino To Fall

Swiss National Bank Scrambling To Merge Troubled Lender With Swiss Rival UBS

By far the most disturbing aspect of the recent government backstops and bailouts of beleaguered banks. Whether in the US or in Europe, government assurances have repeatedly failed to assuage investor fears over troubled banks.

When the extent of Silicon Valley Bank’s interest rate woes was made clear on March 8, it sparked a global rout in bank stocks, with several of Europe’s biggest banks suffering some of their biggest declines.

The selloff in the banking sector spread across the globe on Friday after SVB Financial Group said it was forced to unload assets at a loss following a decline in deposits.

HSBC (ticker: HSBA.UK), Europe’s biggest bank, was down 5.2% in London trading. France’s BNP Paribas (BNP.France) fell 4.5%, and Switzerland’s UBS (UBSG.Switzerland) declined 4.6%. Credit Suisse (CSGN.Switzerland) hit a record low, falling 4.2%.

What started with a single bank had quickly spread to seemingly the entire global banking sector, and the S&P 500 Financials decline began to accelerate.

The banking crisis has since deepened almost daily.

When regulators took over SVB that Friday, and guaranteed all depositors over that weekend, it failed to stop the carnage.

Despite the backstop, the S&P 500 Financials continued to plummet when the markets opened on Monday, March 13.

The market decline helped push First Republic Bank into liquidity jeopardy, leading to a $70 billion loan facility arranged by JP Morgan and then a $30 Billion deposit injection by 11 major US banks.

Despite the multiple votes of banking confidence, First Republic shares have continued to drop.

The stock rose 10% Thursday. The gains were short-lived, reflecting concerns that the move didn’t fully address First Republic’s problems. The company also suspended its dividend Thursday.

The rescue deal offered First Republic a “temporary lifeline,” KBW analyst Christopher McGratty wrote in a research note.

“The significance of these shifts in the balance sheet—along with an announced dividend suspension—paint a grim outlook for both the company and shareholders,” Mr. McGratty wrote.

Meanwhile, across the pond, Credit Suisse—Europe’s 17th largest bank by total assets—went hat in hand to the Swiss National Bank, seeking liquidity support.

Credit Suisse has appealed to the Swiss National Bank for a public show of support after its shares cratered as much as 30 per cent, sparking a broader sell-off in European and US bank stocks.

The request for a reassuring statement about Credit Suisse’s financial health came after its shares sank as low as SFr1.56, having earlier been halted amid a heavy sell-off, according to three people with knowledge of the talks.

Credit Suisse also asked for a similar response from Finma, the Swiss regulator, two of the people said, but neither institution has yet decided to intervene publicly.

Following on the supportive moves of US banking regulators, the Swiss National Bank agreed.

March 15 (Reuters) - Swiss regulators said Credit Suisse (CSGN.S) can access liquidity from the central bank if needed, racing to assuage fears around the lender after it led a rout in European bank shares on Wednesday.

In a joint statement, the Swiss financial regulator FINMA and the nation's central bank said that Credit Suisse "meets the capital and liquidity requirements imposed on systemically important banks."

Almost immediately, Credit Suisse tapped the central bank liquidity line, to the tune of $54 Billion.

Credit Suisse said Wednesday it is borrowing up to 50 billion Swiss francs, or $53.68 billion, from the Swiss National Bank as its stock plunged this week amid fears it will default on debt.

Credit Suisse stock, which initially rose on the news of the backstop, began plummeting again on the news that Credit Suisse meant to actually use it.

So grim has Credit Suisse’ situation become that Swiss regulators are now seeking to arrange a shotgun marriage between Credit Suisse and its Swiss banking rival UBS.

Credit Suisse, UBS and their key regulators are racing to thrash out a deal on the historic merger of Switzerland’s two biggest banks as soon as Saturday evening, people familiar with the situation told the Financial Times.

The Swiss National Bank and regulator Finma have told international counterparts that they regard a deal with UBS as the only option to arrest a collapse in confidence in Credit Suisse. Two people said deposit outflows from the bank topped Sfr10bn ($10.8bn) a day late last week as fears for its health mounted.

As of this writing, that deal is still very much in the works, with reports that UBS wants its own $6 Billion backstop from the Swiss government to complete the deal.

The guarantees would cover the cost of winding down parts of Credit Suisse and potential litigation charges, two people told Reuters.

