Wall Street Is Drunk On Government Kool-Aid

No One Dares Look At The Data For Fear Of Puncturing The Narrative

Yesterday saw two significant economic news releases: The Bureau Of Labor Statistics released the November Producer Price Index News Release Summary, while the Federal Reserve’s Federal Open Market Committee announced that it was standing pat on the federal funds rate for the third straight meeting.

Wall Street was overall quite happy with what both the BLS and the Fed had to say, largely because neither Wall Street nor the Fed acknowledged the obvious: the US economy is spiralling into stagflation. That reality was readily discernible in the Producer Price Index printing no change month on month in the seasonally adjusted data, and moderate decreases in the unadjusted data:

The Producer Price Index for final demand was unchanged in November, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices decreased 0.4 percent in October and rose 0.4 percent in September. (See table A.) On an unadjusted basis, the index for final demand increased 0.9 percent for the 12 months ended in November.

Equally apparent was the Fed’s inability (unwillingness?) to recognize the signs of stagflation even as it largely acknowledged the relevant data points.

Recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter. Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

The U.S. banking system is sound and resilient. Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent.

Once again, the data was ignored for fear of puncturing the preferred narrative. However, as I have argued repeatedly all year, the data remains, and the data remains pointed at either deflation or stagflation as the next turning for the US economy.

Wall Street, of course, was quite happy to play along with the narrative and disregard the data—as it has done time and again since at least the Pandemic Panic Recession.

Equities started the day largely treading water on the release of the latest PPI data, and then surged after the FOMC made its rate announcement.

The Dow Jones index in particular had a good day, closing up 1.4% to set a new all-time high of 37,090.24.

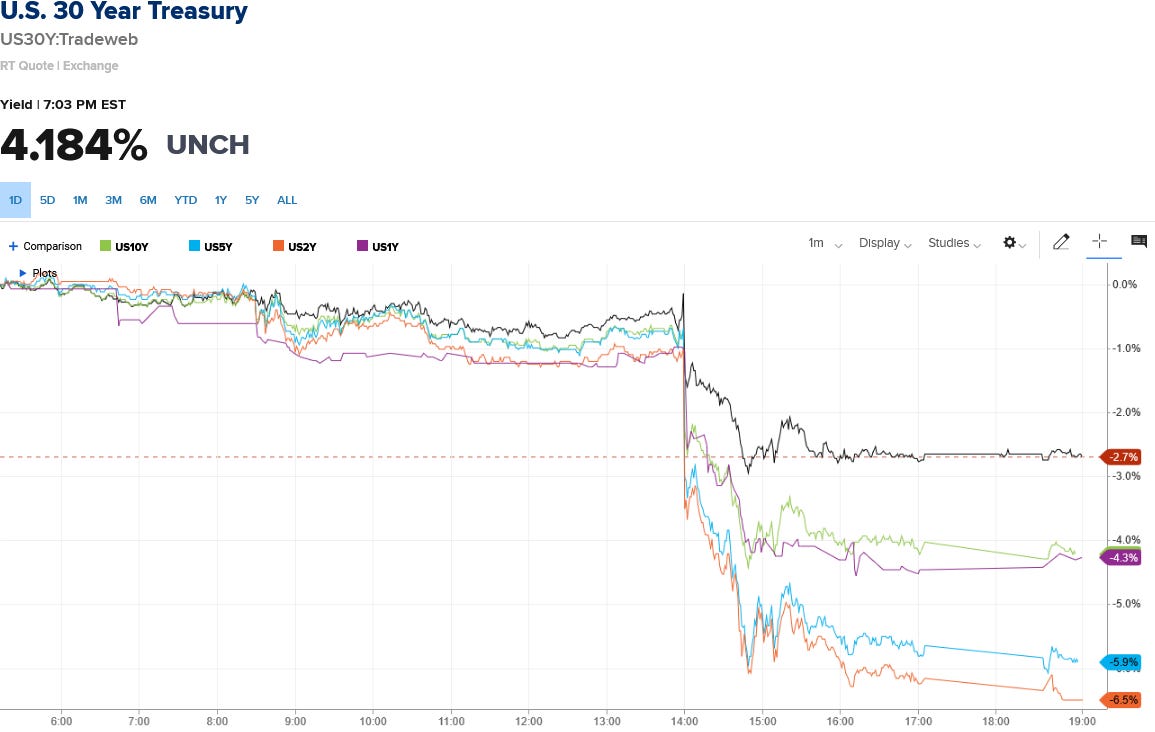

Treasury Yields, for their part, dropped.

