Paul Krugman, "Expert" (And Erroneous) Economist

Even Nobel Laureates Are Simply Wrong Sometimes

The New York Times economist-in-residence Paul Krugman—who is a Nobel Laureate, no less!—has made a career out of saying foolish nonsense and relying on his Nobel Prize to magically make whatever he says true.

His recent defense of the economic lunacy of “Bidenomics” is itself a masterpiece of inanity, insanity, and simple error.

Sorry, folks, but “immaculate disinflation” — rapidly falling inflation without a recession or a big rise in unemployment — is actually happening. The 2021-22 inflation surge definitely rattled Americans after decades of relative price stability, and I’m not here to lecture people about their feelings. But I guess I am here to lecture journalists about using statistics. Presenting misleading numbers that seem to justify public opinion is actually an act of disrespect: Voters have a right to their feelings, but journalists have a duty to present the facts, as best we can understand them.

There is no small irony in Krugman lecturing anyone about statistics, given his demonstrable inability to comprehend them.

However, since the media appears to be rich in “useful idiots”, we should at least make use of Krugman’s idiocy to illuminate how “immaculate disinflation” is a Wall Street pipe dream.

Yes, I am presuming to correct a Nobel Prize winning economist…humility was never my strong suit!

Let us begin with his theory of “compositional effects” on wages since the Pandemic Panic Recession:

Why am I telling you this story? Because it’s most of the story of wages in the U.S. economy since Covid-19 struck. In 2020 the average wage of workers who still had a job shot up, because those who were laid off were disproportionately low-wage service workers. Then, as people resumed in-person shopping, started going to restaurants and so on, growth in average wages was held down because those low-wage workers were being rehired. You need to look through these “compositional effects” to figure out what was really happening to earnings as that played out.

Until recently I thought everyone — well, everyone following economic issues — knew this. (Assuming that people know more about the numbers than they actually do is an occupational hazard for nerds who become pundits.) But lately I’ve been seeing even mainstream news organizations publish charts that look like this:

And these charts are accompanied by commentary to the effect that real wages generally rose under Donald Trump but have generally fallen under Joe Biden, which in turn is supposed to explain why Americans are feeling so negative about the economy.

But that’s not what these charts actually tell us. Mostly they reflect the working stiff temporarily leaving the bar, then coming back.

The major problem with this theory is that “the working stiff” never actually came back.

From the start of the Pandemic Panic Recession to the end, the cohort of Americans not in the labor force rose by 9.1%. As of the October Employment Situation Summary, more than half that amount—4.7%—still has not rejoined the labor force.

Viewed another way, through the labor force participation rate, we can see that labor force participation—which had been steadily rising under Donald Trump prior to the recession, plummeted and has never fully recovered.

By both labor force participation metrics, the phenomenon of the “working stiff” returning to the labor force was largely accomplished by the summer of 2020. Reclamation of sidelined workers since that time has been uneven and problematic at best.

However, even using the Atlanta Fed’s wage growth tracker, which Krugman explicitly advocates, his “compositional effect” argument still does not hold water. The most obvious flaw in his argument is that the lowest quartile of wage earners have had the best year on year growth percentages post recession until this year.

The second flaw is that even the Atlanta Fed’s tool shows the “working stiff” fared the worst post-recession.

Education and Health, Leisure and Hospitality, and Manufacturing all had the worst growth percentages between January 2020 and January 2022.

Viewed along a different dimension, by educational level, we see that there has not been a wide variance in income growth.

In other words, the “compositional effects” of the Pandemic Panic were minimal, and the compositional effects of wage growth since the Pandemic Panic Recession have been equally minimal.

However, Krugman’s theory of compositional effects is also simply the wrong framing because he completely ignores the aggregate effects of consumer price inflation.

While year on year percentage change comparisons can be useful for assessing current trends for both incomes and prices, the practical effects of those changes are actually expressed when we look at the aggregate changes over time—and to do that we use not the year on year percent changes but the indexed change over a specified time. The indexed metrics for both average wages and consumer price inflation tell a far different tale than the fantasy Krugman is spinning.