Talks to resolve the crisis of confidence in Credit Suisse are encountering significant obstacles, and 10,000 jobs may have to be cut if the two banks combine, one of the sources said.

Silicon Valley Bank. First Republic Bank. Credit Suisse. Literally every government show of support for the banking industry has completely failed to calm investor anxiety over banking quite literally worldwide.

Banking fears are emerging even in China, where the PRBC on Friday made a surprise cut to banks reserve requirements (emphasis mine).

In order to promote the effective improvement of the economy and the reasonable growth of the quantity, make a good combination of macro policies, improve the level of serving the real economy, and maintain a reasonable and sufficient liquidity in the banking system, the People's Bank of China decided to reduce the deposits of financial institutions on March 27, 2023. The reserve ratio is 0.25 percentage points (excluding financial institutions that have implemented a 5% deposit reserve ratio). After this reduction, the weighted average deposit reserve ratio of financial institutions is about 7.6%.

(Translation provided by Google Translate)

Governments are telling everyone there’s enough money in the banking system, but no one is believing them—so governments are pumping more money into the banking system.

There is a perverse irony to this global disbelief, as all the currencies involved are fiat currencies, which allows governments to quite literally inject new money into financial systems almost without any real limitation. As we have seen repeatedly over the past 15 years, governments have been quite willing to do just that.

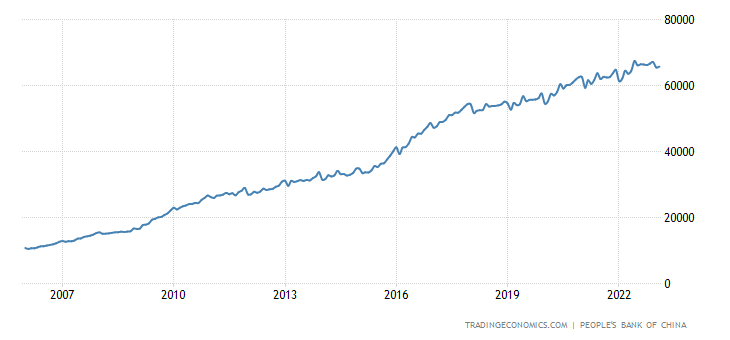

China has not stopped steadily pushing money into its banking system since the 2008 Great Financial Crisis.

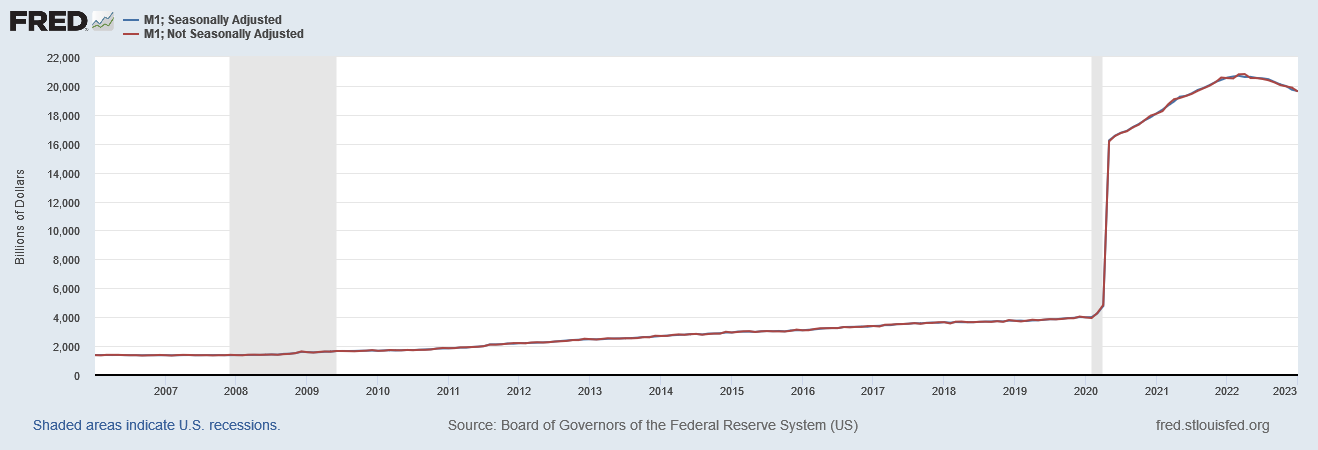

The Federal Reserve began deliberately injecting money, in what is known as “quantitative easing”, in the banking system after the GFC, and did so on a mammoth scale as part of the government’s COVID reponse.