This was unsurprising, given Jay Powell’s willingness to mention the likelihood of rate cuts in 2024, feeding Wall Street’s hopes for a return to the cheap money policies of the past. Also unsurprising is that the largest relative yield declines were for the 2-Year Treasuries, with the 30-Year and 10-Year Treasuries posting the smallest yield declines. Given the Fed’s surreptitious gaming of financial markets since June 2022, effectively forcing the months-long yield inversion that has prevailed in bond markets, this was inevitable.

Such distortions of the bond markets mattered little to Wall Street, however, compared to the thin ray of hope Powell provided that 2024 would be a year of rate cuts and not rate hikes.

In assessing the FOMC rate announcement and Powell’s presser aftewards, it is important to unpack a few of the factual statements made in the FOMC’s initial rate announcement.

Recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter.

What that statement overlooks, of course, is that the bulk of the third quarter’s GDP growth came from an increase in government spending.

That government spending was the primary driver—arguably the sole driver—of economic growth in the US for the third quarter means the US economy is becoming more like China’s. That is not a good thing. There is not a single instance in the whole of human history where government has proven to be a good steward of a country’s economy, nor is there a single instance in the world today where government interventions have proven to be an economic benefit and not an economic harm.

Yet this is the economy the BEA is saying we have. Government spending may be generating artificially good growth numbers today, but that same government spending is bleeding away capital from private investment, without which there will be no growth numbers at all tomorrow. This will never end well.

The problematic nature of the third quarter’s “strong” growth pushes any signs of softening in the fourth quarter further and further in the direction of recession.

The Fed’s take on unemployment also deserves a bit of discussion.

Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low.

Of course, this presumes the jobs data is reliable, which it demonstrably is not.

Accepting the assertion that unemployment is low also requires ignoring the fact that roughly half of the workers pushed out of the labor force by the Pandemic Panic Recession never returned.

The inability of the economy to pull these workers back into the labor force shreds any notion of job markets being “tight” and “healthy”.

Then there is the state of the banking system:

The U.S. banking system is sound and resilient. Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation.

To be sure, bank deposits have shown some recovery from their earlier declines, particularly among smaller banks.