Using Krugman’s baseline of December, 2019, we see that inflation and incomes have behaved as follows:

As we can see, food prices in particular have risen by a greater percentage than incomes have since December 2019.

The Owner’s Equivalent Rent of Primary Residence—a proxy metric for housing costs—has risen by a slightly greater percentage than average incomes since December 2019.

Moreover, using December 2019 as a baseline also obscures the reality that the bulk of the relative improvement of wages vs incomes occurred in the immediate aftermath of the Pandemic Panic Recession, during the Trump Administration.

When we look at income growth vs aggregate inflation since January of 2021, the income picture becomes considerably less optimistic.

Housing and food prices especially have risen by significantly greater percentages than average incomes since the start of Dementia Joe’s Reign of Error.

Some readers may recall these graphs, as I have covered this topic with a broader brush just recently.

Krugman also blanches at the prospect of using the change of Administrations as the base period.

In the end, it’s basically a fool’s errand to try and compare economic performance before and after the White House changed hands; there was just too much crazy stuff going on. What we can say, with considerable certainty, is that while prices have gone up a lot since the pandemic began, most workers’ wages have risen significantly more.

However, that argument is flawed for several reasons. First and foremost, the most disruptive events Krugman cites—the supply chain ruptures of 2020 and the start Russo-Ukrainian War—occurred a full year either before or after that changing of the guard.

Most importantly, however, is that if Krugman is intending to defend “Bidenomics” he is obligated as a matter of intellectual integrity to use January 2021 as his base period—the foundational premise of “Bidenomics” is the wholesale rejection of President Trump’s economic policies. One cannot rationally include in an analysis of “Bidenomics” periods whose economic outcomes were in thrall to the prior administration. Dementia Joe does not get to take credit for the 2020 rise in average wages nor is he accountable for the initial rises in consumer price inflation.

Krugman is also guilty of an insidious straw man argument when he advances his claims that there runaway inflation is a thing of the past.

Or I’m told that real people know that inflation is still running hot, whatever the government numbers may say. Actually, the American Farm Bureau Association, a private group, tells us that Thanksgiving dinner cost 4.5 percent less this year than last. Gasbuddy.com, another private group, tells us that prices at the pump are down more than 30 percent since their peak last year. Neither turkeys nor gas prices are good measures of underlying inflation, but both show that the narrative of inflation still running wild is just not true.

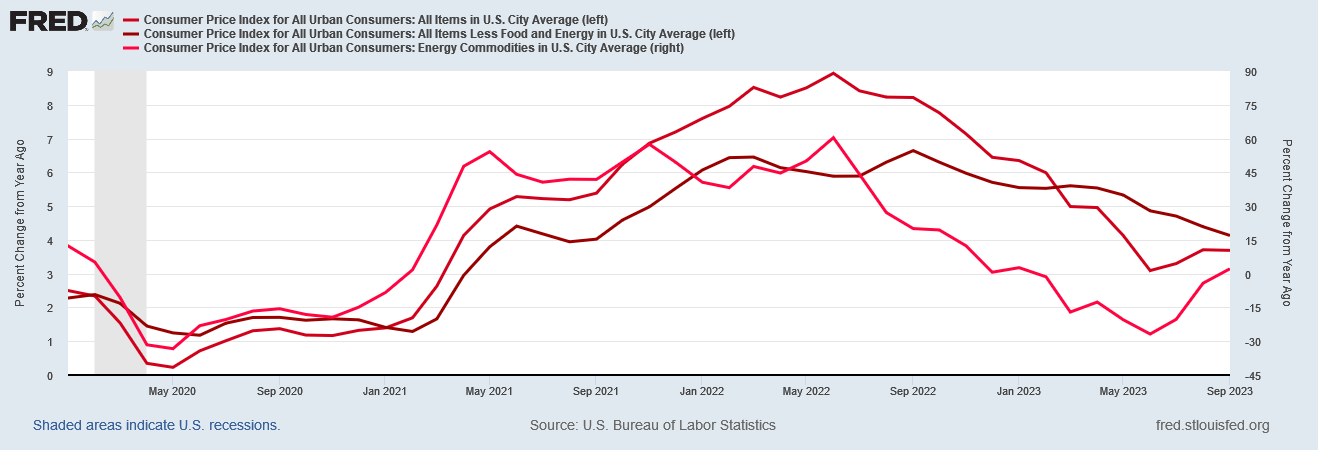

As I have written at some length, the story of consumer price inflation has largely been one of rises and falls in energy pricing.