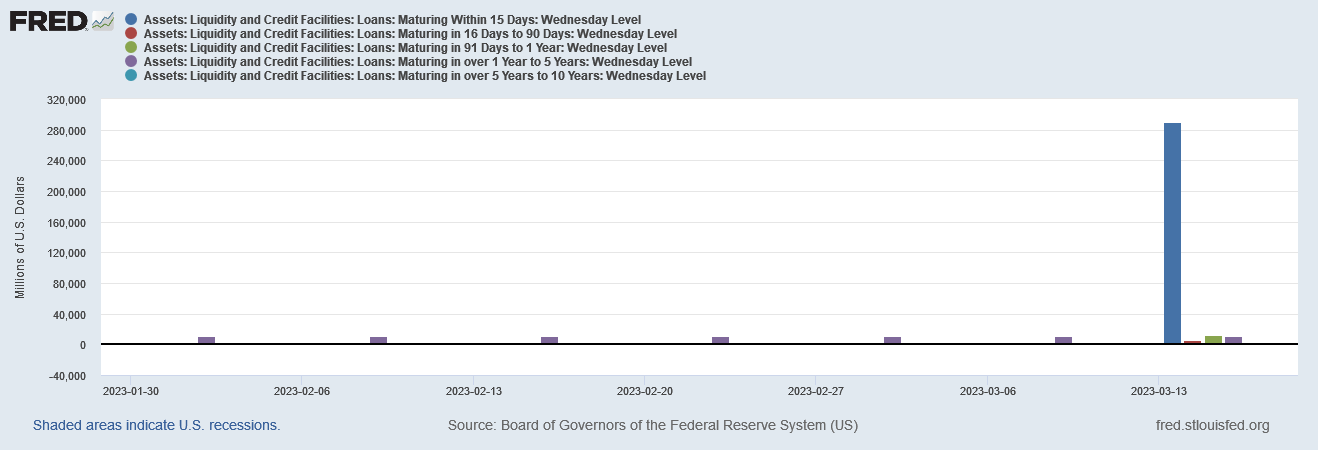

The Fed had only recently began actively shrinking the money supply—a process which has now been well and truly aborted with the tremendous spike in Federal Reserve loans to member banks in response to the recent liquidity fears.

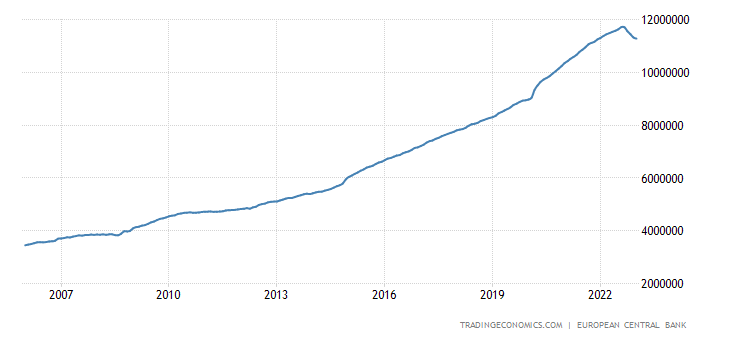

The European Central Bank has largely followed the Fed’s path, although its COVID money injections were more subdued than the Fed’s.

Yet in the US and in Europe banks are still facing serial liquidity crises, and China just pre-emptively added still more money to its banking sector.

Money, money, everywhere and still Credit Suisse’ remaining life is literally being measured in hours.

As I ranted earlier, much of the reason why is the realization that bankers have been, by and large, simply stupid with other people’s money.

They chose to go swimming in the financial ocean stark naked and are now crying that they don’t have a towel to cover with after the tide ran out on them.

It has yet to occur to them that swimming naked without a towel nearby is just plain stupid—which also sums up how Wall Street handles its business of late.

Nor were they merely stupid. They were both stubborn and stupid, refusing to adjust business practices and business models even as central banks began pushing interest rates up.