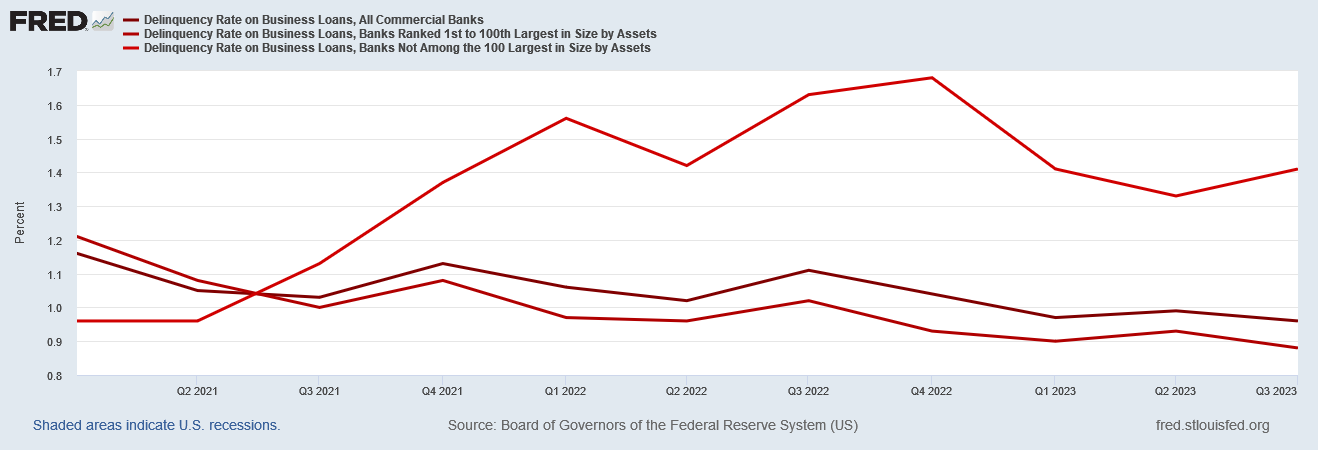

However, smaller banks are also seeing an increase in business loan delinquency.

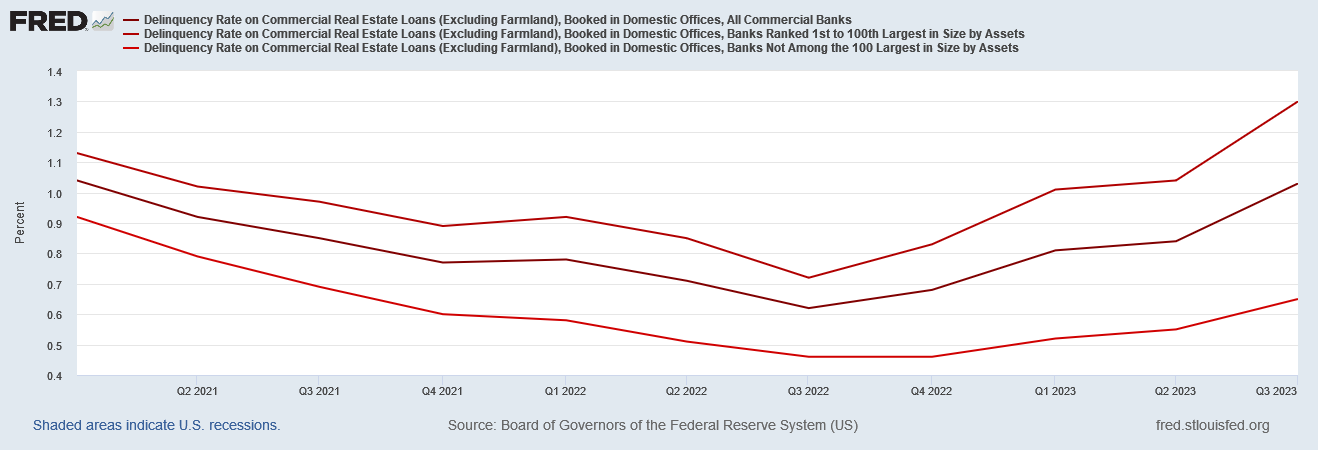

All banks are also seeing significant increases in commercial real estate loan delinquency.

At the same time, banks are starting to gamble once again on Treasuries, with their investment portfolios starting to add Treasuries back in while selling off other assets.

The US banking system and the state of bank credit in this country are somewhat more problematic than Jay Powell wants to admit.

Is the US banking system “strong”? It would be perhaps more accurate to say simply that the banking system is “not weak” and leave it at that.

With the factual basis for Powell’s presser thus placed in a workable context, we can begin to dissect his comments.

In his opening remarks, he glossed over the fact that the US economy is steadily weakning.

Recent indicators suggest that growth of economic activity has slowed substantially from the outsized pace seen in the third quarter. Even so, GDP is on track to expand around 2.5% for the year as a whole, bolstered by strong consumer demand, as well as improving supply conditions.

After picking up somewhat over the summer, activity in the housing sector has flattened out and remains well below the levels of a year ago, largely reflecting higher mortgage rates. Higher interest rates also appear to be weighing on business fixed investment. In our summary of economic projections, committee participants revised up their assessments of GDP growth this year but expect growth to cool with a median projection falling to 1.4% next year.