We do not need to look very far to find the source of the variance: once again, the culprit is energy price inflation, as is plain when we overlay the Consumer Price Index for Energy Commodities

The rise and fall of energy prices not only accounts for most of the excess of headline inflation over core inflation throughout 2022, but the decline of energy prices since June of last year is what has brought headline inflation down much more rapidly than core inflation, and—as noted last month—it is what is pushing headline inflation up now.

However, the real danger now is not runaway hyperinflation, but a toxic stagflationary stew of both inflation and deflation concurrently.

Wall Street wants to believe that October’s inflation data represents a slice of economic good news. If there were not multiple and accumulating signs of economic weakness from literally every direction, perhaps the inflation data would be a slice of economic good news.

Unfortunately, there are multiple and accumulating signs of economic weakness from literally every direction, which means October’s inflation data is ultimately a slice of dangerous economic news and potentially very bad economic news. It is cause not for celebration but for consternation.

Recession is upon us, and is getting worse, not better.

Based on the October Producer Price Index data, deflation may actually yet win out.

Even John Williams’ ShadowStats site acknowledges that consumer price inflation is well below its 2022 peak.

In short, no one except Paul Krugman is seriously advancing a premise of runaway inflation at the present time. 2022 is not 2023.

However, we again must remember that inflation’s corrosive effects are rarely transitory, and it is the accumulation of many price rises that produces lasting economic impact—which is why inflation has finally reached the upper economic strata, even though it is well on its way back to 2% year on year.

Moreover, we should not lose sight of the fact that current economic growth is happening in this country because of major increases in government spending, not private sector investment or consumption.

That government spending was the primary driver—arguably the sole driver—of economic growth in the US for the third quarter means the US economy is becoming more like China’s. That is not a good thing. There is not a single instance in the whole of human history where government has proven to be a good steward of a country’s economy, nor is there a single instance in the world today where government interventions have proven to be an economic benefit and not an economic harm.

Yet this is the economy the BEA is saying we have. Government spending may be generating artificially good growth numbers today, but that same government spending is bleeding away capital from private investment, without which there will be no growth numbers at all tomorrow. This will never end well.

The consequence of such distorted “growth” is an economy which is unhealthy, sclerotic, and stagnant.

The reality is that the economy is and has been sick and increasingly sclerotic, while the Fed’s manipulations of interest rates have not accomplished a damn thing. The reality is that people are earning less now than before, while paying more to buy less. The reality is an economy still very much in recession in spite of what the official data purports to project.

Krugman would prefer you not think about such minor trifles.

One can easily say that the economy is going well for some people, and it most assuredly is.

One can also say that even the best performing economy does not turn out well for some people, and it most assuredly does not.

However, when we attempt to assess whether the economy is healthy or unhealthy, expanding or contracting, we have to gauge impacts not just across the population but over time as well. A price increase of 10% is nothing if wages increase 20% in the same time frame. A price increase of 2% can be quite significant if wages fall 5% in the same time frame.

What we have been seeing in this country is an economic situation unfolding very much like the latter and not at all like the former. While inflation has receded significantly in 2023, and while real wages are showing signs of increase in recent months, these recent favorable trends have a very long way to go before they can overcome the equally real losses in purchasing power and prosperity experienced by all Americans in all income brackets since the Pandemic Panic Recession. Even at that, the seeming “success” of the Federal Reserve in corralling inflation while avoiding a recession—the so-called “immaculate disinflation”—is simply a myth.

Krugman’s misapprehensions and misunderstandings of the data do not alter the very real signs of growing economic weakness in this country. Krugman’s Nobel Prize does not alter the reality that a recession is very much under way in this country, has been under in this country, and will be getting much worse before it gets any better.

Sometimes? That guy is an expert in being wrong.

Perhaps a Noble Laureate comes with a perpetual case of hubris or the "cannot admit to being wrong" effect.😉