Wall Street’s blaming a breakdown in US Treasury bond markets tells us that they will not take proactive steps to avoid the crisis, but will ride their derivative investments right into the inevitable crash. They won’t unwind those transactions until it is too late. The addiction to the “cheap” money of a low interest rate environment is overwhelming common sense and logic, which apparently are telling all but the most somnambulent of investors that their investment strategies are about to go south in a major way, and that it is time to switch strategies.

The Federal Reserve and the European Central Bank have been making money steadily more expensive, explicitly pushing interest rates up for going on a year, and jawboning rates up for even longer than that. As they have done so, they have moved steadily closer to an interest rate inflection that would cause considerable pain in financial circles, as legacy portfolios of debt securities—along with derivative investments with an estimated notional value of $1 Quadrillion world wide, with $200 Trillion in the US alone—see their market value erode as interest rates rise. That such an inflection point was inevitable has always been a known aspect of rising interest rates.

Thus the Federal Reserve is face with a paradox: to corral inflation with the limited theoretical understanding and tools at its disposal, it must raise interest rates to reduce demand and shrink the money supply, yet if it succeeds in shrinking the money supply it will precipitate a replay of the 2008 Great Financial Crisis, only at much greater notional dollar volumes ($200 Trillion and counting).

While not tampering with interest rates would avoid an immediate catalyzing of the crisis, if the Fed does not reduce the money supply it must suppress money velocity, or else risk long-term structural inflation. If the Fed does reduce the money supply, credit derivatives markets are left exposed to an eventual liquidity crisis, which with the current unstable geopolitical situation is likely to happen sooner rather than later.

The world got a preview of this phenomenon last fall when a crisis in UK pension funds forced the Bank Of England to intervene decisively in the UK bond market.

As I have discussed previously, central bank interest rate hikes to cure inflation run the risk of precipitating a general liquidity crisis, as rising interest rates trigger margin calls on a variety of assets to cover the increasing costs of financing. As shifting financial conditions force various investor hands, the potential for there being insufficient liquidity at crucial junctures to allow for orderly unwinding of asset positions rises. The Bank of England intervention appears to have been an effort to stave off just that among UK pension funds, as rising yields threatened their derivative positions—ironically taken out in order to hedge investment risk.

If this is indeed the case, then the BoE stepping in to buy gilts becomes a canary in the coal mine warning that another liquidity crisis similar to the 2008 Great Financial Crisis is forming. Although Federal Reserve Chair Jay Powell has dug his feet in regarding the possibility of any pivot back to Quantitative Easing, the same debt dynamics that led Ben Bernanke down the QE road post-2008 are still very much part of the current financial landscape.

As the UK pension funds crisis demonstrates, even the derivatives at the center of the 2008 financial crisis are still around, merely packaged under different names.

As other commentators opined at the time, the UK pension crisis truly was the canary in the coal mine confirming that a global banking crisis was looming.

We warned already in March 2017 that the global financial system, which broke out during the 2008 financial crisis, has never really been healed. We noted that it and the global economy were kept standing merely by continuous central bank and government interventions and nearly unlimited provisions of credit. On Sept. 28, we got a final confirmation from the BOE that this truly is the case.

We are in deep, deep trouble.

The global banking crisis is now here.

The serial bank failures, the multiple failed government-sponsored backstops and bailouts, and now Credit Suisse’ imminent demise together demonstrate governments are proving powerless to stop the financial train wreck that is happening right before our eyes.

As of this writing, UBS is preparing to make Credit Suisse the next banking domino to fall. If UBS does not complete the process by the time this article sees publication it likely will do so soon after.

Credit Suisse is the next banking domino to fall. Credit Suisse will not be the last banking domino to fall.

Peter - your para here:

The Fed had only recently began actively shrinking the money supply—a process which has now been well and truly aborted with the tremendous spike in Federal Reserve loans to member banks in response to the recent liquidity fears.

I have read elsewhere is not easing (or stopping the tightening), and/or that these loans should not be viewed as allowing the banks to avoid the losses (due to their under-water investments to continue losing value as rates have risen). But I'm not savvy re these topics -- and/or I'm not sure who to trust given their bias to present these consistent with their past predictions or clients. Have you done a deeper dive on these 'loans' and whether they do indeed present a pivot or return to QE (and/or giving the banks a pass on those poor decisions)? Would you please?

Thanks in any event for all you are providing here -- Hoping you have some time to pray, give thanks and reflect on this day of our Lord.

DT

Looks like the merge might not be going through.