Let those numbers sink in: if we accept the 5.2% GDP growth in the third quarter published by the Bureau of Economic Analysis, the Fed is projecting GDP growth for the entire year to be roughly half that percentage, and next year’s GDP growth to be half again from this year’s.

In any economy, those are some pretty dramatic dropoffs in economic performance.

Ironically, Powell even concedes as much by mentioning for the first time since the rate hikes began the potential for rate cuts.

If the economy evolves as projected, the median participant projects that the appropriate level of the Federal Funds Rate will be 4.6% at the end of 2024, 3.6% at the end of 2025, and 2.9% at the end of 2026, still above the median longer-term rate. These projections are not a committee decision or plan.

The only reason for reducing interest rates as the economy “evolves” is to alter the path of that “evolution” by providing monetary stimulus. A softening economy is the historical call for interest rate hikes, not a robust and growing economy. Powell is effectively predicting a worsening economy through 2026. Yet Wall Street embraces this rhetoric!

Of course, as he told the reporter from the Associated Press, the Fed isn’t committed one way or the other.

So, specifically on “any,” we do say that in determining the extent of any additional policy firming, that may be appropriate, so “any additional policy firming,” that sentence. We added “any” as an acknowledgment that we are likely at or near the peak rate for this cycle. Participants didn’t write down additional hikes that we believe are likely, so that’s what we wrote down. But participants also didn’t want to take the possibility of further hikes off the table, so that’s really what we were thinking.

For its part, the Washington Post helped Powell push the “there will be no recession” narrative.

RACHEL SIEGEL: Hi, Chair Powell, Rachel Siegel from The “Washington Post”. Thanks for taking our questions. At this point, can you competently say that the economy has avoided a recession and isn’t headed for one now? And if the answer’s no, I’m curious what you’d still be looking for? Thanks.

JEROME POWELL: I think you can say that there’s little basis for thinking that the economy is in a recession now. I would say that. I think there’s always a probability that there will be a recession in the next year, and it’s a meaningful probability, no matter what the economy’s doing, so it’s always a real possibility. The question is, is it — so, it’s a possibility here.

Of course, with stagflation pretty much a given for the US economy, there’s all sorts of basis for thinking the US is in recession now.

Powell’s take on labor markets, on the other hand, is nothing short of delusional.

NEIL IRWIN: Hi, Chair Powell. Neil Irwin with Axios. How do you look at the labor market now? In particular, you’ve referred even today to evidence that it’s coming into better balance. What would you need to see to conclude that it has reached that balance?

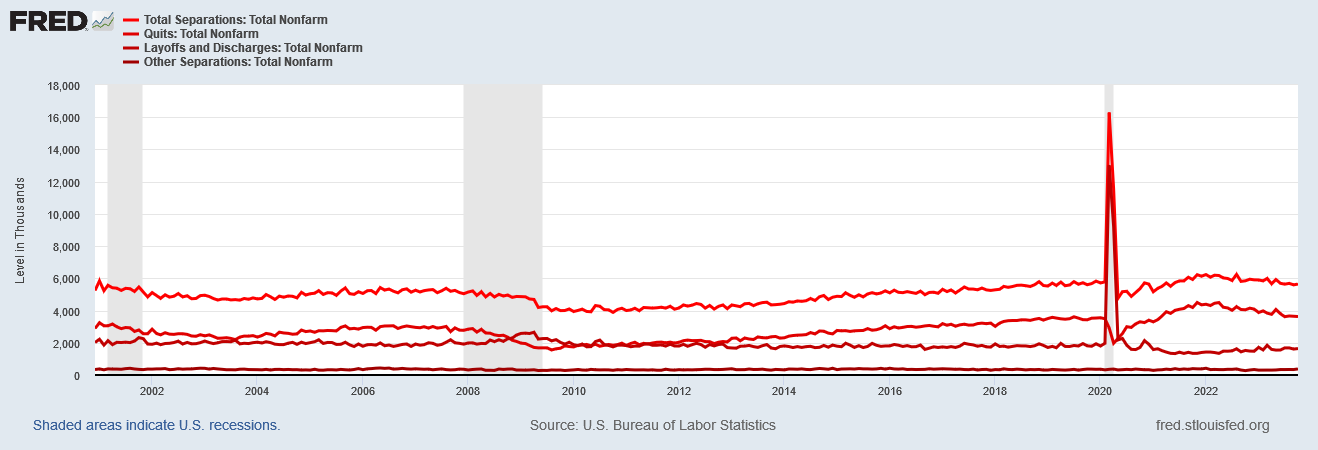

JEROME POWELL: So, on the better balance side, just a lot of things. You see job growth still strong but moving back down to more sustainable levels, given population growth and labor force participation. But let me go on with that list. You know, claims are low. If you look at surveys of businesses, they’re sort of the era of this frantic labor shortage are behind us, and they’re seeing a shortage of labor as being significantly alleviated. If you look at shortages of workers, whereas they thought job availability was the highest it had ever been, or close to it, that’s now down to more normal levels by so many measures — participation, employment — so many measures — the employment, job openings, quits, all of those things.

As I have already pointed out, labor participation is still not back to pre-pandemic levels. As for employment being “back to normal”, the jobless claims data alone says otherwise.

What Powell, corporate media, and Wall Street all ignore is the degree to which labor phenomena such as “the Great Resignation” actually predate the lunatic lockdowns and the Pandemic Panic Recession.

Powell is completely oblivious to the conditions which have made US labor markets increasingly “toxic” rather than “tight”.

Faced with the level of disconnect palpable in Powell’s comments, Wall Street chose to ignore the data and focus on the narrative, finding that more convenient and more palatable.

Wall Street also chose to ignore the fact that yesterday’s Producer Price Index data (unadjusted) showed producer price deflation across the board in November—the first time all year that happened.

Even the year on year changes trended towards deflation.

Perhaps the only aspect of the PPI data Wall Street assessed correctly was the influence of energy price deflation on factory gate prices.

In most other respects, the PPI data showed substantially the same trends towards stagflation and deflation as the October report.

The preferred narrative, needless to say, wants to gloss over such uncomfortable data sets.

This is a familiar pattern—the triumph of narrative over facts, data, and evidence. To restate the obvious, the reason this Substack exists is to push back against the prevailing narratives, so that the facts, the data, and the evidence can occupy their rightful place as the primary basis for making decisions.

Wall Street accepts the prevailing narrative on the economy, for the simple reason that it believes that to be in its best interest. Wall Street is fixated on the Federal Reserve trimming interest rates, and simply refuses to entertain any business strategy other than waiting for the Fed to print more cheap money for them. This has been their stance for well over a year now.

Based on how Wall Street has functioned over the past eighteen months, the emergence of stagflation has upended all their business strategies, and left them clueless as to what they should do next.

One does not need a degree in economics to understand how this can end: badly.

The prevailing narrative might be a preferred narrative, a popular narrative, but it is still only a narrative. The facts, the data, and the evidence will always win out.

The prevailing narrative is that there are no signs of recession in the US economy. The data says the recession in the US—what has been termed a “rolling recession” at the very least, where different sectors slip into recession at different times—has been underway since mid-2022 at the very latest.

As I have said before, always follow the data. The data is always going to prove more reliable than the “experts” and their narratives.

Yes! The ‘anecdotal’ stories of ordinary, Main Street Americans add up to the hard data of a population struggling with high housing costs, soaring food costs, and other economic challenges. Remember the 2016 Election, when all of the mainstream media personalities were so confident that Hillary had won the race that they were visibly astonished when Trump won? Well, they could be in for another shock next November. The narrative-pushers are completely *out of touch* with the reality in this country!

The good news is that the reality of your facts and analysis is going to become more and more obvious to ordinary citizens as each day goes by, and that awakening will change some things. Did you see the Wall Street Journal headline about Mattel laying off more than a thousand workers because toy sales are way down? Ten days until Christmas, and American familiar cannot afford to buy toys for their kids - THAT reality says realms! So by Election Day next November, enough people will have become aware and disgusted enough to vote out the delusional-narrative regime, and be hungry for truth and change. Let’s hope!